In the article “Gensler Asserts SEC Authority Over Crypto as Opponents Waver,” SEC Chair Gary Gensler is highlighted as he takes strides in asserting the SEC’s power over the cryptocurrency market, despite facing challenges in court. Bloomberg’s Sonali Basak and Ava Labs President John Wu join the discussion on “Bloomberg Technology” with Caroline Hyde. They delve into the increasing confidence in the crypto industry shown by major players like BlackRock and Fidelity, who have refiled for their ETFs, signaling a recognition of the real use cases and benefits of tokenizing financial assets. The conversation also touches upon the impact of Wall Street giants entering the crypto industry, the role of native crypto firms, and the potential for a two-tiered system with different levels of service. Additionally, they discuss fee compression in the Bitcoin space and the regulatory landscape surrounding cryptocurrency. All in all, the article provides insights into the growing authority of the SEC in the crypto market and the evolving dynamics of the industry.

Introduction

Welcome to this comprehensive article exploring the current state of the crypto industry and the growing influence of the U.S. Securities and Exchange Commission (SEC). In recent years, the SEC’s power over the crypto market has expanded, leading to a series of challenges faced by the regulatory body in court. This article will delve into the role of SEC Chair Gary Gensler, the wavering stance of opponents, and a discussion with Ava Labs President John Wu on the mood in the crypto industry and the influence of Wall Street. Additionally, we will explore the contrasting dynamics between native crypto firms and Wall Street giants and the impact on Coinbase, as well as the regulatory overhang surrounding the likelihood of SEC approval for ETFs and the hesitation of Wall Street firms. Lastly, we will touch upon the role of leverage and its importance in financial ecosystems.

Background Information

SEC’s Growing Power Over Crypto

Over the past few years, the SEC has steadily increased its influence and jurisdiction over the crypto industry. The regulatory body has taken a firm stance on classifying certain digital assets as securities, subjecting them to the stringent regulations and oversight imposed on traditional securities. This growing power has raised concerns and debates within the industry, as proponents of decentralized finance argue that such regulations inhibit innovation and disrupt the fundamental principles of cryptocurrencies.

Challenges Faced by SEC in Court

Despite its growing power, the SEC has faced challenges in court when attempting to assert its authority over the crypto market. The decentralized nature of cryptocurrencies, coupled with the lack of clear legal frameworks, has presented difficulties for the SEC in effectively regulating the industry. Numerous lawsuits and legal battles have ensued, posing significant hurdles for the regulatory body in establishing consistent and enforceable rules. These challenges highlight a need for clear and comprehensive regulation that takes into account the unique characteristics of the crypto industry.

This image is property of i.ytimg.com.

