Calculating the time it takes to mine a single Bitcoin can be a complex and intricate process. With the rise of cryptocurrency mining, more and more individuals are curious about the potential return on investment. “How Long To Mine 1 Bitcoin?” is a revolutionary product that aims to answer this very question. By providing users with real-time data and advanced algorithms, this product offers a comprehensive and accurate calculation of the time required to mine a single Bitcoin. Whether you are a seasoned cryptocurrency enthusiast or a beginner looking to navigate the world of Bitcoin mining, “How Long To Mine 1 Bitcoin?” provides the essential tools and insights needed to make informed decisions.

Read More About Bitcoin And Crypto IRAs Here!

Understanding Bitcoin Mining

Bitcoin mining is the process by which new bitcoins are created and verified. It involves solving complex mathematical problems using powerful computers to validate and record transactions on the Bitcoin network. Mining plays a crucial role in the security and integrity of the Bitcoin system, as it ensures that transactions are valid and blocks are added to the blockchain in a decentralized manner.

Definition of Bitcoin Mining

Bitcoin mining can be defined as the process of using specialized computer hardware to solve mathematical puzzles, known as hashing algorithms, in order to validate and record transactions on the Bitcoin network. Miners compete with each other to solve these puzzles, and the first one to find a solution is rewarded with newly minted bitcoins.

How Bitcoin Mining Works

Bitcoin mining works by utilizing powerful computers, called mining rigs or ASICs (Application-Specific Integrated Circuits), to solve complex mathematical problems. These problems involve finding a unique answer, known as a hash, that meets certain criteria set by the Bitcoin protocol. The first miner to find a valid hash for a block of transactions is rewarded with a fixed amount of newly created bitcoins.

Purpose of Bitcoin Mining

The primary purpose of Bitcoin mining is twofold. Firstly, it ensures that all transactions on the Bitcoin network are valid and secure. Miners verify the authenticity of each transaction by confirming that the sender has sufficient funds and that the transaction has not been tampered with. Secondly, mining is essential for the creation of new bitcoins. As the miner successfully adds a new block of transactions to the blockchain, they are rewarded with a predetermined amount of newly minted bitcoins.

The Mechanics of Bitcoin Mining

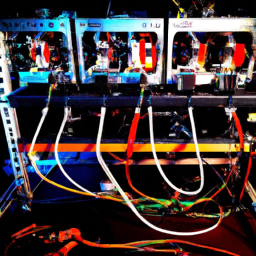

Bitcoin Mining Hardware

Bitcoin mining hardware refers to the specialized computer equipment designed specifically for mining bitcoins. These devices are highly optimized for solving the complex mathematical problems required for mining, and they offer significantly higher computational power and energy efficiency compared to regular consumer-grade computers. Examples of popular mining hardware include ASICs from manufacturers like Bitmain and MicroBT.

Bitcoin Mining Software

Bitcoin mining software is responsible for managing the mining hardware and coordinating its efforts to solve the mathematical problems required for mining. The software connects the mining hardware to the Bitcoin network and provides instructions for carrying out the mining process. Popular mining software options include CGMiner, BFGMiner, and EasyMiner, among others.

Role of Miners in Verified Transactions

Miners play a crucial role in verifying transactions on the Bitcoin network. They collect recently broadcasted transactions into blocks and then compete to solve the mathematical problem associated with each block. Once a miner finds a valid solution, they broadcast it to the network, confirming the validity of the transactions within the block.

Generation of New Bitcoins

Mining is responsible for the generation of new bitcoins. As miners successfully solve the mathematical problems and add new blocks to the blockchain, they are rewarded with a predetermined amount of bitcoins. This reward serves as an incentive for miners to continue their mining efforts and contribute to the overall security and operation of the Bitcoin network.

Factors Impacting Bitcoin Mining Speed

Bitcoin Mining Difficulty

Bitcoin mining difficulty refers to the ease or difficulty of mining new blocks on the Bitcoin network. The Bitcoin protocol adjusts the mining difficulty every 2,016 blocks, or roughly every two weeks, in order to maintain a consistent block generation rate of approximately 10 minutes. The difficulty is adjusted based on the total computational power of the network, ensuring that new blocks are not generated too quickly or too slowly.

Mining Equipment’s Hash Rate

The hash rate of mining equipment determines its computational power and ability to solve the mathematical problems required for mining. A higher hash rate means that the equipment can perform more calculations per second, increasing the chances of finding a valid solution and receiving the mining reward. Miners often strive to maximize their hash rate by using the most powerful and efficient mining hardware available.

