Centralized and decentralized lending have become hot topics in the financial industry. In a recent video by Bloomberg Technology, Gauntlet Networks CEO and Co-Founder Tarun Chitra explains the key differences between the two lending models. Centralized lending involves lenders like Genesis BLOCK and Celsius, who offer unsecured loans to market makers while accepting deposits from consumers or institutions. However, as interest rates tightened, these centralized lenders struggled to maintain the necessary capital and faced a credit crunch when borrowers, who had invested in volatile cryptocurrencies, faced significant losses. This has sparked a trend towards decentralized finance, where customers can prioritize withdrawals over shareholders, reducing the risk of credit crunches in the system.

Looking ahead, Chitra predicts that the industry will likely see a shift towards more collateralized lending and a broader adoption of decentralized finance. However, he also points out specific pricing dislocations, such as the worrying discount on GTC and the correlation with the halting of Genesis lending. The main question that arises from the ongoing credit crisis is the issue of collateral and its implications for the future of the lending industry. As the industry evolves, it becomes crucial for lenders and borrowers alike to understand the differences between centralized and decentralized lending and the role collateral plays in mitigating financial risks.

This image is property of i.ytimg.com.

Centralized Lending

Definition of centralized lending

Centralized lending refers to a lending system in which financial institutions and intermediaries serve as intermediaries between borrowers and lenders. In this model, a central authority, such as a bank or a lending platform, controls and manages the lending process.

How centralized lending works

In centralized lending, borrowers typically submit loan applications to the centralized lending platform or financial institution. The platform or institution reviews the application, assesses the borrower’s creditworthiness, and determines the terms and conditions of the loan. If approved, the lender disburses the funds to the borrower, and the borrower agrees to repay the loan amount plus interest over a specified period of time.

Examples of centralized lending platforms

Some well-known examples of centralized lending platforms include traditional banks, peer-to-peer lending platforms, and online lending marketplaces. Banks, like JP Morgan or Wells Fargo, have served as centralized lending entities for centuries. Peer-to-peer lending platforms, such as LendingClub or Prosper, connect individuals looking to borrow with lenders willing to provide funds. Online lending marketplaces, such as Kiva or Funding Circle, facilitate loans between borrowers and lenders, focusing on specific niches or industries.

Advantages of centralized lending

One of the main advantages of centralized lending is the convenience and ease of access for borrowers. Centralized lending platforms typically have well-established processes and infrastructure, making it easier for borrowers to apply for loans and access funds quickly. Additionally, centralized lenders often offer a wide range of loan products to cater to different needs, including personal loans, business loans, and mortgages.

For lenders, centralized lending platforms can provide opportunities to earn interest income by lending money to borrowers. These platforms often have systems in place to assess borrower creditworthiness, reducing the risk of default and potentially offering attractive returns to lenders.

Disadvantages of centralized lending

Despite the advantages, centralized lending also has its limitations. One of the major drawbacks is the potential for bias in the lending process. Centralized lenders, such as banks, may rely heavily on credit scores and financial history, which can disadvantage borrowers with limited credit history or alternative sources of income. Additionally, the centralized nature of these platforms means that borrowers and lenders may have limited control over the terms and conditions of the loan, leaving them exposed to the lender’s decisions.

Another disadvantage of centralized lending is the high cost associated with intermediaries. Traditional financial institutions often charge higher interest rates and fees to cover their operational costs. These costs can be passed on to borrowers, making loans more expensive compared to alternative lending models.

Decentralized Lending

Definition of decentralized lending

Decentralized lending, also known as peer-to-peer lending or DeFi lending (Decentralized Finance lending), is a lending system that operates on blockchain technology without the need for intermediaries or middlemen. In decentralized lending, borrowers and lenders interact directly through smart contracts, which are self-executing contracts with the terms of the loan encoded on the blockchain.

How decentralized lending works

Decentralized lending platforms leverage blockchain technology to connect borrowers and lenders directly. Borrowers submit loan requests on these platforms, and lenders can review these requests and choose to fund them. Smart contracts, built on blockchain platforms like Ethereum, automatically execute the loan agreement, handle collateralization (if required), and enforce repayment terms.

