In the latest episode of Studio 1.0, Emily Chang sits down with Katie Haun, the CEO and Founder of Haun Ventures, to discuss the regulation of crypto. The conversation revolves around President Biden’s recent executive order on crypto, the confusion among crypto founders regarding regulations, and the potential consequences of falling behind in the crypto race. Haun emphasizes the need for the U.S. government to recognize the importance of crypto and take stock of the growing field. She also touches upon the role of stable coins and the importance of not stifling innovation in the crypto space. Overall, the conversation sheds light on the current state of crypto regulation and its potential impact on the future of the industry.

Regulation and Crypto

Importance of regulating crypto

Regulating the crypto industry is of paramount importance due to several reasons. Firstly, regulation helps to protect investors and consumers from potential risks associated with cryptocurrencies. The decentralized and unregulated nature of the crypto market makes it susceptible to fraud, scams, and market manipulation. By implementing proper regulations, governments can provide a safer environment for individuals to engage in crypto-related activities.

Secondly, regulation allows for increased transparency and accountability in the crypto space. It ensures that businesses and individuals operating in the industry adhere to certain standards and guidelines. This helps to build trust and confidence among investors and encourages wider adoption of cryptocurrencies.

Furthermore, regulating crypto can help prevent money laundering and other illegal activities. Cryptocurrencies have been used for illicit purposes due to their pseudonymity and ease of cross-border transactions. With the right regulations in place, governments can monitor and track crypto transactions, reducing the potential for criminal activities.

Finally, regulation can promote market stability and prevent excessive volatility. The crypto market has experienced significant price swings in the past, often due to market speculation or lack of oversight. Regulatory measures can help mitigate these risks and create a more stable environment for investors and users.

Challenges in regulating crypto

Regulating the crypto industry poses several challenges that need to be addressed. One of the biggest challenges is the global nature of cryptocurrencies. As cryptocurrencies operate on a decentralized and borderless network, regulations in one country may have limited impact on transactions and activities conducted in another jurisdiction. This raises the need for international coordination and harmonization of regulations to effectively regulate the crypto market.

Another challenge is the constantly evolving nature of the crypto industry. Technological advancements, such as the development of new cryptocurrencies or decentralized finance (DeFi) platforms, can outpace regulatory frameworks. Regulators need to stay up-to-date with the latest trends and innovations to ensure their regulations remain relevant and effective.

Additionally, balancing the need for regulation without stifling innovation is a delicate task. While regulations are necessary to protect consumers and investors, overly burdensome regulations can hinder the growth and development of the crypto industry. Striking a balance between regulation and innovation is crucial to foster the growth of the industry while ensuring adequate safeguards are in place.

Current state of crypto regulation

The current state of crypto regulation varies significantly across different countries and jurisdictions. Some countries have embraced cryptocurrencies and implemented supportive regulations, while others have taken a more cautious or restrictive approach.

In countries like the United States and Japan, governments have implemented comprehensive regulatory frameworks for cryptocurrencies. These regulations cover areas such as anti-money laundering (AML) and know-your-customer (KYC) requirements, licensing and registration of crypto exchanges, and taxation.

On the other hand, countries like China and India have taken a more skeptical stance towards cryptocurrencies. China banned initial coin offerings (ICOs) and shut down crypto exchanges in 2017, citing concerns over financial stability and potential risks. However, there have been recent indications of a shift in their approach, with China exploring the development of its own central bank digital currency (CBDC).

Overall, the regulatory landscape for cryptocurrencies is still evolving and varies greatly from one country to another. The lack of unified global regulation poses challenges for businesses operating in the crypto space, as they need to navigate different legal requirements and compliance standards.

The Role of Government

Government’s responsibility in regulating crypto

The government plays a crucial role in regulating the crypto industry, primarily to protect its citizens and maintain financial stability. It is the government’s responsibility to establish and enforce regulations that ensure the integrity and security of crypto-related activities.

