Are there any bright spots for crypto venture funds? Following scandals and lawsuits, venture funding for the crypto industry has seen a significant decline, hitting its lowest level since 2020. However, there is hope for improvement in the coming quarters. Despite the slowdown in deal cycles, crypto VC funds are expected to deploy capital in the space, leading to an uptick in the market. As investors take their time to understand the business models and meet the teams behind crypto projects, they will likely become more comfortable and start investing more in the industry. Additionally, there are still exciting opportunities in infrastructure development, institutional interest, and decentralized physical infrastructure networks. Despite concerns about founders moving out of the US due to regulatory challenges, it is believed that the talent and innovation in crypto largely remain in the country. The rebound for crypto is expected to happen towards the end of this year or early next year, as funding increases and startups demonstrate strong products and business models.

Bright spots for crypto venture funds

Infrastructure

When it comes to crypto venture funds, one of the bright spots is the focus on infrastructure. Infrastructure plays a crucial role in the success of any industry, and the crypto space is no exception. From underlying blockchains to scaling solutions, there is a growing emphasis on developing the necessary infrastructure to support the growth and adoption of cryptocurrencies.

One key area of infrastructure development is the decentralized physical infrastructure networks. These networks involve the use of physical locations and hardware to support the decentralized nature of cryptocurrencies. By dispersing the infrastructure across multiple locations, the risks of centralization and vulnerability to attacks can be minimized. This decentralized approach ensures that the network remains robust and resilient.

Decentralized physical infrastructure networks

Decentralized physical infrastructure networks have gained significant attention in the crypto venture space. These networks involve the establishment of physical locations, commonly known as mining farms or data centers, that are strategically distributed across different regions. The purpose of these physical locations is to support the operations of the blockchain network by providing computing power for transaction verification and data storage.

By distributing the infrastructure across multiple locations, the decentralized physical infrastructure networks aim to achieve greater security, reliability, and scalability. This distributed approach reduces the risk of a single point of failure and makes it more difficult for any malicious actor to disrupt the network. Additionally, the use of renewable energy sources for powering these infrastructure networks aligns with the broader goal of promoting sustainable and environmentally friendly solutions.

Global talent and regulations

Another bright spot for crypto venture funds lies in the global talent and regulatory landscape. The crypto industry has attracted top talent from diverse backgrounds, including computer science, finance, and cryptography. This influx of talent has brought valuable expertise and innovative ideas to the crypto space, fueling its growth and development.

Furthermore, while regulations surrounding cryptocurrencies and blockchain technology are still evolving, there has been a notable shift towards more thoughtful and inclusive regulatory frameworks. Governments around the world are starting to recognize the potential benefits of cryptocurrencies and are actively working on creating regulatory environments that encourage innovation while addressing concerns related to consumer protection, money laundering, and market manipulation.

The combination of a talented workforce and a favorable regulatory landscape bodes well for crypto venture funds. It provides them with access to skilled individuals who can contribute to the development of innovative projects, as well as the assurance that their investments are operating within a regulated framework.

This image is property of i.ytimg.com.

Factors affecting crypto venture funding

Deployment of capital

One of the key factors influencing crypto venture funding is the deployment of capital. Unlike traditional venture funding, which typically involves investing in equity or debt instruments, crypto venture funds deploy capital in the form of cryptocurrencies. This allows for easier and faster transactions, as well as increased liquidity. However, it also exposes investors to greater volatility and risk, as the value of cryptocurrencies can fluctuate significantly.

The deployment of capital in the crypto space requires careful consideration of the investment strategy, risk tolerance, and market conditions. Investors need to evaluate the potential returns and risks associated with different investment opportunities and make informed decisions on how to allocate their capital accordingly.

Diligence cycles

Due diligence is an essential aspect of crypto venture funding. Given the nascent nature of the industry and the high level of complexity involved in blockchain technology, conducting thorough due diligence is crucial to assess the viability and potential of a project. This involves evaluating the technology, team, market opportunity, competitive landscape, and regulatory compliance of the targeted investment.