Smart contracts eliminate the need for traditional intermediaries, as they ensure transparency, security, and automation of the lending process. Moreover, decentralized lending platforms often offer various loan options, allowing borrowers to obtain loans for personal needs, business ventures, or even borrowing against cryptocurrency assets.

Examples of decentralized lending platforms

Prominent examples of decentralized lending platforms include Compound, Aave, and MakerDAO. These platforms leverage blockchain technology to enable peer-to-peer lending and borrowing. For instance, on Compound, users can lend and borrow cryptocurrency assets by supplying or borrowing against collateral. Aave allows users to earn interest on deposited cryptocurrencies, while also providing lending and borrowing options.

Advantages of decentralized lending

Decentralized lending presents several advantages compared to centralized lending. One of the key benefits is the increased accessibility and inclusiveness it offers. Decentralized lending platforms typically have fewer barriers to entry, allowing borrowers who may not qualify for traditional loans to access funds. The removal of intermediaries also means that borrowers and lenders have more control over the terms and conditions of the loans, which can lead to fairer and more flexible loan agreements.

Another advantage of decentralized lending is the potential for lower interest rates. Without the need for intermediaries, transaction costs can be reduced, resulting in competitive interest rates for borrowers and higher returns for lenders.

Disadvantages of decentralized lending

Despite its advantages, decentralized lending also faces challenges and limitations. One significant disadvantage is the lack of regulation and oversight. Decentralized lending platforms operate outside traditional financial frameworks, which can lead to potential risks for both borrowers and lenders. Without proper oversight, borrowers may face difficulties in resolving disputes or obtaining recourse in case of fraudulent activity.

Furthermore, decentralized lending platforms can be more exposed to market volatility and liquidity risks. Since loans in the decentralized lending ecosystem are based on collateral, fluctuations in the value of the collateralized assets can affect borrowers and lenders. For borrowers, a decrease in the value of their collateral may require additional funds to maintain the loan-to-value ratio. For lenders, a decrease in collateral value may result in potential losses if the borrower defaults on the loan or if liquidation of the collateral is triggered.