One of the key responsibilities of the government is to establish a clear legal framework for cryptocurrencies. This includes defining the legal status of cryptocurrencies, establishing licensing requirements for crypto businesses, and ensuring compliance with anti-money laundering and consumer protection regulations. By providing a clear legal framework, the government can bring legitimacy to the crypto industry and foster trust among users and investors.

Moreover, the government is responsible for monitoring and supervising the crypto market to prevent fraud, market manipulation, and other illegal activities. This involves conducting regular audits and inspections of crypto exchanges and trading platforms to ensure fair practices and compliance with regulations. By actively monitoring the market, the government can identify and address any potential risks or violations promptly.

Additionally, the government should collaborate with industry stakeholders, such as blockchain and cryptocurrency companies, to develop effective regulations. These collaborations are crucial to understand the intricacies of the technology, gather industry insights, and ensure that the regulations are practical and aligned with the industry’s needs.

Impact of government regulations on the crypto industry

Government regulations have a significant impact on the crypto industry, shaping the growth, development, and adoption of cryptocurrencies. The impact can be both positive and negative, depending on the nature and effectiveness of the regulations.

Positive regulations can provide a sense of stability and legitimacy to the crypto market. They can attract institutional investors and traditional financial institutions, who may have been hesitant to enter the market due to regulatory uncertainties. This increased participation can lead to improved liquidity and greater adoption of cryptocurrencies.

Furthermore, regulations that prioritize investor protection can help to mitigate risks and fraud in the crypto space. By establishing clear guidelines for initial coin offerings (ICOs) and token sales, investors can make informed decisions and avoid falling victim to scams. This, in turn, can enhance confidence in the market and encourage greater participation from both investors and users.

On the other hand, overly restrictive or burdensome regulations can stifle innovation and hinder the growth of the crypto industry. Excessive regulatory requirements can create barriers to entry for startups and small businesses, limiting competition and innovative developments. This can potentially hinder the maturation of the industry and slow down technological advancements.

Moreover, inconsistent or fragmented regulations across jurisdictions can create challenges for businesses operating in the global crypto market. The lack of harmonization can lead to regulatory arbitrage, where businesses relocate to countries with more favorable regulation, resulting in a loss of revenue and talent for other jurisdictions.

Overall, the impact of government regulations on the crypto industry is a delicate balance between fostering innovation, ensuring investor protection, and maintaining financial stability. Governments need to carefully consider the long-term implications of their regulations to create a conducive environment for the industry to thrive.

This image is property of i.ytimg.com.

International Perspective

Comparison of crypto regulations in different countries

The regulatory approach to cryptocurrencies varies significantly across different countries, reflecting the diverse attitudes and concerns of governments worldwide. Here is a comparison of crypto regulations among select countries:

-

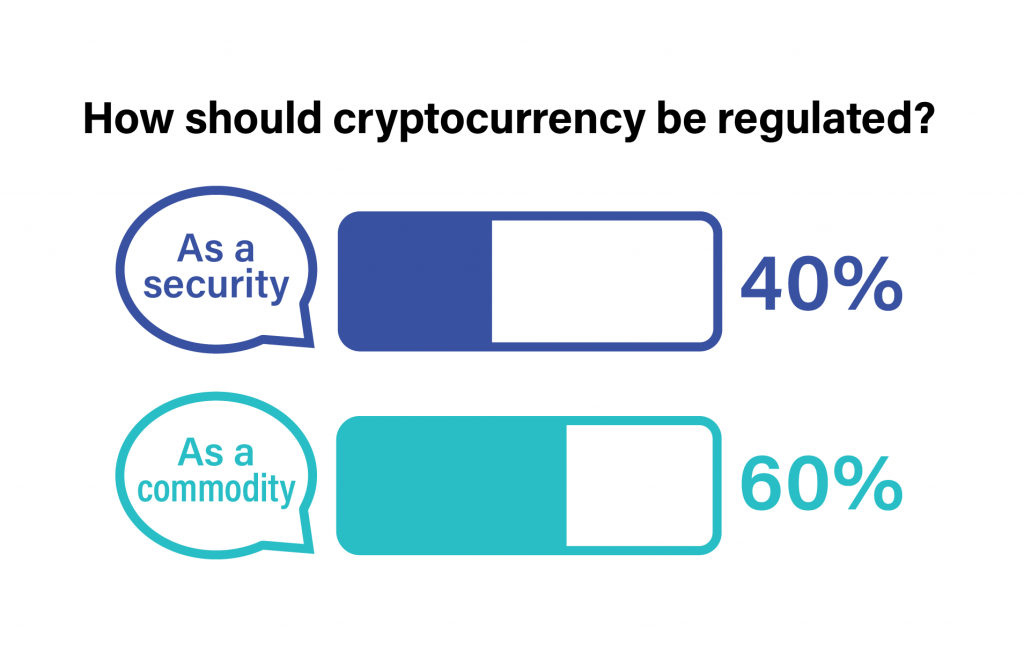

United States: The U.S. has taken a comprehensive approach to crypto regulation. The Securities and Exchange Commission (SEC) has deemed certain cryptocurrencies as securities, subjecting them to registration and disclosure requirements. The Financial Crimes Enforcement Network (FinCEN) enforces AML and KYC regulations for crypto businesses. However, the U.S. lacks a unified regulatory framework, with different agencies having overlapping jurisdiction.

-

Japan: Japan has established a clear legal framework for cryptocurrencies, recognizing Bitcoin as legal tender. The country requires crypto exchanges to obtain licenses from the Financial Services Agency (FSA) and comply with strict AML and security regulations. Japan’s proactive approach to regulation has made it a major hub for crypto businesses.

-

Switzerland: Switzerland has taken a more liberal approach to crypto regulation, aiming to position itself as a “Crypto Valley.” The country has introduced a regulatory framework that provides clarity on the treatment of cryptocurrencies and initial coin offerings. This approach has attracted numerous blockchain and crypto companies to set up operations in Switzerland.

-

China: China has adopted a more cautious and restrictive stance towards cryptocurrencies. The country has banned ICOs, shut down crypto exchanges, and implemented strict capital controls to prevent capital flight. However, there have been indications of a shift in China’s approach, with the exploration of a central bank digital currency (CBDC) and pilot projects in certain cities.

-

India: India has shown a mixed stance towards cryptocurrencies. The Reserve Bank of India (RBI) has banned banks from providing services to crypto businesses, effectively restricting the industry’s growth. However, the Supreme Court of India overturned the ban in 2020, providing a glimmer of hope for the crypto community. The government is now considering the introduction of a regulatory framework for cryptocurrencies.

It is important to note that this is not an exhaustive comparison, and crypto regulations can evolve rapidly in response to market dynamics and government priorities.

Effect of different regulatory approaches on the global market

The different regulatory approaches to cryptocurrencies have a significant impact on the global market. They shape the competitive landscape, influence investment decisions, and determine the level of innovation and adoption within the crypto industry.

Countries that have adopted a supportive and progressive regulatory approach, like Japan and Switzerland, have attracted substantial investments and seen significant growth in their crypto ecosystems. The clarity and stability provided by favorable regulations have made these countries attractive for both local and international crypto businesses.

On the other hand, countries with restrictive or uncertain regulations, such as India and China, have experienced challenges in fostering the development and adoption of cryptocurrencies. Investors and businesses may be deterred by regulatory uncertainties and the potential risks associated with operating in such jurisdictions.

The impact of crypto regulations goes beyond individual countries. As cryptocurrencies operate on a global scale, the lack of harmonization or conflicting regulatory approaches can pose challenges for cross-border transactions and international business collaborations. It is crucial for governments to engage in international cooperation and seek common standards to ensure the smooth functioning of the global crypto market.

The evolving nature of crypto regulation necessitates ongoing dialogue and collaboration among governments, industry stakeholders, and international organizations to address the challenges and foster a conducive regulatory environment.

Securing Investor Protection

Ensuring transparency in ICOs and token sales

Initial coin offerings (ICOs) and token sales have revolutionized the way startups and blockchain projects raise funds. However, they also present significant risks for investors due to the lack of regulatory oversight. Ensuring transparency in ICOs and token sales is crucial to protect investors and foster a healthy ecosystem.