However, the diligence cycles within the crypto industry can be quite lengthy, mainly due to the technical complexities and regulatory uncertainties. Crypto venture funds need to allocate sufficient time and resources to conduct proper due diligence, with the aim of minimizing the risk of investing in projects that may not deliver on their promises or may face legal challenges in the future.

Capital raising timeline

The capital raising timeline is another factor that can impact crypto venture funding. In traditional venture funding, the fundraising process can take several months, involving multiple rounds of negotiations and due diligence. However, the crypto industry has witnessed the emergence of Initial Coin Offerings (ICOs) and Initial Exchange Offerings (IEOs), which allow projects to raise funds quickly through the sale of cryptocurrencies or tokens.

These fundraising methods enable accelerated capital raising timelines, allowing projects to secure funding in a matter of weeks or even days. While this can provide startups with the necessary capital to fuel their growth, it also poses challenges for investors in terms of evaluating and participating in these fundraising events within such short time frames.

Investors’ comfort level

Investors’ comfort level with the crypto industry is a significant factor impacting funding decisions. The inherent volatility and regulatory uncertainties in the crypto space can make some investors wary of committing capital to the industry. However, as the industry matures and regulatory frameworks become more established, investor comfort levels are expected to increase.

Building trust and confidence among investors requires transparency, accountability, and robust governance structures within crypto ventures. Projects that can demonstrate a commitment to these principles are more likely to attract a higher level of investor interest and funding.

Business models and product-market fit

The strength of a crypto venture’s business model and its product-market fit are crucial factors in attracting funding. Investors are looking for projects that have a clear value proposition, a market need, and a scalable business model. Additionally, projects that can demonstrate traction and user adoption are generally more attractive to investors, as they indicate a higher probability of success.

Crypto venture funds seek out projects that have the potential to disrupt existing industries or address unmet market needs. By investing in projects that are solving real-world problems and have a clear path to revenue generation, these funds increase their chances of achieving significant returns on their investments.

Rebound timing

The timing of a rebound in the crypto market can significantly impact venture funding. The crypto industry experiences periods of significant volatility, and the timing of a rebound can have a profound effect on investor sentiment and funding availability. When the market is in a bullish phase, investor confidence and risk appetite increase, resulting in an influx of capital into the space. Conversely, during bearish periods, funding may become scarcer as investors become more cautious.

Crypto venture funds need to navigate these market cycles and make strategic investment decisions based on their assessment of market conditions and the overall long-term potential of the projects they are funding. By understanding the market dynamics and adapting their strategies accordingly, these funds can maximize their chances of success.

This image is property of i.ytimg.com.

Specific areas of activity for crypto

Underlying blockchains and scaling solutions

One of the specific areas of activity for crypto venture funds is investing in underlying blockchains and scaling solutions. Blockchains serve as the foundation for most cryptocurrencies and decentralized applications (dApps). Investing in the development of scalable and secure blockchains is crucial for the long-term success of the crypto industry.

Additionally, investing in scaling solutions is essential to address the scalability issues faced by many blockchain networks. The ability to process a high volume of transactions quickly and efficiently is crucial for widespread adoption and usability. Crypto venture funds play a vital role in supporting the research, development, and implementation of scaling solutions that can enhance the performance of blockchains.

Institutional interest and services

In recent years, there has been a significant increase in institutional interest in cryptocurrencies and blockchain technology. Traditional financial institutions, such as banks and asset management firms, are exploring opportunities to incorporate cryptocurrencies into their existing product offerings or develop new services specifically tailored to the crypto market.

Crypto venture funds can capitalize on this institutional interest by investing in projects that cater to the needs of institutional clients. This includes projects focused on developing institutional-grade custody solutions, trading platforms, and financial products that meet the regulatory requirements and risk management standards of institutional investors.