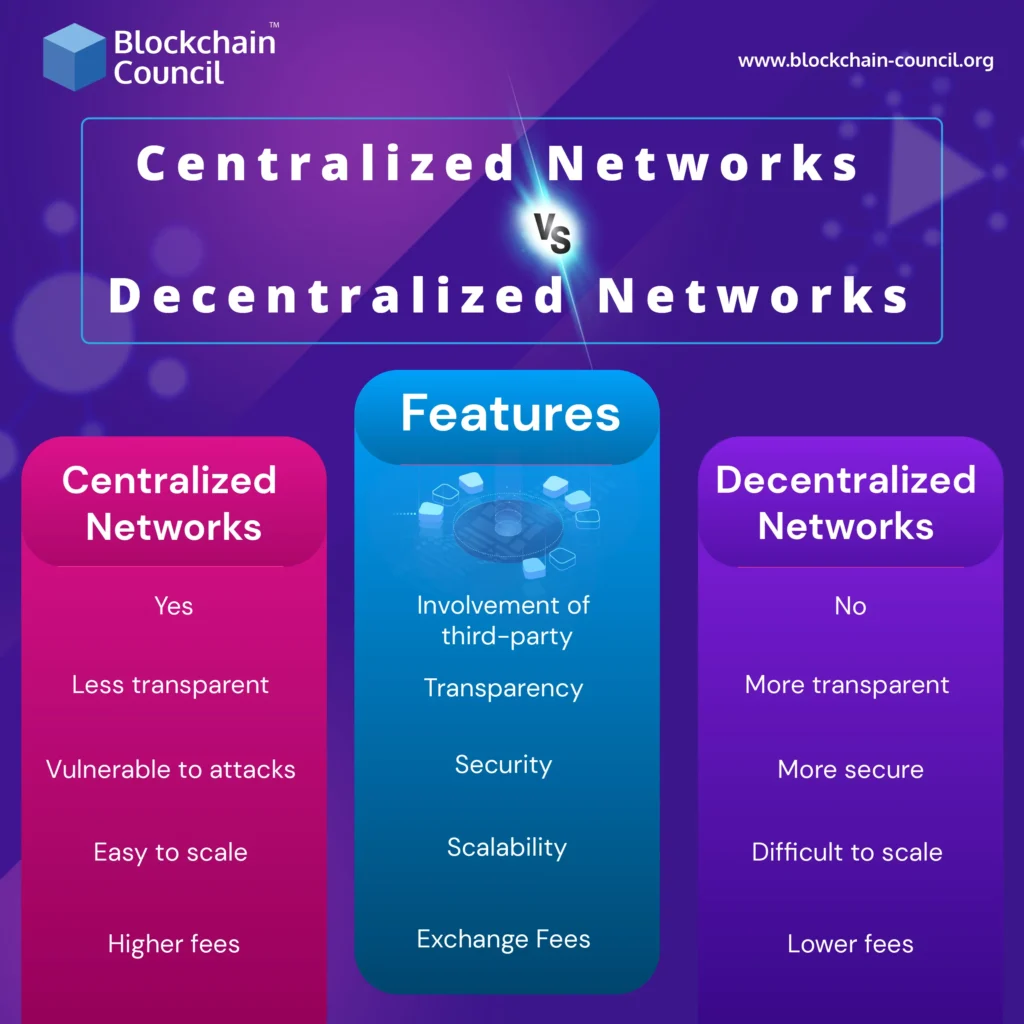

Comparison of Centralized and Decentralized Lending

Key differences between centralized and decentralized lending

The key differences between centralized and decentralized lending lie in the intermediaries, control, and infrastructure involved. Centralized lending relies on financial institutions as intermediaries, while decentralized lending allows for direct borrowing and lending between individuals.

In centralized lending, control over the loan terms, interest rates, and collateral requirements lies with the lenders or the centralized lending platform. On the other hand, decentralized lending platforms leverage smart contracts and decentralized governance models, enabling borrowers and lenders to have more control over terms through consensus-based decision-making.

From an infrastructure standpoint, centralized lending platforms often have well-established systems and regulatory compliance requirements. Decentralized lending platforms, being built on blockchain technology, benefit from transparency, security, and automation through smart contracts but may lack regulatory oversight.

Risk factors in centralized lending

Centralized lending is exposed to various risk factors, including counterparty risk, market volatility risk, and systemic risk. Counterparty risk arises from the possibility of the borrower defaulting on the loan, which can lead to financial losses for lenders. Market volatility risk refers to the potential impact of market fluctuations on the value of collateral and the ability of borrowers to repay the loans. Systemic risk poses a threat to centralized lending in the event of financial crises or disruptions in the overall economy, affecting the stability and availability of funds for lending.

Risk factors in decentralized lending

Decentralized lending also has its set of risk factors. The primary risk is connected with the volatility of the collateralized assets. If the value of the collateral drops significantly, borrowers may face the risk of their positions being liquidated, potentially leading to losses. Additionally, smart contract vulnerabilities can expose decentralized lending platforms to hacking or exploitation, resulting in the loss or theft of funds.

Transparency in centralized and decentralized lending

Transparency is a crucial aspect of both centralized and decentralized lending, albeit in different ways. In centralized lending, platforms and financial institutions are responsible for providing transparency regarding loan terms, interest rates, and fees. However, due to the closed nature of these systems, borrowers and lenders may have limited visibility into the overall lending process.

In decentralized lending, transparency is inherent in the blockchain technology used. Every transaction, including loan agreements and repayments, is recorded on the blockchain, creating an auditable and transparent ecosystem. Borrowers and lenders can verify loan terms, collateralization ratios, and repayments without relying on trust in intermediaries.

Flexibility and control in centralized and decentralized lending

Centralized lending offers borrowers limited flexibility and control over loan agreements. Borrowers often have to accept the terms and conditions set by the centralized lending platform or financial institution. Lenders also have limited control over interest rates and loan approval processes, which are mostly governed by the centralized lender.