Regulators can play a vital role in achieving transparency by requiring comprehensive disclosure of information. ICO issuers should provide detailed whitepapers outlining their project’s objectives, technology, use of funds, and potential risks. Additionally, regulatory frameworks can mandate regular reporting and updates, allowing investors to make informed decisions based on accurate and up-to-date information.

Monitoring and enforcing compliance with these regulatory requirements is equally important. Regulators need to actively monitor ICOs and token sales to identify fraudulent or misleading offerings. They should collaborate with industry stakeholders to establish best practices and conduct audits to ensure compliance with regulations.

Furthermore, educating investors about the risks and potential rewards of ICO investments is crucial. Investing in ICOs is highly speculative, and investors need to understand the inherent risks associated with early-stage projects. Government agencies and industry associations can develop educational campaigns to raise awareness and provide guidance to potential investors.

Preventing fraud and scams in the crypto space

The decentralized and pseudonymous nature of cryptocurrencies makes them attractive targets for fraudsters and scammers. Governments have a responsibility to protect investors and users from fraudulent schemes and ensure the integrity of the crypto market.

Regulatory measures should focus on identifying and prosecuting fraudulent activities in the crypto space. This includes fraudulent coin offerings, Ponzi schemes, and other forms of investment scams. Regulatory agencies should work closely with law enforcement agencies to investigate and take legal action against such activities to deter potential fraudsters.

Additionally, enforcing AML and KYC regulations can help prevent money laundering and illicit activities in the crypto market. By requiring crypto businesses to verify the identities of their customers and report suspicious transactions, governments can mitigate the risks associated with illicit use of cryptocurrencies.

Public awareness campaigns are also essential to help users identify and avoid scams. Governments can collaborate with industry associations and consumer protection organizations to educate users about common scams and provide tips on how to protect themselves. This can include raising awareness about phishing attacks, fake investment schemes, and fraudulent exchanges.

Investor education and awareness

Investor education and awareness are crucial components of investor protection in the crypto industry. Given the rapidly evolving nature of the market and the unique risks associated with cryptocurrencies, educating investors is of paramount importance.

Governments can collaborate with industry stakeholders to develop educational materials and programs that help investors understand the fundamentals of cryptocurrencies, the risks involved, and best practices for secure investments. This can include providing guidance on wallet security, avoiding scams, and conducting thorough due diligence before investing in crypto projects.

Moreover, governments should encourage the availability of unbiased and reliable information for investors. This can be achieved through the promotion of transparent and regulated platforms for research and analysis of cryptocurrencies. By providing access to accurate information, investors can make informed decisions based on reliable data.

Investor protection should also extend to redress mechanisms for aggrieved investors. Governments can establish dispute resolution mechanisms to handle complaints and resolve disputes between investors and service providers. This provides investors with a sense of security and confidence in engaging with the crypto market.

By prioritizing investor education, awareness, and protection, governments can create a safer and more inclusive ecosystem that fosters trust and confidence in the crypto industry.

This image is property of i.ytimg.com.

Balancing Innovation and Risk

Promoting technological advancements in crypto

The crypto industry is at the forefront of technological innovation, revolutionizing various sectors such as finance, supply chain management, and decentralized applications. Governments should play a proactive role in promoting and supporting these technological advancements to foster economic growth and competitiveness.

Regulators can create an environment that encourages innovation by establishing clear guidelines and regulations for emerging technologies like blockchain and cryptocurrencies. This includes providing legal certainty, intellectual property protection, and supporting research and development initiatives.

Furthermore, government agencies can collaborate with industry stakeholders, academia, and research institutions to explore the potential applications of blockchain technology beyond cryptocurrencies. This can involve funding research projects, organizing hackathons or innovation challenges, and facilitating knowledge sharing among different sectors.

Supportive regulatory sandboxes can also be established to allow startups and companies to test innovative blockchain-based solutions in a controlled environment. These sandboxes provide a space for experimentation while ensuring compliance with relevant regulations.

