In the midst of the crypto winter, there seems to be something different this time around. Emily Chang, in a video produced by Bloomberg Technology, interviews Katie Haun, the CEO and Founder of Haun Ventures, to explore the current state of the crypto cycle. With over a decade of experience in the crypto industry, Haun reflects on the fluctuations of the market, highlighting that each cycle brings in more and more people. However, she also points out that the impact of the crypto winter varies depending on the sector of the ecosystem one looks at. While some areas may be cooling off, others, like developers and technology enthusiasts, still consider crypto to be hot.

What sets this crypto winter apart is the presence of significant global macro conditions. Inflation is soaring and geopolitical tensions, such as the war in Ukraine, are intensifying. These factors add an extra layer of complexity to the crypto market, making it a unique situation compared to previous downturns. Haun also brings attention to the rise of algorithmic stable coins, acknowledging their potential but highlighting the need to evaluate widespread adoption in relation to their technology capabilities. Overall, this article dives into the distinct characteristics of the current crypto winter and offers insights into its effects on the industry.

This image is property of i.ytimg.com.

State of the Crypto Cycle

Crypto Cycles: Hot and Cold

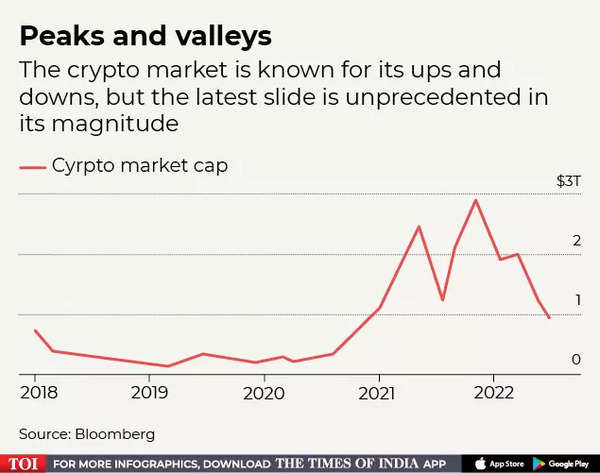

The crypto market is notorious for its volatility, characterized by recurring cycles of extreme highs and lows. These cycles, often referred to as “bull” and “bear” markets, have become a defining feature of the crypto ecosystem. During bull markets, prices skyrocket, and optimism abounds as investors eagerly embrace cryptocurrencies. However, the tides quickly turn during bear markets, plunging investors into a period of despair and uncertainty. The crypto cycle is a perpetual dance between these hot and cold phases.

More People Entering Each Cycle

With each passing cycle, the crypto market attracts a growing number of participants. As the industry matures, more investors, institutions, and even governments are recognizing the potential of cryptocurrencies and blockchain technology. This influx of new players injects fresh capital and ideas into the market, driving innovation and growth. However, it also introduces new challenges and dynamics that can shape the future direction of the crypto cycle.

Different Perspectives in the Ecosystem

Within the crypto ecosystem, there is a myriad of perspectives. Some enthusiasts and believers in the technology see cryptocurrencies as the future of finance, advocating for their mainstream adoption. Others approach the market with skepticism, viewing it as a speculative bubble that is bound to burst. The clash of these perspectives adds to the dynamism of the crypto cycle, fueling the ongoing debates about the fundamental value and long-term viability of cryptocurrencies.

Crypto Winter in Global Macro Conditions

Inflation at Record Highs

One of the macroeconomic factors influencing the crypto market is the surge in global inflation. Inflation erodes the value of traditional fiat currencies, driving investors to seek alternative stores of value. Cryptocurrencies, with their decentralized nature and limited supply, appeal to those looking to hedge against inflation. As a result, during times of high inflation, cryptocurrencies often experience increased demand and upward price pressures.

War in Ukraine

The geopolitical landscape also has a significant impact on the crypto cycle. Currently, tensions in Eastern Europe, such as the ongoing war in Ukraine, create an atmosphere of uncertainty and instability. In times of conflict, investors flock to safe-haven assets, which can include cryptocurrencies. The threat of war and the potential disruption of traditional financial systems can drive individuals and institutions to seek shelter in the decentralized world of crypto.

Other Factors Affecting the Market

Aside from inflation and geopolitical tensions, there are various other factors that can significantly influence the crypto cycle. Economic recessions, financial market volatility, technological advancements, regulatory developments, and even societal trends all play a role in shaping the trajectory of the market. Understanding and navigating these factors is crucial for anyone seeking to comprehend the complex dynamics of the crypto cycle.

