In the wake of the Silvergate meltdown, the collapse of the lender has had a negative impact on crypto sentiment. Kadena COO Anastasia Bez discusses the importance of building solid technology to support crypto companies and innovation, as well as the need for interchain cooperation and tech literacy. She highlights the interplay between centralized finance and decentralized finance, emphasizing the necessity for integration with banks to ensure functioning companies. While concerns about contagion risks remain, there is optimism about the technology and the ongoing collaboration and innovation within the industry. Kadena aims to provide a scalable proof-of-work blockchain with secure and fast infrastructure, enabling businesses to build on top of it without compromising on security. Their smart contract language, PACT, offers safety features and accessibility for developers, making it easier to understand and utilize the technology.

As the crypto industry navigates through challenges, it is important to build resilient businesses in both the tech and business worlds. Anastasia Bez highlights the need for education and continued innovation in the space, acknowledging the complexities of the onboarding process for newcomers. Despite ongoing concerns, there is still interest in adopting blockchain technology, with companies exploring partnerships and ways to harness its power. The focus is on striking a balance between conservatism and innovation in order to solve real-world problems and build viable businesses. The overall goal is to foster a better understanding of blockchain technology and ensure its accessibility for everyone, enabling the growth of the ecosystem.

This image is property of i.ytimg.com.

The Interplay of Centralized and Decentralized Finance

In today’s financial landscape, we can see the interplay between centralized and decentralized finance becoming increasingly prominent. Centralized finance, as the name suggests, refers to traditional banking systems and financial institutions that have been the backbone of our economy for centuries. On the other hand, decentralized finance (DeFi) represents a new wave of financial innovation that operates outside of traditional financial intermediaries.

Integration with Banks

One of the most interesting developments in the crypto industry is the growing integration between decentralized finance and traditional banks. As cryptocurrencies gain mainstream adoption, many banks have started exploring how they can incorporate this technology into their offerings. Some banks have even started offering custody services for cryptocurrencies, allowing customers to store their digital assets securely.

The integration between centralized and decentralized finance brings several benefits. On one hand, it allows traditional banking customers to tap into the potential of cryptocurrencies without having to navigate the complex world of decentralized platforms. On the other hand, it brings more liquidity and legitimacy to the decentralized finance space, as traditional banking institutions lend their credibility to this nascent industry.

Interweaving Centralized and Decentralized Thinking

As the worlds of centralized and decentralized finance converge, a new way of thinking is emerging. It is no longer a question of choosing between centralized or decentralized systems, but rather finding a way to integrate the best of both worlds. This interweaving of ideas requires embracing the efficiency and transparency of decentralized finance while incorporating the regulatory oversight and customer protection provided by centralized systems.

This integration is not without its challenges. The decentralized nature of cryptocurrencies can clash with the requirements of traditional regulatory frameworks, leading to tensions and uncertainties. However, by fostering an open dialogue and collaboration between regulators, financial institutions, and crypto enthusiasts, we can strike a balance that allows for innovation while ensuring the stability of the financial system.

Concerns about the Health of the Crypto Industry

Although the crypto industry has made significant strides in recent years, it is not without its concerns. The volatile nature of cryptocurrencies and the potential for market manipulation have raised eyebrows among regulators and investors. However, it is important to differentiate between legitimate concerns and fear-mongering.

Continuing Ripple Effect

One concern that often comes up is the potential ripple effect that a collapse in the crypto industry could have on the broader economy. While it is true that a significant slump in the crypto market can have repercussions, it is important to remember that the crypto industry is still relatively small compared to the traditional financial system. The interconnectedness between the two is limited, and the impact of a crypto downturn would be contained.

Optimism in the Technology and Building of Infrastructure

Despite the concerns, there is widespread optimism regarding the long-term potential of cryptocurrencies and blockchain technology. Many believe that the crypto industry is still in its infancy and that current challenges can be overcome through innovation and collaboration. Building a robust infrastructure, including secure exchanges, reliable custody solutions, and scalable blockchain networks, is crucial to addressing concerns and ensuring the health of the crypto industry.

This image is property of assets.bwbx.io.