Mining Pool Selection

Mining pools are groups of miners who combine their computational power to increase their chances of successfully mining new blocks. By pooling their resources, miners can collectively solve the mathematical problems more quickly and distribute the resulting rewards among all participants. The choice of a mining pool can significantly impact the speed and profitability of mining operations.

Electricity Costs and Availability

Bitcoin mining requires a substantial amount of electricity to power the mining hardware and keep it running continuously. The cost and availability of electricity can have a significant impact on mining speed and profitability. Miners often look for regions with low electricity costs or renewable energy sources to minimize their operational expenses and maximize their potential profits.

Estimating the Time to Mine One Bitcoin

Calculating the Mining Difficulty

The mining difficulty of Bitcoin is a crucial factor in estimating the time to mine one bitcoin. The higher the mining difficulty, the more difficult it is to find a valid hash and mine new blocks. To calculate the mining difficulty, the Bitcoin protocol adjusts the difficulty level every 2,016 blocks to maintain a consistent block generation rate.

Considering the Current Hash Rate

The current hash rate, which represents the total computational power of the Bitcoin network, also affects the time to mine one bitcoin. A higher hash rate means that more miners are actively participating, increasing the competition to find valid hashes and mine new blocks. As the hash rate increases, the time required to mine one bitcoin typically decreases.

Investigating Current Bitcoin Block Reward

Bitcoin block rewards refer to the number of bitcoins given to miners for successfully mining a new block of transactions. Currently, the block reward is set at 6.25 bitcoins per block. As the number of bitcoins generated per block decreases over time, the time required to mine one bitcoin will increase accordingly.

Taking Pool Fees into Account

When mining as part of a mining pool, it is important to consider the pool fees. Mining pools typically charge a small percentage of the mining rewards as a fee for their services. These fees can vary depending on the pool and can impact the overall profitability and time to mine one bitcoin.

Understanding Bitcoin Halving and Mining Difficulty

Concept of Bitcoin Halving

Bitcoin halving is a pre-programmed event that occurs approximately every four years, reducing the block reward in half. The purpose of halving is to control the supply of new bitcoins and ensure that the total number of bitcoins is limited to 21 million. The most recent halving occurred in May 2020, reducing the block reward from 12.5 bitcoins to the current 6.25 bitcoins per block.

Impact of Halving on Bitcoin Mining

Bitcoin halving has a significant impact on mining operations. With a reduced block reward, miners receive fewer new bitcoins for their mining efforts. This can affect the profitability of mining operations and may lead to increased competition and resource allocation to maintain profitability. Miners need to adapt to the changing rewards landscape and adjust their strategies accordingly.

Adjustments in Mining Difficulty

Bitcoin halving also has implications for mining difficulty. As mining rewards decrease, some miners may become unprofitable and stop mining. This could potentially lead to a decrease in the total computational power (hash rate) of the network. To maintain the block generation rate, the Bitcoin protocol adjusts the mining difficulty every 2,016 blocks to ensure that the average time to mine a block remains approximately 10 minutes.

Effects of Technology on Bitcoin Mining

Advancements in Mining Hardware

Advancements in mining hardware technology have significantly impacted Bitcoin mining. The introduction of specialized ASICs has increased the hash rate, making it more difficult for miners using older or less powerful equipment to compete. Miners continually seek the latest and most efficient mining hardware to stay competitive and maximize their mining returns.

Impact of Faster Internet Speed

Faster internet speeds have also played a role in improving the efficiency of Bitcoin mining. Miners rely on fast and stable internet connections to connect to the Bitcoin network and transmit their mining solutions. With faster internet speeds, miners can reduce the time required to propagate their solutions and potentially increase their chances of being the first to find a valid hash.

Role of Mining Pools in Increasing Mining Speed

Mining pools have become an integral part of the Bitcoin mining ecosystem. By pooling their computing resources, miners can collectively solve blocks more quickly and increase their chances of receiving mining rewards. Mining pools also enable smaller miners to participate in mining and share in the rewards, leveling the playing field and promoting decentralization.

Choosing the Right Mining Equipment

Understanding Different Types of Mining Hardware

When choosing mining equipment, it is important to understand the different types available. ASICs (Application-Specific Integrated Circuits) are currently the most commonly used mining hardware and offer the highest hash rates and energy efficiency. GPU (Graphics Processing Unit) mining is another option, although it is less profitable for Bitcoin mining compared to ASICs. FPGA (Field-Programmable Gate Array) mining is a less common option that offers a balance between hash rate and energy efficiency.