Serious Carnage in the Market

Impact on Algorithmic Stablecoins

Algorithmic stablecoins, a type of cryptocurrency designed to maintain a relatively stable value, often bear the brunt of market downturns. These stablecoins rely on complex algorithms and mechanisms to adjust their supply and demand dynamically. However, during times of extreme market volatility, maintaining stability becomes a considerable challenge. Significant price fluctuations can trigger system failures, leading to a loss of confidence in these stablecoin projects.

Widespread Adoption of Luna and Terra

Amid the market carnage, two algorithmic stablecoins have managed to gain significant traction: Luna and Terra. These projects have successfully achieved widespread adoption and have demonstrated resilience in the face of market downturns. Their innovative design and robust mechanisms have instilled confidence in investors and positioned them as leading players in the algorithmic stablecoin space. Luna and Terra serve as testaments to the potential and importance of stablecoins in a volatile market.

Challenges Faced by Algorithmic Stablecoins

Potential Issues with Stability

Algorithmic stablecoins are not without their challenges. Critics argue that the stability of these coins is predicated on complex algorithms that can be prone to failures and vulnerabilities. Any shortcomings in the design or implementation of these algorithms can lead to instability and potentially significant losses for users. As the market matures, it becomes increasingly important to address these concerns and refine the mechanisms that underpin algorithmic stablecoins.

Concerns about Scalability and Adoption

Scalability and adoption are two critical factors for the success of any cryptocurrency project, and algorithmic stablecoins are no exception. As more users enter the ecosystem, the demand for stablecoins will inevitably increase. However, scaling the infrastructure to accommodate the growing number of users and transactions poses a significant challenge. Additionally, widespread adoption relies on building trust and overcoming the skepticism surrounding stablecoins, which often requires navigating complex regulatory landscapes.

Need for Further Innovation

In the fast-paced world of cryptocurrencies, innovation is paramount. Algorithmic stablecoins must continuously evolve and adapt to the changing market conditions and investor demands. This requires ongoing research and development to enhance stability mechanisms, improve scalability, and address any emerging issues. The pursuit of innovation is crucial not only for the success of individual stablecoin projects but also for the overall resilience and sustainability of the crypto ecosystem.

This image is property of image.cnbcfm.com.

Regulatory Uncertainty and Crackdowns

Increased Regulatory Scrutiny

Regulatory scrutiny and the legal framework surrounding cryptocurrencies have long been subjects of debate and contention. Governments around the world are grappling with how to regulate an industry that operates in a borderless and decentralized manner. In recent years, there has been a clear trend of increased regulatory scrutiny, fueled by concerns over money laundering, tax evasion, and consumer protection. This regulatory uncertainty introduces volatility and can significantly impact the sentiment and behavior of market participants.

Government Crackdowns on Crypto

As governments strive to exert control over the crypto market, they have implemented various measures to curtail its growth. Some countries have banned or restricted cryptocurrencies altogether, while others have introduced strict regulations and reporting requirements for businesses and individuals operating in the space. These government crackdowns can disrupt trading activities, limit liquidity, and create barriers to entry for new participants. The impact of such actions on the crypto cycle is undeniable and often leads to periods of market turbulence.

Impact on Market Sentiment

The regulatory landscape plays a crucial role in shaping market sentiment and investor behavior. Positive regulatory developments can foster confidence, attract institutional players, and drive market growth. Conversely, negative regulatory actions and uncertainties can create fear, uncertainty, and doubt (FUD), dampening investor sentiment and leading to massive selloffs. The delicate balance between regulation and innovation remains a ongoing challenge for the crypto community.

Shift in Investor Mentality

Learning from Previous Market Cycles

The crypto community has learned valuable lessons from past market cycles. Previous bull and bear markets have brought both euphoria and pain, ultimately serving as a source of wisdom for investors. Many participants now approach the market with a more measured mentality, understanding the cyclical nature of cryptocurrencies and the need for a long-term perspective. The ability to learn from history and avoid falling prey to irrational exuberance or excessive pessimism is crucial for navigating the crypto cycle.

Long-Term Investment Mindset

As the crypto market matures, there is a growing recognition of the importance of a long-term investment mindset. While short-term trading can be lucrative, it also carries substantial risks and is heavily influenced by market sentiment and speculation. Investors increasingly focus on fundamental analysis, evaluating the underlying technology, team, and community behind a cryptocurrency project. This shift towards a more long-term investment horizon promotes stability, rational decision-making, and ultimately augments the overall health of the market.

Focus on Fundamentals and Value

The emphasis on fundamentals and value in the crypto market has become more pronounced in recent years. Investors now scrutinize projects not only for their potential for short-term gains but also for their ability to deliver long-term value and utility. The advent of decentralized finance (DeFi) and non-fungible tokens (NFTs) has spurred innovation and brought further recognition to the importance of real-world use cases and tangible value creation. A focus on genuine utility and sustainable growth is essential for attracting long-term investors and driving meaningful adoption.

