The latest report from Glassnode Insights suggests that Bitcoin’s record-low volatility and decline in short-term holders may be signaling a bull market. Traders see the low volatility as a positive sign, but they may be overlooking potential negative outcomes. Bitcoin’s trading range has been exceptionally narrow, indicating reduced volatility and investor fatigue. This has led to marginal profits or losses for traders exiting their positions. The report concludes that establishing a new price range is crucial to stimulate fresh spending and potentially increase volatility. However, it is important to consider whether Bitcoin’s low volatility is reflective of broader market trends in stocks, oil, bonds, and currencies. This article examines these factors and explores the potential impact of a global economic recession on Bitcoin’s price.

Bitcoin’s low volatility and decline in short-term holders

Explanation of Bitcoin’s low volatility

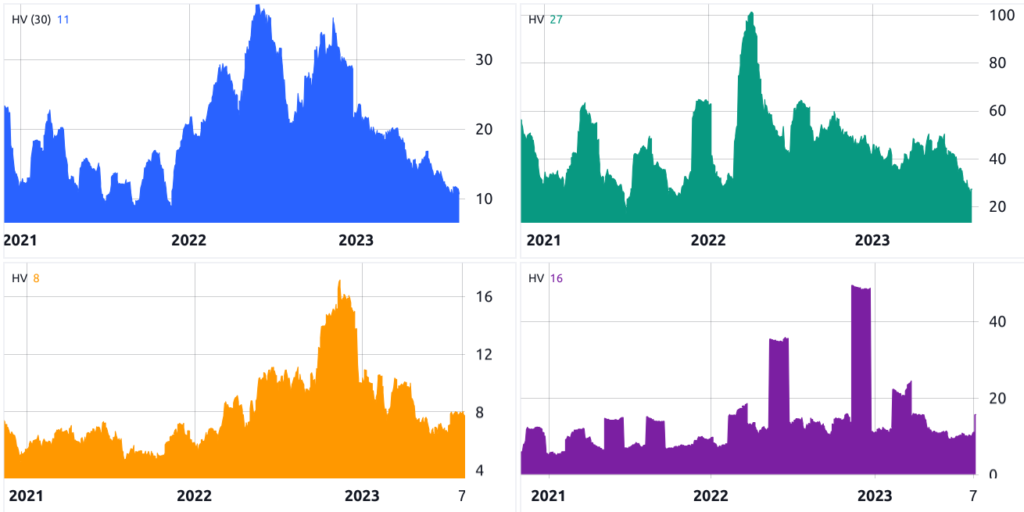

Bitcoin has recently experienced historically low levels of volatility, with its trading range becoming exceptionally narrow. This is indicated by the mere 2.9% separation between Bitcoin’s Bollinger Bands, which is a technical analysis tool used to measure volatility. In the past, this level of low volatility has only been observed twice: in September 2016 and in January 2023.

According to a report from Glassnode Insights, reduced volatility in Bitcoin is often accompanied by investor fatigue, leading to the movement of coins based on their cost close to the current price. This suggests that traders are making marginal profits or losses with their trades. In order to stimulate fresh spending and potentially increase volatility, a new price range needs to be established.