Factors to Consider When Choosing Hardware

Several factors should be considered when choosing mining hardware. These include the upfront cost of the equipment, its hash rate and energy efficiency, the availability of compatible mining software, and the overall profitability of the mining operation. It is also important to consider the future outlook of the hardware and whether it will remain competitive in the ever-evolving mining landscape.

Estimating Hardware’s Return on Investment

When selecting mining equipment, it is crucial to estimate the return on investment (ROI) to determine its profitability. Factors such as hardware costs, electricity costs, the mining difficulty, and potential mining rewards should be taken into account. Calculating the ROI helps miners make informed decisions and maximize their potential profits in the long run.

Choosing the Right Mining Pool

Understanding the Concept of Mining Pools

A mining pool is a group of miners who combine their computing power to increase their chances of successfully mining new blocks. The rewards obtained from mining are distributed among the participants based on their contribution to the pool’s overall hash rate. Joining a mining pool provides a more consistent and predictable income compared to solo mining, where miners rely solely on their own computational power.

Pros and Cons of Joining a Mining Pool

Joining a mining pool has several advantages. It increases the chances of earning mining rewards, especially for smaller miners who may not have sufficient computational power to mine solo. Mining pools also provide a steady income stream, as rewards are distributed regularly among the participants. However, joining a mining pool means sharing the rewards with other miners and paying pool fees, which can reduce the overall profitability.

Factors to Consider When Choosing a Mining Pool

When selecting a mining pool, several factors should be considered. These include the pool’s reputation, fee structure, payout frequency, size, and stability. It is also important to consider the pool’s mining policies, such as how the rewards are distributed and the method of payment. Miners should choose a pool that aligns with their preferences and goals.

Reducing the Time to Mine One Bitcoin

Tips and Strategies to Mine Bitcoin Faster

To reduce the time required to mine one bitcoin, miners can employ several tips and strategies. These include optimizing their mining rigs for higher hash rates, joining high-performance mining pools, utilizing remote mining facilities with low-cost electricity, and taking advantage of mining hardware advancements. By implementing these strategies, miners can potentially increase their mining speed and profitability.

Investing in Advanced Mining Hardware

Investing in advanced mining hardware can significantly improve mining speed and efficiency. Upgrading to the latest ASICs with higher hash rates and lower energy consumption can increase the chances of successfully mining new blocks. However, it is important to carefully consider the costs and potential returns before making any hardware investments.

Joining Efficient Mining Pools

Choosing high-performance mining pools that consistently achieve faster block solution times can also reduce the time to mine one bitcoin. By joining pools with a strong track record and reliable infrastructure, miners increase their chances of receiving mining rewards more frequently, ultimately decreasing the overall mining time.

Keeping an Eye on Electricity Costs

Electricity costs can have a significant impact on mining profitability and the time required to mine one bitcoin. Miners should consider utilizing locations with low-cost electricity or renewable energy sources to minimize operational expenses. It is also crucial to optimize the energy efficiency of mining rigs and reduce unnecessary power consumption.

Risks and Challenges in Bitcoin Mining

Environmental Impacts of Bitcoin Mining

Bitcoin mining consumes a substantial amount of electricity, and much of that electricity is generated using fossil fuels. This has led to concerns regarding the carbon footprint and environmental impact of mining operations. Miners and industry stakeholders are exploring sustainable mining practices and renewable energy sources to mitigate these environmental concerns.

Financial Risks Involved in Bitcoin Mining

Bitcoin mining is subject to financial risks due to its volatile nature. The price of bitcoin can fluctuate significantly, impacting the profitability of mining operations. Additionally, the costs of mining equipment, electricity, and maintenance can affect the financial viability of mining ventures. Miners need to carefully manage these risks and adapt to market conditions to ensure profitability.

Legal and Regulatory Challenges

Bitcoin mining faces various legal and regulatory challenges in different jurisdictions. Some countries have embraced cryptocurrencies and mining, providing a favorable environment for miners. However, others have imposed restrictions or even banned mining activities. Miners need to navigate these legal and regulatory landscapes to operate in compliance with local laws.

Potential Reward Decrease Over Time

As mentioned earlier, the block reward for mining new bitcoins decreases over time due to the halving events. This decrease in rewards can affect the profitability and incentives for miners. While the transaction fees attached to each block can partially offset the reduction in block rewards, miners need to carefully plan and adjust their strategies to adapt to the changing reward structure.