Building a Scalable Proof of Work Blockchain

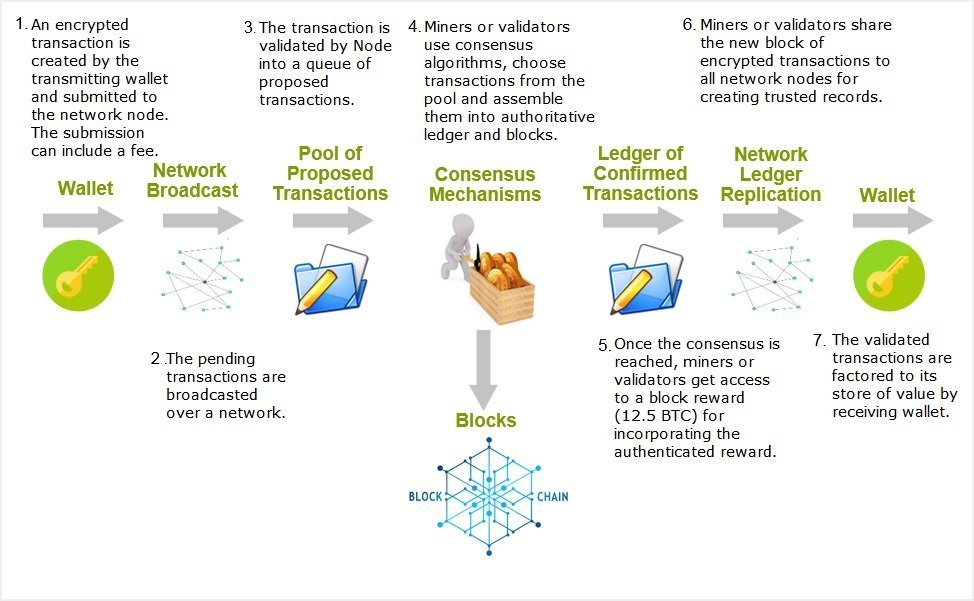

The scalability of blockchain networks has been a topic of much debate within the crypto community. While decentralized systems offer increased transparency and security, they often struggle to handle large transaction volumes, leading to slow confirmation times and high fees. One potential solution to this scalability challenge is the implementation of a scalable Proof of Work (PoW) blockchain.

Structure and Security of the Chain

A scalable PoW blockchain utilizes a combination of innovative consensus mechanisms and network architecture to achieve higher transaction throughput. By optimizing the structure and security of the blockchain, it becomes possible to process a higher number of transactions per second while still maintaining the integrity of the network. This would result in faster confirmation times and lower fees, making cryptocurrencies more practical for everyday use.

Smart Contract Language and Accessibility

Another crucial aspect of building a scalable PoW blockchain is the development of smart contract languages that are accessible for developers of all backgrounds. Smart contracts are self-executing agreements programmed on the blockchain, and they play a vital role in enabling decentralized applications (dApps) and other functionalities. By creating user-friendly smart contract languages, the barrier to entry for developers is lowered, allowing for faster innovation and the creation of a thriving blockchain ecosystem.

This image is property of i.ytimg.com.

Traditional Companies’ Interest in Crypto Space

The growing interest of traditional companies in the crypto space is a clear indication of the increasing acceptance and potential of cryptocurrencies. Many of these companies have recognized the disruptive nature of blockchain technology and are actively exploring ways to incorporate it into their business models.

Balance between Innovation and Conservatism

Traditional companies entering the crypto space often face a balancing act between embracing innovation and navigating the risks associated with cryptocurrencies. While blockchain technology offers unprecedented opportunities for efficiency and transparency, it also introduces new complexities and risks. Striking the right balance involves thorough research, collaboration with industry experts, and a willingness to adapt existing processes to leverage the benefits of cryptocurrencies.

Partnerships and Building in the Space

To navigate the crypto space successfully, traditional companies often enter into partnerships with established blockchain firms or invest in building their own blockchain infrastructure. By leveraging the expertise and experience of established players in the crypto industry, traditional companies can overcome technological barriers and gain a competitive edge. These partnerships also contribute to the overall growth and maturation of the crypto ecosystem, fostering collaboration and knowledge-sharing between traditional and crypto-native companies.

This image is property of d1e00ek4ebabms.cloudfront.net.

The Need for Tech Literacy in the Crypto Space

As cryptocurrencies and blockchain technology continue to penetrate various industries, the need for tech literacy becomes increasingly important. To fully understand the potential, benefits, and risks associated with cryptocurrencies, individuals must educate themselves about the underlying technology and its implications.

Importance of Education

At its core, the crypto industry relies on decentralized and distributed systems, cryptography, and innovative consensus algorithms. By educating oneself about these core concepts, individuals can make informed decisions and navigate the crypto landscape effectively. This education can take the form of online resources, workshops, or even dedicated cryptocurrency courses offered by educational institutions.

Issues with Bureaucratic Onboarding

One challenge hindering tech literacy in the crypto space is the bureaucratic onboarding process associated with traditional financial institutions. Opening a bank account or accessing investment opportunities in cryptocurrencies often involves lengthy paperwork, background checks, and complex verification processes. Simplifying the onboarding process and increasing accessibility to crypto-related services can empower individuals to explore the world of cryptocurrencies and understand their potential.

In conclusion, the interplay between centralized and decentralized finance is shaping the future of the financial industry. The integration of decentralized finance with traditional banking institutions brings benefits such as increased accessibility and liquidity. Concerns about the crypto industry’s health can be addressed through continued innovation, collaboration, and the building of robust infrastructure. A scalable Proof of Work blockchain is crucial for addressing scalability challenges while maintaining the security and integrity of the network. Traditional companies venturing into the crypto space must find a balance between innovation and conservatism, as well as build partnerships to leverage the expertise of established crypto firms. Finally, the need for tech literacy in the crypto space underscores the importance of education and the removal of bureaucratic barriers to entry. By embracing both centralized and decentralized thinking and fostering collaboration, we can unlock the full potential of cryptocurrencies and blockchain technology.