Impact of short-term holders on Bitcoin’s price

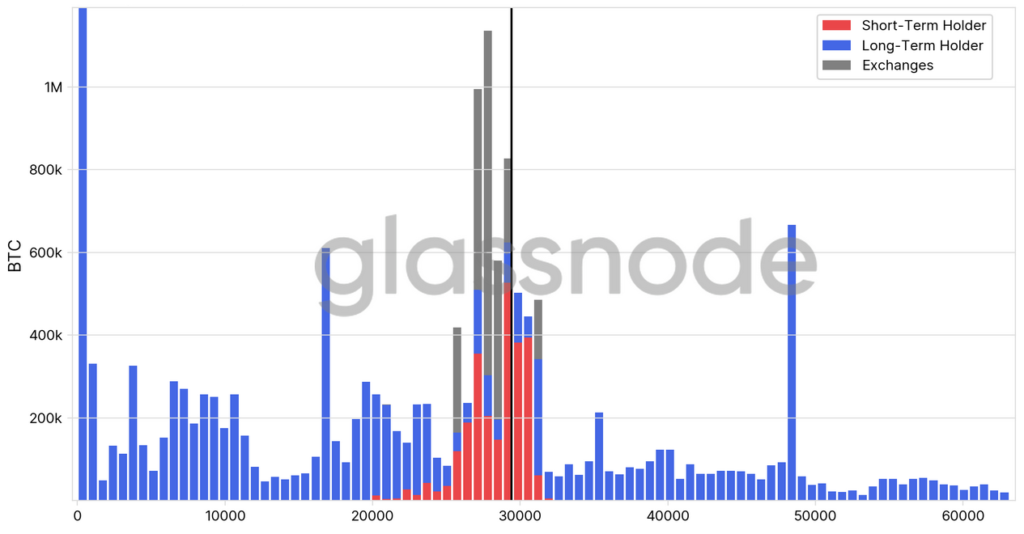

The concentration of short-term holders in a specific price range can have an impact on Bitcoin’s price. Glassnode’s data shows that there is a significant concentration of short-term holders between the price of $25,000 and $31,000. This pattern is similar to what has been observed during past bear market recoveries.

However, it is worth noting that many of these short-term holders are still holding positions with losses, which creates selling pressure. On the flip side, the supply held by long-term holders has reached an all-time high. The shift in the distribution of supply between short-term and long-term holders can have implications for Bitcoin’s price if there is a change in position by long-term holders.

Historically low levels of volatility in Bitcoin

Comparison to previous periods of low volatility

The current low volatility in Bitcoin is comparable to previous periods of low volatility in the cryptocurrency’s history. In September 2016, Bitcoin traded near $604 with a similar level of low volatility. Similarly, in January 2023, Bitcoin maintained a steady value of $16,800 with low volatility. These periods of low volatility were followed by periods of increased volatility and price movement.

Potential reasons for low volatility

There are several potential reasons for Bitcoin’s current low volatility. One possible explanation is the broader market conditions, as other traditional markets such as stocks, oil, bonds, and currencies are also experiencing low volatility. This suggests that the overall market sentiment and risk appetite may be influencing Bitcoin’s volatility.

Another possible reason is investor fatigue. After a prolonged period of price stability, traders may be less inclined to make significant trades, leading to reduced volatility. Additionally, the concentration of short-term holders within a specific price range may also contribute to low volatility as they may be less likely to engage in significant trading activity.

Bitcoin’s volatility in comparison to traditional markets

Bitcoin’s volatility can be compared to the volatility of traditional markets such as stocks, oil, bonds, and currencies. Currently, the S&P 500 and the West Texas Intermediate oil price have similarly low levels of volatility. The U.S. Dollar Index, however, has experienced increased volatility, while the 10-year Treasury yield’s volatility has also recently risen.

The comparison of Bitcoin’s volatility to traditional markets suggests that Bitcoin is not an outlier in terms of volatility. Instead, it is part of a broader trend of reduced volatility across various asset classes. This further supports the idea that market sentiment and risk appetite are important factors influencing Bitcoin’s volatility.

Short-term holders’ price distribution

Concentration of short-term holders between $25,000 and $31,000

One notable observation in Glassnode’s data is the concentration of short-term holders between the price range of $25,000 and $31,000. This concentration is similar to what has been observed during past bear market recoveries. It suggests that short-term holders may be more active in this price range, potentially impacting Bitcoin’s price movements.

Similarities to past bear market recoveries

The concentration of short-term holders within a specific price range is reminiscent of past bear market recoveries in Bitcoin. During these periods, short-term holders often become more active as they try to capitalize on potential price movements. This can create additional volatility in the market as traders react to short-term price fluctuations.