Decentralized lending, on the other hand, provides borrowers and lenders with more flexibility and control. Borrowers can negotiate loan terms directly with lenders, and lenders can choose which loan requests to fund. Additionally, decentralized lending platforms empower users to participate in the governance and decision-making processes through voting mechanisms, giving them a say in the evolution of the platform.

Regulation and Legal Considerations

Regulatory challenges for centralized lending

Centralized lending operates within well-established financial frameworks and regulations. However, these regulations vary across jurisdictions, making it challenging for platforms to operate on a global scale. Compliance with Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations can also be time-consuming and costly for centralized lending platforms.

Moreover, the lending platforms themselves may require licenses or permits to operate legally, which can pose additional regulatory challenges. These licensing requirements vary depending on the type of loan products offered and the jurisdictions in which the lending platforms operate.

Regulatory challenges for decentralized lending

Decentralized lending faces unique regulatory challenges due to its disruptive nature and lack of central control. Regulators are still grappling with how to classify and regulate decentralized lending platforms. The decentralized nature of these platforms also makes it difficult for regulators to impose traditional compliance measures, such as KYC and AML.

Legal uncertainties surround decentralized lending as well, particularly regarding the enforceability of smart contracts and the liability of platform developers. The absence of intermediaries and the reliance on blockchain technology create complexities in determining legal recourse and responsibilities.

Legal implications of centralized and decentralized lending

Centralized lending platforms are subject to legal obligations and contractual agreements. Borrowers and lenders enter into legally binding loan agreements, and non-compliance can lead to legal consequences. Centralized lending platforms must also adhere to consumer protection and privacy laws to safeguard borrower information and ensure fair lending practices.

Decentralized lending, while offering increased transparency, faces challenges in terms of enforcing legal obligations. Smart contracts, being self-executing and immutable, are designed to ensure trust and automation. However, unforeseen circumstances or disputes may require legal intervention, where the traditional legal system may not readily recognize or accommodate smart contracts.

Government involvement and oversight

Governments play a crucial role in regulating and overseeing both centralized and decentralized lending. Centralized lending falls under the purview of financial regulatory bodies, such as central banks and financial services authorities. These authorities set rules and regulations to ensure the stability and integrity of the financial system and protect the interests of borrowers and lenders.

Decentralized lending poses new challenges for governments, as the technology operates outside traditional financial systems. Authorities around the world are beginning to address the regulatory aspects of decentralized lending, exploring frameworks that strike a balance between innovation and consumer protection. Government involvement and oversight in decentralized lending can help establish legal clarity, enhance investor confidence, and mitigate potential risks.

This image is property of cdn.ttgtmedia.com.

Impact on Borrowers and Lenders

Access to loans for borrowers

Centralized lending platforms, with their stringent credit assessment processes, may restrict access to loans for borrowers with limited credit history or unconventional income sources. These borrowers may face difficulty in meeting the strict requirements imposed by centralized lenders.

Decentralized lending, with its focus on inclusivity, provides opportunities for borrowers who may not qualify for traditional loans. Through decentralized lending platforms, borrowers can tap into a global pool of lenders who are open to lending without the stringent requirements of centralized platforms, thus increasing access to loans for a broader range of borrowers.

Interest rates and loan terms in centralized and decentralized lending

Centralized lending often comes with higher interest rates compared to decentralized lending. The involvement of intermediaries in centralized lending results in additional fees and costs, which are passed on to borrowers. These fees, along with the need to cover operational expenses, contribute to the higher interest rates charged by traditional financial institutions.

Decentralized lending platforms, being more efficient and automated, can offer competitive interest rates due to reduced operational costs. Additionally, the direct peer-to-peer nature of decentralized lending eliminates or reduces intermediation fees, resulting in potentially lower interest rates for borrowers.

Loan terms in centralized and decentralized lending may also differ. Centralized lending platforms may have standardized loan terms that borrowers must accept. In contrast, decentralized lending platforms facilitate negotiation between borrowers and lenders, allowing for more flexible loan terms tailored to individual needs.

Collateral requirements in centralized and decentralized lending

Centralized lending often involves collateral requirements to mitigate the lender’s risk. Traditional lenders may require borrowers to provide valuable assets, such as real estate or vehicles, as collateral. These collateral requirements can limit access to loans for borrowers who lack substantial assets or are unwilling or unable to provide collateral.