Identifying and mitigating risks associated with crypto

As with any emerging technology, cryptocurrencies and blockchain come with inherent risks. Governments play a critical role in identifying and mitigating these risks to protect businesses, investors, and the broader economy.

Risk assessment and analysis are essential components of effective regulation. Governments should conduct thorough assessments of the risks associated with different crypto-related activities, such as ICOs, tokenized assets, and decentralized finance (DeFi). This includes analyzing potential systemic risks, cybersecurity vulnerabilities, and market manipulation risks.

Once risks are identified, regulators can implement appropriate measures to mitigate them. This can involve imposing capital requirements or stress testing on crypto businesses to ensure their financial soundness. Regulators can also establish cybersecurity standards and best practices to protect users’ funds and personal information.

Moreover, governments should actively collaborate with international organizations, such as the Financial Action Task Force (FATF), to address cross-border risks. Crypto-related activities often transcend national boundaries, making international cooperation and information sharing critical in addressing global risks.

Creating a regulatory environment that encourages innovation

Creating a regulatory environment that encourages innovation while mitigating risks is a delicate balancing act. Governments need to strike the right balance between fostering technological advancements and ensuring consumer and investor protection.

Regulatory frameworks should be flexible and adaptive to accommodate the fast-paced nature of the crypto industry. Regulations that are overly restrictive or stifling can deter innovation and hinder the growth of the industry. Flexibility allows for experimentation and adaptation to new technologies and business models, while still maintaining appropriate safeguards.

Furthermore, regulatory sandboxes and pilot programs can provide a safe space for innovative projects to thrive. These programs allow startups and companies to test their ideas and products under regulatory supervision, enabling regulators to gain insights into emerging technologies while allowing businesses to operate within a controlled environment.

Engaging with industry stakeholders is crucial to foster innovation-friendly regulations. Government agencies should actively seek input and feedback from the crypto community, including startups, businesses, and developers. Regular dialogue and collaboration between regulators and industry participants can help identify emerging trends, address regulatory gaps, and ensure that regulations are practical and effective.

By striking a balance between innovation and risk mitigation, governments can create a regulatory environment that supports the growth and development of the crypto industry while safeguarding the interests of all stakeholders.

Crypto Exchanges and Trading Platforms

Licensing and registration requirements for exchanges

Crypto exchanges play a vital role in the crypto ecosystem as platforms for users to buy, sell, and trade cryptocurrencies. To ensure the integrity and security of these platforms, governments need to establish licensing and registration requirements for exchanges.

Licensing requirements help ensure that only reputable and qualified entities operate as crypto exchanges. Governments can set specific criteria, such as capital requirements, cybersecurity standards, and AML procedures, that exchanges must meet to obtain a license. Regular audits and inspections should be conducted to ensure ongoing compliance with these requirements.

Registration requirements allow governments to have a comprehensive view of all crypto exchanges operating within their jurisdiction. Registration provides exchanges with a legal status and subjects them to regulatory oversight. This helps to prevent unregulated and potentially fraudulent exchanges from operating and protects users from potential risks.

Governments should work closely with industry stakeholders to develop licensing and registration requirements that balance the need for investor protection with encouraging innovation and competition. Collaborations with industry associations and self-regulatory bodies can help establish industry best practices and ensure that regulations are practical and effective.

Monitoring and supervision of trading platforms

Monitoring and supervision of crypto trading platforms are crucial to maintain market integrity and protect users from unfair practices. Governments should establish mechanisms to actively monitor these platforms and ensure compliance with relevant regulations.

Monitoring can involve real-time surveillance of trading activities to detect market manipulation, insider trading, and other illicit activities. Governments can collaborate with exchanges to implement advanced surveillance technology and data analytics to identify suspicious trading patterns and report any potential violations.

Supervision goes beyond monitoring and involves conducting regular inspections and audits of trading platforms. Governments should enforce regulations related to AML, KYC, cybersecurity, and consumer protection to ensure compliance. Adequate regulatory enforcement can deter fraudsters and protect users from potential risks.