Decentralized physical infrastructure networks

Decentralized physical infrastructure networks, as mentioned earlier, offer an exciting avenue for crypto venture funds. Investing in the development of physical locations that support mining operations and other essential functions of blockchain networks can provide a stable and sustainable source of revenue for investors.

Moreover, these networks contribute to the overall decentralization and security of the crypto ecosystem. By supporting the infrastructure required for the operation of blockchain networks, crypto venture funds can play a crucial role in fostering the growth and adoption of cryptocurrencies.

This image is property of i.ytimg.com.

Global talent and regulatory landscape

Regulatory arbitrage

The global talent and regulatory landscape have a significant impact on the success of crypto venture funds. Regulatory arbitrage, which refers to taking advantage of regulatory differences between jurisdictions, can create opportunities or challenges for these funds.

Different countries have varying levels of regulatory clarity and frameworks for cryptocurrencies. Some jurisdictions are more crypto-friendly and have embraced cryptocurrencies, while others have imposed stricter regulations or even banned certain crypto activities altogether. Crypto venture funds need to consider these regulatory variations when evaluating potential investment opportunities and determining the best jurisdictions to operate in.

Founders’ location and recruitment

The location of founders and the ability to recruit top talent are crucial considerations for crypto venture funds. Certain regions have emerged as crypto hubs, attracting talented individuals with the necessary expertise and experience in the industry. Access to this pool of talent is advantageous for crypto venture funds, as it increases the likelihood of investing in high-quality projects with strong potential for success.

However, the location of founders can also present challenges, particularly if they are operating in jurisdictions with unfavorable regulatory environments. Regulatory uncertainties and restrictions can create obstacles for projects and limit their ability to scale and thrive. Crypto venture funds need to carefully evaluate the regulatory landscape and assess the potential impact on their investments before making funding decisions.

Comparison with fintech industry

When considering the global talent and regulatory landscape for crypto venture funds, it is helpful to draw comparisons with the fintech industry. The fintech industry has experienced significant growth and innovation over the past decade, disrupting traditional financial services and attracting substantial investments.

Many of the regulatory challenges and talent acquisition strategies that crypto venture funds face are similar to those encountered by the fintech industry. By analyzing how the fintech industry has navigated regulatory landscapes and attracted talent, crypto venture funds can gain valuable insights and apply those lessons to their own operations.