Decentralized lending platforms can provide alternative collateral options. Borrowers can collateralize digital assets, such as cryptocurrencies or non-fungible tokens (NFTs), without the need for physical assets. This broader range of collateral options expands borrowing opportunities for individuals who hold digital assets but may lack traditional forms of collateral.

Lender profitability in centralized and decentralized lending

Centralized lending platforms have traditionally provided lenders with relatively stable and predictable returns. These platforms often have established risk management systems and robust processes in place to mitigate credit risk. Lenders can earn interest income based on the loan amount disbursed and the agreed-upon interest rate.

Decentralized lending platforms offer lenders the opportunity for potentially higher returns, but with varying levels of risk. Lenders can earn interest by lending directly to borrowers and benefit from the efficiency and transparency of blockchain-based lending. However, the decentralized lending ecosystem carries unique risks, such as collateral volatility and smart contract vulnerabilities, which can impact lender profitability.

Security and Risk Management

Securing funds in centralized lending

Centralized lending platforms focus on security and risk management to protect borrower and lender funds. These platforms typically implement stringent security measures, such as encryption protocols, secure data storage, and multi-factor authentication, to safeguard user accounts and transactions. Additionally, centralized lending platforms often have contingency plans in place to handle potential disruptions or breaches, ensuring the continuity and security of operations.

Securing funds in decentralized lending

Decentralized lending platforms prioritize security through the use of blockchain technology. The decentralized nature of these platforms reduces the risk of single points of failure and enhances data security. Funds and assets are stored on the blockchain, protected by cryptographic keys and secured by consensus mechanisms.

However, in decentralized lending, the primary risk lies in smart contract vulnerabilities and potential hacker attacks. Thorough auditing, regular code updates, and security reviews are necessary to minimize the risk of exploitation or loss of funds. Additionally, users must practice good security habits when interacting with decentralized lending platforms, such as protecting their private keys and avoiding suspicious or malicious smart contracts.

Mitigating risks in centralized lending

Centralized lending platforms employ risk management strategies to mitigate potential risks. These strategies include comprehensive credit assessment processes, collateral requirements, and insurance policies. By assessing borrowers’ creditworthiness and ensuring adequate collateralization, platforms aim to minimize the risk of default. Insurance policies may also be employed to protect lenders against potential losses due to borrower defaults.

Centralized lending platforms also perform ongoing monitoring and risk analysis to identify and address potential credit risks. This proactive approach allows platforms to make informed decisions and manage risk exposure effectively.

Mitigating risks in decentralized lending

Decentralized lending platforms address risks through various mechanisms. Collateralization is a key element in mitigating risk in decentralized lending. Lenders often require borrowers to provide collateral, which acts as a safeguard against default. Collateralized assets are typically held in smart contracts and can be liquidated to cover losses in the event of a default.

To address smart contract vulnerabilities, decentralized lending platforms rely on rigorous auditing and testing processes. Smart contracts undergo extensive security assessments by external auditors to identify and fix any potential vulnerabilities. Additionally, decentralized lending platforms often maintain bug bounties and incentivize developers and users to identify and report security flaws, further enhancing the security of the platform.

Insurance and protection for borrowers and lenders

In centralized lending, borrowers often have access to insurance products, such as payment protection insurance or mortgage insurance, to protect against unforeseen circumstances. These insurance products can provide borrowers with financial security in case of events like job loss, disability, or property damage.

Decentralized lending is still exploring the integration of insurance products into the ecosystem. While decentralized lending platforms may not offer traditional insurance policies, blockchain-based solutions, such as decentralized insurance protocols, are emerging. These protocols aim to provide coverage against borrower default or smart contract exploits, providing an additional layer of protection for borrowers and lenders in the decentralized lending space.

This image is property of www.blockchain-council.org.

Market Trends and Future Outlook

Current market trends in centralized lending

In recent years, centralized lending has seen significant growth and evolution. Traditional financial institutions have embraced digital lending platforms, streamlining loan application processes and leveraging technology for quicker loan approvals. The rise of online lending marketplaces and peer-to-peer lending platforms has also expanded access to loans for borrowers while offering investment opportunities to lenders.

