Cointelegraph.com News, a prominent website that covers fintech, blockchain, and Bitcoin news, provides its readers with an array of compelling updates in its latest article. From court decisions on crypto issuance and Bitcoin ETF delays to higher taxes on cryptocurrencies in Brazil, this article explores a diverse range of topics. Additionally, readers can find analysis on Bitcoin price action, predictions on Bitcoin price movements, and intriguing articles on Bitcoin wallet loopholes, the growth of the Lightning Network, and Binance dropping the majority of its USD Coin reserves. One significant highlight is the revelation from SoFi, a US bank, as it discloses a staggering $166 million in crypto holdings in its Q2 earnings report. Notably, Grayscale’s CEO, Michael Sonnenshein, emphasizes the importance of maintaining a balanced regulatory approach towards cryptocurrency to prevent stifling innovation in the United States. With its comprehensive coverage, this article promises to captivate readers seeking the latest updates in the cryptocurrency realm.

US bank reveals $166M in crypto holdings: Q2 earnings report

This image is property of images.cointelegraph.com.

Overview of SoFi’s Q2 earnings report

SoFi, a prominent US bank, recently released its Q2 earnings report, which includes some remarkable revelations regarding its crypto holdings. This report provides investors and the wider financial community with valuable insights into the bank’s performance and its exposure to the burgeoning cryptocurrency market.

Details of SoFi’s crypto holdings

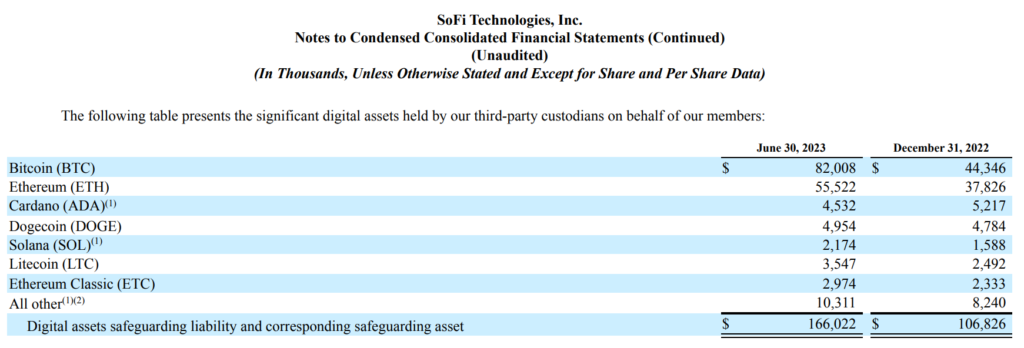

According to the Q2 earnings report, SoFi has disclosed a staggering $166 million in crypto holdings. This significant investment in cryptocurrencies showcases the bank’s strategic approach to diversify its portfolio and tap into the potential growth and returns offered by the crypto market. SoFi’s crypto holdings reflect a strong belief in the long-term viability and value of digital currencies, which have gained immense popularity in recent years.

This image is property of s3.cointelegraph.com.

Implications for the US banking industry

SoFi’s substantial crypto holdings underscore a shifting dynamic in the US banking industry. While traditional banks have been cautious about entering the crypto space, SoFi’s bold move demonstrates the potential for financial institutions to incorporate digital assets into their investment portfolios. This development could prompt other banks to reconsider their stance on cryptocurrencies, as they witness the success and potential profitability of SoFi’s strategy.

Comparison with other banks’ crypto holdings

SoFi’s $166 million in crypto holdings places it among the leading banks in terms of cryptocurrency investments. However, it’s essential to make comparisons with other banks’ crypto holdings to gain a comprehensive understanding of the industry landscape. By analyzing the size and composition of other banks’ crypto portfolios, market observers can assess the diversity and risk appetite of financial institutions within the crypto market.

This image is property of i-invdn-com.investing.com.

Regulatory challenges and considerations

While SoFi’s crypto holdings indicate a promising future for the bank, it’s important to acknowledge the regulatory challenges and considerations associated with the crypto market. The CEO of Grayscale, Michael Sonnenshein, has emphasized the need for a balanced regulatory approach to cryptocurrencies. Striking the right balance ensures that regulatory measures do not hinder innovation but rather foster a thriving crypto ecosystem in the United States.

Market reactions and investor sentiment

SoFi’s disclosure of its substantial crypto holdings has sparked significant interest and curiosity among investors and market participants. The market reactions and investor sentiment toward this announcement will be closely monitored in the coming weeks. Positive reactions may encourage other banks and financial institutions to explore their own crypto investment opportunities, contributing to the overall growth and acceptance of digital currencies in the traditional financial sector.

This image is property of i.ytimg.com.

Discover the secret crypto strategies that experts don’t want you to know.

Analysis of the crypto market’s impact on SoFi’s overall performance

An in-depth analysis of the impact of the crypto market on SoFi’s overall performance is crucial for understanding the bank’s strategy and financial wellbeing. By studying the correlation between crypto market trends and SoFi’s earnings, investors and analysts can ascertain the bank’s ability to navigate the crypto landscape effectively. This analysis will help in evaluating the bank’s risk management practices and its potential for sustained growth in the future.

Future projections for SoFi’s crypto holdings

Based on the positive market sentiment and the potential for further growth in the crypto market, projections can be made for SoFi’s future crypto holdings. As the adoption of cryptocurrencies continues to accelerate, SoFi may choose to increase its investment in digital assets, capitalizing on the opportunities presented by this emerging market. However, future projections must also consider potential risks and vulnerabilities associated with the crypto market.

This image is property of images.cointelegraph.com.

Missed out on the Bitcoin boom? Our latest crypto guide reveals the next big thing.

Potential risks and vulnerabilities for SoFi

While SoFi’s crypto holdings offer immense potential for growth and profitability, it is crucial to acknowledge the inherent risks and vulnerabilities associated with the crypto market. Volatile price fluctuations, regulatory uncertainties, and emerging cybersecurity threats pose significant challenges that must be carefully managed. SoFi must employ robust risk management strategies to mitigate these risks and protect its crypto holdings from potential losses.

Conclusions and implications for the wider crypto ecosystem

In conclusion, SoFi’s disclosure of $166 million in crypto holdings in its Q2 earnings report represents a significant milestone for the US banking industry. This move highlights the potential for financial institutions to diversify their portfolios and embrace the emerging crypto market. The positive market reactions and investor sentiment toward SoFi’s announcement further support this paradigm shift in the traditional financial sector.

It is imperative for other banks and financial institutions to recognize the implications of SoFi’s actions and carefully consider their own involvement in the crypto market. The regulatory landscape must evolve to strike a balance between fostering innovation and protecting investors’ interests. As the crypto industry grows and matures, collaborations between traditional banks and the crypto ecosystem may become more prevalent, ultimately shaping the future of finance.

Why are Wall Street elites terrified of this new crypto guide? Unveil the game-changing info.