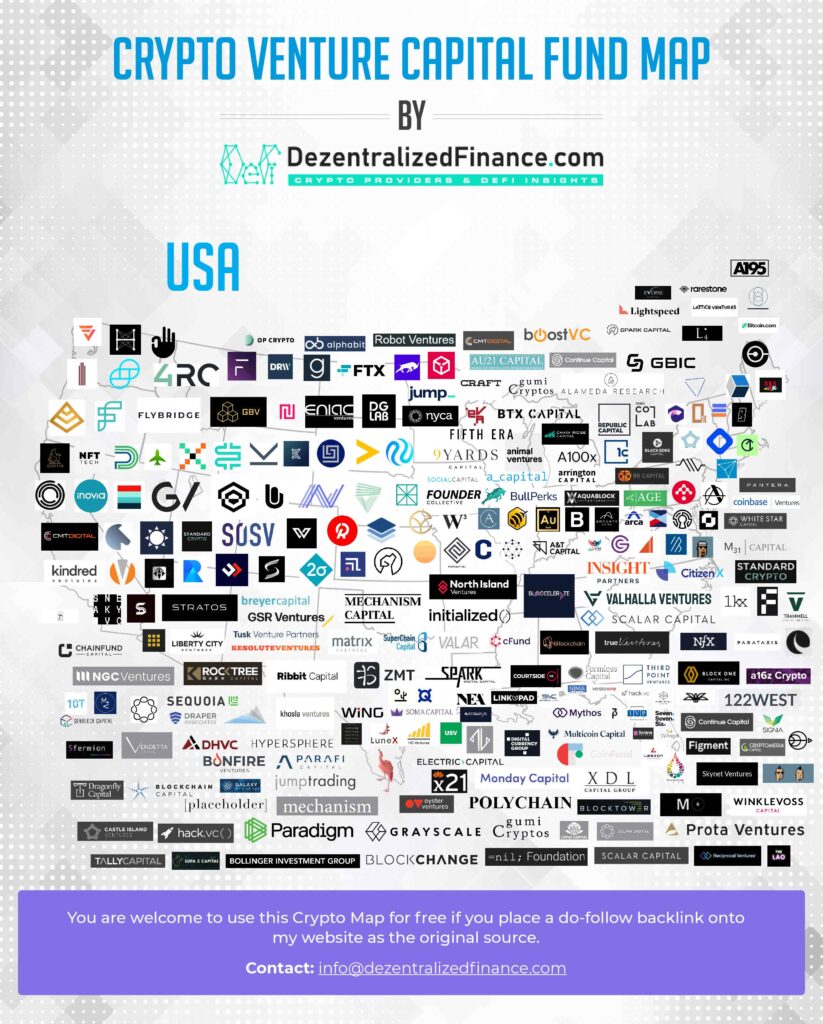

This image is property of dezentralizedfinance.com.

Rebound for Crypto.com

Importance of funding

Funding plays a crucial role in the rebound for Crypto.com. As a cryptocurrency platform, Crypto.com relies on financial resources to develop and expand its product offerings, drive user adoption, and increase its market share. Without sufficient funding, the company may struggle to compete in a rapidly evolving and competitive market.

Crypto venture funds can provide the necessary capital to support Crypto.com’s growth objectives and help position the company for success. By securing funding from reputable and experienced investors, Crypto.com can enhance its credibility and gain access to valuable resources, such as industry expertise, networks, and strategic guidance.

Timeline for investor comfort

Investor comfort is an important consideration for the rebound of Crypto.com. As mentioned earlier, the comfort level of investors in the crypto industry impacts funding decisions. Crypto.com needs to demonstrate transparency, accountability, and a commitment to regulatory compliance to instill confidence in potential investors.

Furthermore, as the regulatory landscape continues to evolve and mature, investors’ comfort level is expected to increase. By actively engaging with regulators, ensuring compliance with applicable laws, and implementing robust governance practices, Crypto.com can position itself as a trusted and reliable player in the industry, attracting a higher level of investor interest and funding.

Expected increase in capital and founders

The rebound for Crypto.com is likely to result in an increase in capital and founders. As investor confidence returns to the crypto market, more capital is likely to flow into the industry. This increased availability of capital can provide Crypto.com with the necessary resources to execute its growth strategies, expand its product offerings, and enhance its market position.

Additionally, as the industry rebounds, talented founders may be more inclined to enter the market and launch new projects. These founders bring fresh ideas, innovation, and expertise, further driving the growth and development of the crypto ecosystem. Crypto.com, as an established player in the industry, can leverage its position to attract top talent and form strategic partnerships with promising startups.

In conclusion, the crypto venture funding landscape is influenced by various factors such as infrastructure development, diligence cycles, regulatory landscape, and investor comfort levels. Infrastructure, including decentralized physical infrastructure networks, plays a vital role in supporting the growth and adoption of cryptocurrencies. Global talent and regulatory landscape shape the success of crypto venture funds, with the need to navigate regulatory arbitrage and attract top talent. Crypto venture funds are actively investing in specific areas like underlying blockchains, institutional interest, and decentralized physical infrastructure networks. The rebound for Crypto.com relies on securing funding, investor comfort, and an expected increase in capital and founders. Overall, the crypto venture funding space presents bright spots and opportunities for investors looking to capitalize on the potential of cryptocurrencies and blockchain technology.