Another emerging trend in centralized lending is the integration of machine learning and artificial intelligence (AI) algorithms into credit assessment processes. These technologies enable lenders to make more accurate and efficient credit decisions, improving loan underwriting and reducing the risk of defaults.

Current market trends in decentralized lending

Decentralized lending, driven by the rise of blockchain technology and cryptocurrencies, has gained traction as a disruptive force in the lending industry. Marketplaces for decentralized lending have emerged, offering various loan products to cater to different needs, from unsecured personal loans to loans backed by digital assets.

A notable trend in decentralized lending is the growth of decentralized stablecoin lending. Stablecoins, digital currencies pegged to stable assets like fiat currencies, provide a predictable lending environment with reduced price volatility. Lenders and borrowers can transact in stablecoins, mitigating the risks associated with the volatility of cryptocurrencies.

The future of centralized lending

Centralized lending is likely to continue evolving as technology advances and customer preferences change. Traditional financial institutions will increasingly adopt digital lending platforms to improve efficiency and customer experience. Integration with emerging technologies such as blockchain and AI will enhance the accuracy and speed of credit assessments, enabling faster loan approvals and potentially lowering interest rates.

Additionally, centralized lending may explore new avenues, such as green lending, to cater to the growing demand for sustainable financing. Offering loans for renewable energy projects or environmentally friendly initiatives can align centralized lenders with the evolving needs and values of borrowers.

The future of decentralized lending

Decentralized lending is poised for growth and innovation, driven by the expanding decentralized finance (DeFi) ecosystem. As blockchain technology continues to mature, decentralized lending platforms will become more user-friendly and accessible to a broader range of borrowers and lenders. The integration of oracle solutions will enable the inclusion of real-world data, expanding lending opportunities beyond the realm of purely digital assets.

Regulatory frameworks around decentralized lending are also likely to evolve to provide legal clarity and consumer protection. Governments are recognizing the potential benefits of decentralized finance and are exploring ways to establish a balanced regulatory environment that fosters innovation while ensuring market integrity.

Integration of centralized and decentralized lending

The future of lending is likely to witness the integration of centralized and decentralized lending models. Hybrid platforms that combine the best elements of both models are already emerging. These platforms aim to harness the efficiency and transparency of decentralized lending while leveraging centralized lending’s experience, infrastructure, and compliance capabilities.

By combining the advantages of both models, borrowers can access a wider range of loan options, lenders can diversify their portfolios, and the overall lending ecosystem can benefit from enhanced stability, efficiency, and inclusivity.

Case Studies and Examples

Successful centralized lending platforms

One example of a successful centralized lending platform is LendingClub. LendingClub disrupted the lending industry by creating a peer-to-peer lending platform, connecting borrowers and lenders directly. Through its platform, LendingClub has facilitated billions of dollars in loans, providing borrowers with access to affordable credit and offering lenders alternate investment options.

Another example is Prosper, another prominent peer-to-peer lending platform. Prosper has built a vast network of borrowers and lenders, connecting individuals seeking personal loans with lenders looking for investment opportunities. Prosper’s success lies in its ability to streamline the borrowing process, provide personalized loan options, and maintain a robust credit assessment system.

Successful decentralized lending platforms

Compound and Aave are widely recognized as successful decentralized lending platforms. Compound, built on the Ethereum blockchain, allows users to lend or borrow various cryptocurrencies. Through its algorithmically determined interest rates and robust collateralization mechanisms, Compound has become one of the largest players in decentralized lending.

Aave, another Ethereum-based lending platform, offers users the ability to lend and borrow cryptocurrencies, earning interest or obtaining funds. Aave’s innovative features, such as flash loans and user-defined variable interest rates, have contributed to its popularity among DeFi enthusiasts.

Lessons learned from past failures

The lending industry, both centralized and decentralized, has seen its fair share of failures and challenges. Past failures have highlighted the importance of risk management, due diligence, and compliance in lending practices. Weak risk assessment processes and inadequate collateralization requirements have led to the collapse of lending platforms, resulting in financial losses for lenders and borrowers.