Moreover, governments should collaborate with international organizations, other regulatory bodies, and law enforcement agencies to address cross-border risks and coordinate regulatory efforts. The global nature of the crypto market necessitates international cooperation to maintain market integrity and protect users in an interconnected world.

Ensuring fair practices and preventing market manipulation

Fair practices and market integrity are fundamental for the sustainable growth of the crypto industry. Governments play a critical role in establishing regulations that prevent market manipulation, insider trading, and unfair practices.

Regulators should set clear guidelines on market conduct, including rules and regulations that promote fair and transparent trading practices. These guidelines can include requirements for adequate disclosure of information, prevention of insider trading, and prohibition of market manipulation strategies such as wash trading and spoofing.

Monitoring and surveillance technologies can help identify potential market manipulation or insider trading activities. Governments should invest in advanced surveillance tools and data analytics capabilities to efficiently detect and investigate any indications of market manipulation.

Furthermore, governments should collaborate with exchanges and trading platforms to establish a robust compliance framework. This includes conducting regular audits and inspections to ensure that platforms are adhering to the regulations, and appropriate mechanisms are in place to handle complaints and disputes.

By ensuring fair practices, transparency, and market integrity, governments can foster a trusted and reliable crypto trading environment that benefits investors, businesses, and the broader economy.

This image is property of sep-news.s3.us-west-2.amazonaws.com.

Taxation and Reporting

Tax obligations for crypto users and businesses

Taxation of cryptocurrencies is an area that governments are increasingly focusing on to capture revenue and create a level playing field with traditional financial assets. It is important for individuals and businesses involved in crypto-related activities to understand their tax obligations.

Governments are progressively issuing guidelines and regulations regarding the taxation of cryptocurrencies. In general, cryptocurrencies are treated as property or assets for tax purposes, attracting capital gains tax (or loss) when sold or exchanged. In some countries, cryptocurrencies may also be subject to income tax when received as payment for goods or services.

Individuals and businesses should maintain accurate records of their crypto transactions, including the date of acquisition, cost basis, and date of sale or exchange. This documentation is crucial for accurate reporting and fulfilling tax obligations.

Furthermore, governments may require individuals and businesses to report their crypto holdings, transactions, and gains/losses in tax returns or directly to tax authorities. Failure to report crypto-related income or gains may result in penalties or legal consequences.

It is important for taxpayers to seek professional advice or consult relevant tax authorities to ensure compliance with local tax regulations. Tax laws and regulations regarding cryptocurrencies are still evolving, and it is essential to stay informed about the latest developments to prevent unintentional non-compliance.

Reporting requirements for crypto transactions

Governments are increasingly implementing reporting requirements to enhance transparency and enforce tax compliance in the crypto space. Reporting obligations primarily apply to crypto exchanges and businesses operating in the industry.

Crypto exchanges are often required to report certain transactions or provide information on user activities to tax authorities. This includes reporting high-value transactions, suspicious activities, and the identities of users involved. These reporting requirements help tax authorities track and monitor crypto-related activities to ensure compliance with tax regulations.

Similarly, businesses that accept cryptocurrencies as payment for goods or services may also be subject to reporting obligations. They may need to provide details of crypto transactions, including the value of the transaction and the identities of the parties involved.

Additionally, individuals may be required to report their crypto transactions, particularly when crossing certain thresholds. Governments may introduce reporting mechanisms to capture large or high-frequency transactions, ensuring that individuals report any capital gains or income generated from crypto activities.

Importantly, governments need to strike a balance between enhancing transparency and user privacy. Stricter reporting requirements may encroach on individuals’ privacy rights, so it is crucial for regulations to be proportionate, targeted, and compliant with data protection laws.

Addressing challenges in taxing decentralized finance (DeFi)

Decentralized finance (DeFi) has emerged as a rapidly growing sector within the crypto industry, presenting unique challenges for taxation. DeFi protocols facilitate financial services such as lending, borrowing, and trading without intermediaries, making it difficult to assess tax obligations.