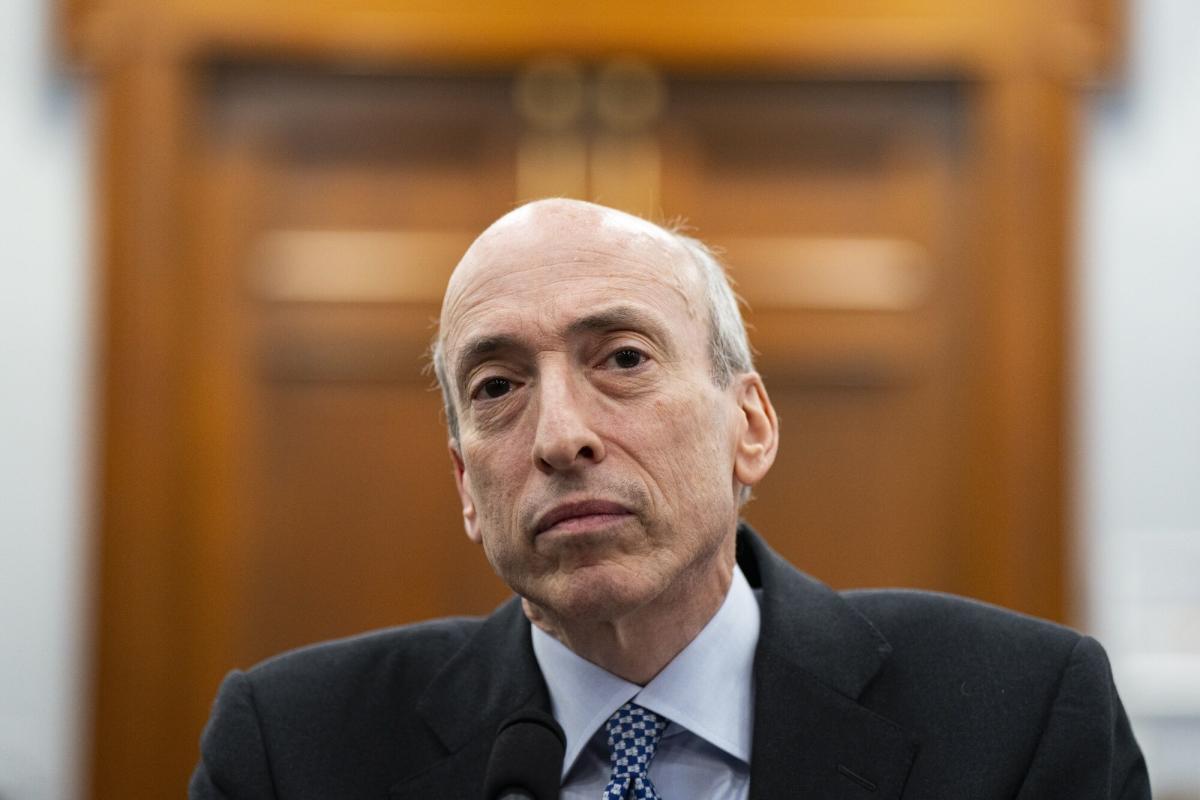

SEC Chair Gary Gensler

In April 2021, Gary Gensler was appointed as the Chair of the SEC. Gensler, a former professor at MIT and an expert in blockchain and digital currencies, brings a deep understanding of the crypto industry to his role. His appointment has sparked both hope and apprehension among participants in the crypto market, as his background suggests a potential for more robust regulation. Gensler’s approach to regulating cryptocurrencies will likely shape the future of the industry and determine its level of integration with traditional financial systems.

Opponents Wavering

Despite the SEC’s growing power, opponents of increased regulation have begun to waver in their stance. The exponential growth of the crypto industry, as well as notable endorsements from prominent figures like Elon Musk and institutional investors, have shifted the narrative surrounding cryptocurrencies. More individuals and organizations are recognizing the potential benefits of digital assets, leading to a growing acceptance and willingness to engage in discussions about sensible regulation.

This image is property of assets.bwbx.io.

Discussion with Ava Labs President John Wu

To gain further insights into the mood in the crypto industry and the influence of Wall Street, we spoke with John Wu, the President of Ava Labs, a leading platform for building decentralized applications. Wu provided valuable perspectives on the current state of the industry and the dynamics at play.

Mood in the Crypto Industry

According to Wu, the mood in the crypto industry is one of cautious optimism. While the rapid price fluctuations and regulatory uncertainties have caused volatility in the market, there is a general sense of excitement regarding the potential for cryptocurrencies to revolutionize finance. Wu emphasized the importance of striking a balance between innovation and regulation, ensuring that necessary safeguards are in place without stifling growth and development.

Influence of Wall Street on the Crypto Industry

Wu acknowledged the increasing influence of Wall Street in the crypto industry. While native crypto firms have been at the forefront of innovation and development, the entry of Wall Street giants has brought additional credibility and institutional interest. The participation of traditional financial institutions has also raised concerns about the potential for the industry to become centralized and diverge from its original decentralized vision. Striking a balance between the interests of Wall Street and the principles of decentralization will be crucial for the future of the crypto market.

Native Crypto Firms vs. Wall Street Giants

The crypto industry can be seen as a meeting point of two worlds – native crypto firms and Wall Street giants. Native crypto firms, born out of the ideals of decentralization and empowerment, have been the driving force behind the innovation and development in the industry. On the other hand, Wall Street giants bring a wealth of experience, resources, and regulatory compliance to the table. The interaction between these two worlds presents a unique challenge, as both sides seek to find common ground and collaborate while maintaining the core values of cryptocurrencies.

Providing Credibility to the Space

The entry of Wall Street giants into the crypto industry has brought credibility and legitimacy to the space. Institutional investors and traditional financial firms bring a level of trust and oversight that appeals to a broader range of investors. This influx of institutional interest has also paved the way for increased liquidity in crypto markets, enabling smoother trading and improved price stability. However, it is essential to ensure that the entry of Wall Street does not compromise the decentralized nature of cryptocurrencies and the principles of empowerment and financial inclusivity they represent.