This image is property of static.toiimg.com.

Emergence of Institutional Players

Institutional Adoption of Cryptocurrencies

Institutional players, such as hedge funds, asset managers, and pension funds, have started to recognize the potential of cryptocurrencies as an asset class. Traditional investment firms have begun allocating significant capital to cryptocurrencies, driving increased liquidity, and injecting stability into the market. This institutional adoption brings with it a level of credibility and legitimacy that further solidifies cryptocurrencies’ place in the financial landscape.

Entry of Traditional Financial Institutions

In addition to hedge funds and asset managers, traditional financial institutions have also entered the crypto space. Major banks and payment processors have begun offering cryptocurrency-related products and services, allowing their customers to invest, trade, and transact in digital assets. This integration of cryptocurrencies into the existing financial infrastructure not only expands the reach of cryptocurrencies but also bridges the gap between the traditional and digital worlds.

Impact on Market Dynamics

The entrance of institutional players and traditional financial institutions has significant implications for market dynamics. Increased institutional involvement can bring stability, liquidity, and broader access to capital, which can support market growth. However, it can also introduce a new set of risks, such as market manipulation and concentration of control. Striking the right balance between institutional involvement and maintaining the decentralized ethos of cryptocurrencies is an ongoing challenge for the crypto community.

Technological Advancements in the Crypto Space

Improvements in Blockchain Scalability

One of the longstanding challenges facing cryptocurrencies is the scalability of blockchain networks. As more users and transactions enter the ecosystem, existing blockchains can become congested, leading to slower processing times and higher fees. However, ongoing research and development efforts are addressing these scalability issues. New consensus mechanisms, layer-two solutions, and improvements in network architecture are paving the way for increased scalability and improved user experience.

Rise of Decentralized Finance (DeFi)

Decentralized finance, or DeFi, has emerged as one of the most innovative and disruptive sectors within the crypto ecosystem. DeFi encompasses a range of financial applications built on blockchain technology, including lending platforms, decentralized exchanges, and yield farming protocols. These decentralized financial products aim to provide transparent, permissionless, and inclusive alternatives to traditional financial services. The rise of DeFi has attracted significant attention and investment, further fueling the growth and evolution of the crypto market.

Impact of NFTs on the Market

Non-fungible tokens, or NFTs, have taken the world by storm, captivating mainstream media and garnering the attention of collectors, artists, and investors. NFTs represent unique digital assets that can be bought, sold, and traded on blockchain platforms. They have revolutionized digital ownership and proven to be a powerful tool for creators, enabling them to monetize their work in new and innovative ways. The popularity of NFTs has introduced a new dimension to the crypto market and expanded its reach beyond cryptocurrency enthusiasts.

This image is property of image.cnbcfm.com.

Growing Interest from Retail Investors

Increased Participation of Retail Investors

The crypto cycle has witnessed a surge in interest and participation from retail investors. The accessibility of cryptocurrencies, coupled with the allure of potentially high returns, has attracted a whole new generation of investors. Retail investors now have various avenues to enter the market, including cryptocurrency exchanges, mobile apps, and even traditional brokerage platforms. This democratization of access has brought unprecedented levels of retail participation and has contributed to the overall liquidity and vibrancy of the crypto market.

Accessibility of Cryptocurrencies

The growing accessibility of cryptocurrencies has been a pivotal factor in their widespread adoption. Unlike traditional financial assets, cryptocurrencies can be easily bought, sold, and stored using digital wallets and online platforms. This accessibility has removed many barriers to entry and empowered individuals to take control of their financial lives. However, it also comes with risks, as the lack of education and understanding of cryptocurrencies can lead to uninformed investment decisions and potential losses.

Social Media Influence on Investment Decisions

Social media has emerged as a powerful force shaping investment decisions and driving market sentiment in the crypto world. Platforms like Twitter, Reddit, and TikTok have become hotbeds of discussion, speculation, and even market manipulation. Influencers and experts on these platforms can sway public opinion and trigger waves of buying or selling activity. The viral nature of social media can amplify the impact of positive or negative news, introducing an additional layer of volatility to the crypto cycle.

Conclusion

The crypto cycle is a complex and dynamic phenomenon, influenced by a multitude of factors, including global macro conditions, technological advancements, regulatory developments, and market sentiment. With each passing cycle, the crypto market attracts more participants, expands its reach, and evolves. Each phase of the cycle presents unique opportunities and challenges that shape the future of cryptocurrencies. As the market continues to mature, it is crucial for participants to remain informed, take a long-term view, and focus on the fundamental value and potential of cryptocurrencies and blockchain technology. By navigating the crypto cycle with diligence and foresight, individuals and institutions can position themselves for success in this ever-changing landscape.