Lessons learned include the need for transparency, proper due diligence, and ongoing monitoring to ensure the health and stability of lending platforms. Robust risk management frameworks, security measures, and regulatory compliance must be integral parts of lending operations to protect the interests of all stakeholders.

Real-world applications of centralized and decentralized lending

The impact of both centralized and decentralized lending can be observed in a wide range of real-world applications. Centralized lending has played a significant role in enabling economic growth by providing loans for businesses, home mortgages, and personal financing. As more traditional financial institutions adopt digital lending platforms, the accessibility and convenience of loans for individuals and businesses continue to improve.

Decentralized lending, on the other hand, has opened up new possibilities beyond traditional financing models. It has enabled peer-to-peer lending for financially underserved individuals, cross-border lending without intermediaries, and even lending against cryptocurrency assets. Decentralized lending has also been instrumental in driving financial inclusion in developing countries where access to banking services is limited.

This image is property of www.blockchain-council.org.

The Role of Blockchain and Cryptocurrencies

How blockchain technology enables decentralized lending

Blockchain technology provides the foundations for decentralized lending by allowing for transparent, immutable, and auditable transactions. Through blockchain, decentralized lending platforms eliminate the need for intermediaries and enable direct peer-to-peer interaction. Digital assets can be tokenized and seamlessly transferred on the blockchain, allowing for efficient borrowing and lending between individuals across the globe.

Smart contracts, built on blockchain platforms, automate loan agreements, collateral management, and repayment schedules. These self-executing contracts eliminate reliance on trust and central control, ensuring transparency, security, and efficiency in the lending process.

Role of cryptocurrencies in centralized and decentralized lending

Cryptocurrencies play a significant role in both centralized and decentralized lending models. In centralized lending, cryptocurrencies like Bitcoin or Ethereum can be used as collateral for loans. Cryptocurrencies offer advantages such as fast transactions, security, and global reach, making them attractive collateral options.

In decentralized lending, cryptocurrencies are the backbone of the lending ecosystem. Borrowers can collateralize cryptocurrencies to secure loans, while lenders can lend their cryptocurrencies to earn interest. The use of cryptocurrencies facilitates cross-border lending and eliminates the need for traditional banking infrastructure, ensuring instant and global access to funds.

Advantages and challenges of using blockchain in lending

Blockchain technology offers several advantages for lending, including increased efficiency, transparency, and security. By eliminating intermediaries, blockchain-powered lending minimizes paperwork, reduces transaction costs, and increases the speed of loan approvals and disbursements.

Blockchain’s transparent nature ensures that all transactions and loan agreements are recorded on the blockchain, making the lending process auditable and verifiable. The immutability of blockchain protects against data tampering and fraud, enhancing the integrity of the lending ecosystem.

However, the adoption of blockchain in lending also presents challenges. Scalability and throughput remain significant hurdles, as blockchain networks may struggle to handle the volume of transactions required for widespread lending adoption. Additionally, legal and regulatory frameworks need to be developed to address the unique aspects of blockchain-based lending, ensuring consumer protection and preventing illicit activities.

Conclusion

Centralized and decentralized lending models offer distinct advantages and disadvantages. Centralized lending has historically been the dominant form of lending, providing borrowers with convenient access to loans and lenders with opportunities for investment. However, the centralized nature of these platforms brings limitations in control and flexibility.

Decentralized lending, powered by blockchain technology and cryptocurrencies, brings innovation and inclusivity to the lending industry. It offers borrowers alternatives to traditional loans and enables lenders to earn attractive returns. However, decentralized lending faces challenges in terms of regulation, security, and scalability.

The future of lending is likely to see the integration of centralized and decentralized models, creating hybrid platforms that combine the benefits of both. Moreover, continued advancements in blockchain technology and regulatory frameworks will shape the lending landscape, promoting financial inclusion, transparency, and efficiency.

As borrowers and lenders navigate the evolving lending ecosystem, understanding the advantages, disadvantages, and risks associated with centralized and decentralized lending will empower them to make informed decisions and leverage the opportunities presented by these models.