This image is property of www.insurancejournal.com.

Impact on Coinbase

As one of the most prominent cryptocurrency exchanges, Coinbase has been at the forefront of the industry’s growth. However, the growing influence of regulators and the entry of Wall Street giants have raised concerns about the company’s future.

Fee Compression on Retail Side

With increased competition and regulatory scrutiny, Coinbase may face fee compression on the retail side of its operations. As traditional financial institutions and larger crypto exchanges enter the market, they bring economies of scale and the ability to offer lower fees, potentially squeezing Coinbase’s profit margins. To remain competitive, Coinbase will need to find innovative ways to differentiate itself and provide unique value to its retail customers.

Institutional Use of Coinbase

On the institutional front, Coinbase’s position remains strong. Its reputation for security and compliance, coupled with its infrastructure and regulatory compliance, makes it an attractive option for institutional investors. As Wall Street giants delve deeper into the crypto industry, Coinbase will likely continue to play a significant role as a gateway for institutional investors looking to enter the market. Continued partnerships and collaboration with regulatory bodies will be crucial in maintaining Coinbase’s position as a trustworthy and compliant exchange for institutional use.

Regulatory Overhang

The regulatory overhang surrounding the crypto industry has significant implications for its development and integration into traditional financial systems. Two key factors contributing to this overhang are the expectations of SEC approval for Exchange-Traded Funds (ETFs) and the hesitation of Wall Street firms to fully embrace cryptocurrencies.

Expectations of SEC Approval for ETFs

The approval of ETFs by the SEC is highly anticipated by both crypto enthusiasts and investors. ETFs would provide a regulated channel for investors to gain exposure to cryptocurrencies without the need for direct ownership. The SEC, however, has been cautious in its approach, citing concerns over market manipulation and investor protection. The decision to approve ETFs could have a profound impact on the accessibility and adoption of cryptocurrencies, bringing them closer to mainstream acceptance and integration.

Hesitation of Wall Street Firms

While some Wall Street firms have embraced cryptocurrencies, others remain hesitant to fully engage with the asset class. Regulatory uncertainty, concerns over market volatility, and the potential reputational risks associated with cryptocurrencies have contributed to this hesitation. However, as the industry matures and regulatory frameworks become more established, it is likely that more Wall Street firms will enter the crypto market, further cementing the industry’s legitimacy and acceptance.

Liquidity in Bitcoin Markets

Liquidity in Bitcoin markets is a critical factor in the development and stability of the crypto industry. As Wall Street firms and institutional investors enter the market, liquidity is expected to increase, leading to improved price stability and reduced volatility. This increased liquidity will also attract a wider base of investors, further driving the adoption and integration of cryptocurrencies into traditional financial systems.

This image is property of s.yimg.com.

Role of Leverage

Leverage plays a crucial role in financial ecosystems, allowing participants to magnify their exposure to assets and potentially increase their potential returns. In the context of the crypto industry, leverage enables traders and investors to take larger positions in cryptocurrencies, amplifying both potential gains and losses. The responsible use of leverage is essential for maintaining market stability and protecting market participants, as excessive leverage can lead to heightened volatility and systemic risks. As the industry continues to evolve, regulators will need to strike a balance by implementing sensible leverage limits that promote healthy market growth while mitigating risks.

Conclusion

The growing power of the SEC over the crypto industry, the impact of SEC Chair Gary Gensler’s policies, and the wavering stance of opponents highlight the dynamic nature of the current regulatory landscape. The industry’s integration of Wall Street giants brings both credibility and challenges, and the impact on Coinbase serves as a clear example of the changing dynamics. The regulatory overhang surrounding ETF approval and Wall Street firms’ hesitation further adds to the uncertainties faced by the crypto industry. However, the industry remains optimistic, driven by the potential for cryptocurrencies to reshape finance. Achieving a balance between innovation and regulation, while maintaining the principles of decentralization and inclusivity, will be crucial in determining the long-term success and integration of cryptocurrencies into traditional financial systems. By carefully navigating these challenges and making informed decisions, the future of the crypto industry holds immense potential for both participants and society as a whole.