The decentralized nature of DeFi raises questions about identifying taxable events and determining the fair market value of assets. DeFi platforms are typically governed by smart contracts, and transactions are executed automatically based on pre-defined rules. This makes it challenging for tax authorities to capture and assess such transactions.

Governments need to address these challenges and establish clear guidelines for taxing DeFi activities. This may involve developing new methods for assessing the fair market value of decentralized assets, automating the reporting and taxation processes, and collaborating with industry stakeholders to develop innovative solutions.

Additionally, international cooperation is crucial to address taxation challenges in the global DeFi space. Given its borderless nature, DeFi activities can span multiple jurisdictions, making coordination between tax authorities essential to ensure fair and consistent taxation.

Governments should actively engage with DeFi developers, industry participants, and tax experts to understand the unique aspects of DeFi and develop appropriate regulations and taxation frameworks. Striking a balance between innovation, taxation, and user privacy is key to fostering the growth of the DeFi sector while ensuring a fair and compliant tax system.

Consumer Protection

Safeguarding user funds and personal information

Consumer protection is a critical aspect of crypto regulation. The decentralized and pseudonymous nature of cryptocurrencies presents unique challenges in safeguarding user funds and personal information. Governments need to establish regulations that promote security and protect users from potential risks.

One of the key measures to safeguard user funds is the regulation of custodial services. Crypto exchanges and wallet providers that hold users’ funds should implement robust security measures, including multi-factor authentication, cold storage, and encryption to prevent unauthorized access or theft.

Furthermore, governments can establish insurance requirements for custodial services to provide additional protection for users’ funds in case of security breaches or losses. Insurance coverage can help mitigate the financial impact on users and improve confidence in the use of crypto custodial services.

Protecting users’ personal information is equally important. Governments should establish data protection regulations that require crypto businesses to handle users’ data securely and responsibly. This includes obtaining informed consent for data collection, implementing robust cybersecurity measures, and complying with applicable data protection laws.

Moreover, governments should promote user education and awareness about security best practices. By educating users about wallet security, phishing attacks, and other potential risks, individuals can take proactive measures to protect themselves. Governments can collaborate with industry associations and consumer protection organizations to develop educational campaigns and resources.

Regulating advertising and promotion of crypto products

The crypto industry has seen a proliferation of misleading or fraudulent advertising and promotional activities. To protect consumers, governments should establish regulations that govern the advertising and promotion of crypto products and services.

Regulations can require clear and accurate disclosure of information in advertisements, prohibiting false or misleading claims about the risks, benefits, or potential returns of crypto investments. Advertisements should provide balanced and objective information to enable consumers to make informed decisions.

Additionally, governments can establish rules to prevent the promotion of fraudulent or unregulated crypto schemes. This includes prohibiting endorsements by celebrities or public figures without proper disclosure, as well as penalizing businesses that engage in dishonest marketing practices.

Regulators should actively monitor and investigate potential violations of advertising regulations in the crypto industry. Collaboration with advertising standards bodies and industry associations can help enforce regulations and hold businesses accountable for misleading advertisements or promotions.

Handling customer complaints and disputes

Establishing mechanisms to handle customer complaints and disputes is crucial for effective consumer protection in the crypto industry. Governments should ensure that there are accessible and efficient channels for users to seek redress and resolve conflicts with crypto businesses.

Regulatory frameworks should mandate businesses to have clear and transparent customer support and complaint resolution processes. This includes providing users with multiple communication channels, response timeframes, and dispute resolution mechanisms.

Governments can establish ombudsman or arbitration services specifically tailored to address crypto-related disputes. These services can provide impartial and efficient resolution of complaints, ensuring a fair outcome for consumers.

Moreover, governments should establish legal frameworks that enable individuals to seek legal recourse in case of unresolved disputes. Access to justice is crucial for consumer protection, and governments should ensure that individuals have the means to enforce their rights through the legal system if necessary.

By regulating advertising and promotions, establishing redress mechanisms, and ensuring compliance with consumer protection regulations, governments can enhance consumer confidence and trust in the crypto industry.