Supply held by long-term holders

All-time high supply held by long-term holders

While short-term holders may be more active within a specific price range, the supply held by long-term holders has reached an all-time high. This suggests that a significant portion of Bitcoin’s supply is held by investors with a long-term investment horizon. The increase in the supply held by long-term holders may indicate a strengthening conviction in Bitcoin’s value over the long term.

Impact on Bitcoin’s price in case of position change

In the event that long-term holders decide to change their positions, it could have an impact on Bitcoin’s price. Assuming a relatively optimistic scenario where only 10% of the BTC held by long-term investors at a price of $47,000 or higher change their positions before Bitcoin surpasses $40,000, this would amount to about six and a half months of the current mining output. This highlights the potential impact of a global economic recession on Bitcoin’s price, as changes in long-term holders’ positions can influence overall market dynamics.

Impact of global economic recession on Bitcoin’s price

Consideration of potential economic factors

When analyzing Bitcoin’s price and volatility, it is important to consider potential economic factors that can influence the cryptocurrency market. Currently, the U.S. 10-year Treasury yields are nearing their highest level in 16 years, and the 30-year fixed average mortgage rate in the United States is flirting with the 7% mark. These factors can have implications for investor sentiment and risk appetite, which in turn can impact Bitcoin’s price.

Possibility of volatile market conditions

In the event of an economic recession, volatile market conditions are likely to occur. Higher yields in equities may attract investors, leading to increased volatility. Rising government and corporate borrowing costs can strain budgets and profitability, potentially impacting investor sentiment. Additionally, real estate markets may slow down due to the impact on mortgage affordability. These circumstances may prompt central banks to implement fiscal policies to support economic activity, which can result in upward inflation pressure. Bitcoin’s price and volatility may be influenced by these market conditions.

Bitcoin’s reaction to stress in traditional markets

Uncertainty of how holders will react

The reaction of Bitcoin holders to stress in traditional markets is uncertain. While Bitcoin has historically exhibited low volatility compared to stocks, oil, and currencies, it is uncertain how holders will react in the face of adverse economic conditions. The historically low volatility in Bitcoin may be preceding a period of turmoil, and holders may change their sentiment and actions accordingly.

Contradiction to historically low volatility

The contradiction between historically low volatility and the potential for holders to react to stress in traditional markets raises questions about the future direction of Bitcoin’s price. Will Bitcoin serve as a hedge against escalating inflation and economic uncertainty, or will it experience increased volatility and price movements? Only time will provide the answers to these questions.

Bitcoin as a hedge against inflation

Possibility of Bitcoin serving as a hedge

Bitcoin has often been touted as a potential hedge against inflation and economic uncertainty. Its decentralized nature and limited supply make it an attractive alternative investment during periods of economic instability. Bitcoin’s value is not directly tied to traditional financial assets, which can make it an appealing option for investors looking to diversify their portfolios. However, the effectiveness of Bitcoin as a hedge against inflation is still a topic of debate among experts.

Time will provide answers

As with any investment, the true nature of Bitcoin as a hedge against inflation will only become clear with time. Market dynamics, macroeconomic factors, and investor sentiment will all play a role in determining Bitcoin’s value and its effectiveness as a hedge. Ongoing research and analysis will continue to provide insights into Bitcoin’s role in the global financial landscape.

Conclusion

In conclusion, Bitcoin’s recent low volatility and decline in short-term holders have raised questions about the future direction of its price. While low volatility can be seen as a positive indicator for a bull market, it is important to consider the potential impact of macroeconomic factors and the reactions of long-term holders. Bitcoin’s volatility in comparison to traditional markets and its potential as a hedge against inflation further add to the complexity of analyzing its price movements. Ultimately, time will provide the answers to these questions as the cryptocurrency market continues to evolve.

Disclaimer: This article is for general information purposes only and should not be taken as legal or investment advice. The views, thoughts, and opinions expressed here are solely those of the author and do not necessarily reflect or represent the views and opinions of the publication.