This image is property of www.cato.org.

Collaboration between Government and Industry

Engaging industry stakeholders in the regulatory process

Collaboration between governments and industry stakeholders is essential for the development of effective and inclusive crypto regulations. Governments should actively engage with blockchain and cryptocurrency companies, industry associations, academic institutions, and other relevant stakeholders to gather insights, exchange knowledge, and establish collaborative frameworks.

Consultation processes should be conducted to seek feedback from industry participants when developing regulations. This allows regulators to understand the unique challenges and opportunities presented by the crypto industry and develop tailored regulations that address the industry’s needs without stifling innovation.

Furthermore, governments should engage with industry associations to develop industry standards, best practices, and codes of conduct. By involving industry stakeholders in the regulatory process, regulations can be informed by practical knowledge and industry expertise.

Establishing communication channels for feedback and dialogue

Transparent and open communication channels between governments and the crypto industry are crucial for effective regulation. Governments should establish formal mechanisms for industry stakeholders to provide feedback, raise concerns, and share insights on regulatory proposals and developments.

Regular dialogue sessions, consultations, or workshops can be organized to facilitate discussions and promote understanding between regulators and the crypto community. This fosters a collaborative environment where both parties can work together to develop effective and practical regulations.

Government agencies should also make efforts to provide clear guidance and respond promptly to inquiries from the crypto industry. Timely and accurate communication clarifies regulatory expectations and reduces uncertainties for businesses. Governments should strive to be accessible and responsive to industry concerns.

Fostering cooperation to address emerging challenges

The crypto industry is characterized by rapid technological advancements and emerging challenges. Collaboration between governments and the industry is crucial to address these challenges effectively.

Government agencies should actively collaborate with international organizations, such as the FATF and the International Organization of Securities Commissions (IOSCO), to develop common standards and guidelines. International cooperation is vital to address cross-border risks, regulatory arbitrage, and ensure the harmonization of regulations.

Moreover, governments should establish mechanisms to share information and best practices with other jurisdictions. Collaborative initiatives, such as information-sharing agreements and cross-border regulatory sandboxes, can facilitate knowledge exchange and promote coordinated approaches to regulation.

Additionally, governments should support research and development initiatives within the crypto industry. By funding research projects, supporting blockchain labs or innovation centers, and providing grants to startups and entrepreneurs, governments can foster innovation and address emerging challenges.

By fostering collaboration and cooperation between governments and the crypto industry, the regulatory landscape can adapt to the evolving needs of the industry and ensure the effective and sustainable development of the crypto ecosystem.

Conclusion

In conclusion, the regulation of cryptocurrencies and the crypto industry is crucial to ensure investor protection, promote market integrity, and foster innovation. Governments play a vital role in establishing clear regulatory frameworks that address the unique challenges of the crypto space while encouraging technological advancements.

By regulating ICOs and token sales, preventing fraud and scams, and promoting investor education, governments can protect individuals from potential risks and create a safer environment for crypto-related activities. Establishing a balance between innovation and risk management is essential to foster the growth of the industry.

Regulation of crypto exchanges and trading platforms can safeguard market integrity, prevent market manipulation, and ensure fair practices. Additionally, taxation and reporting requirements help capture revenue and enforce compliance, while addressing challenges specific to decentralized finance.

Consumer protection measures, such as safeguarding user funds and personal information, regulating advertising practices, and handling customer complaints, create trust and confidence among users. Collaboration between the government and the industry is vital to develop effective and inclusive regulations that promote innovation while protecting consumers.

The global crypto landscape is diverse, with countries taking varied approaches to regulation. International cooperation and harmonization of regulations are essential to address challenges in the global market, foster innovation, and ensure a level playing field.

In the ever-evolving crypto industry, finding a balance in regulation is crucial. Governments should embrace progressive regulation that fosters innovation, protects consumers, and supports the growth of the crypto ecosystem. A call to action for effective and forward-thinking regulation will help shape a sustainable and inclusive future for cryptocurrencies and blockchain technology.