“Harnessing the Power of Blockchain” is an engaging article that focuses on a discussion between Ola Doudin, the Co-Founder and CEO of BitOasis, and Yat Siu, the Co-Founder and Executive Chairman of Animoca Brands, at the 2023 Qatar Economic Forum. The conversation, led by Bloomberg’s Caroline Hyde, explores the future of blockchain technology and its impact on various industries. The article highlights key points such as the transformative nature of blockchain in online value exchange, the concept of the metaverse and web3, the potential of tokenization, the importance of regulation, and the role of trust in the crypto industry. It offers valuable insights into the evolving world of blockchain and cryptocurrency, making it a must-read for anyone interested in staying informed about technological advancements and their economic implications.

Overview of Blockchain Technology

Definition of blockchain

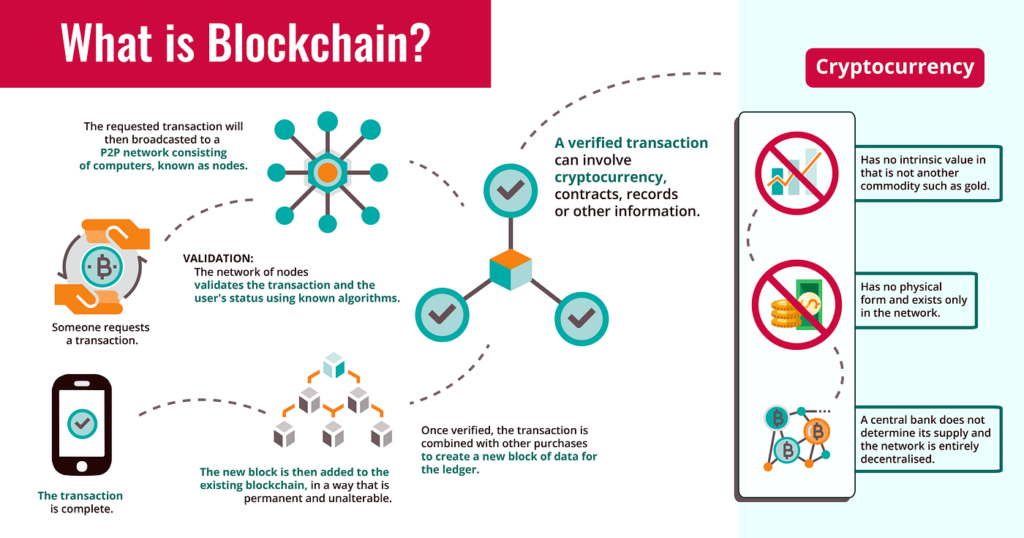

Blockchain is a decentralized digital ledger that records and verifies transactions across multiple computers or nodes. It is designed to be transparent, secure, and tamper-resistant. The technology behind blockchain allows for the creation of a permanent and immutable record of transactions, which can be accessed and verified by anyone, ensuring trust and eliminating the need for intermediaries.

How blockchain changes value exchange online

Blockchain technology has revolutionized the way value is exchanged online by introducing a trustless and decentralized system. It eliminates the need for intermediaries, such as banks or financial institutions, in financial transactions. With blockchain, transactions can be conducted peer-to-peer, securely and without the need for a central authority.

Blockchain also provides transparency in value exchange. Because all transactions are recorded on the public ledger, they can be accessed and verified by anyone at any time. This adds a level of transparency and accountability to online transactions that was previously unavailable.

Another significant change brought by blockchain is the reduction in transaction costs. Traditional financial systems involve various intermediaries, each charging their fees for their services. With blockchain, these intermediaries are eliminated, reducing costs and making transactions more affordable and accessible to a larger population.

Interview with Ola Doudin and Yat Siu

Participants and context

Our interview participants were Ola Doudin, the CEO and Co-founder of BitOasis, and Yat Siu, the CEO of Animoca Brands. Both Ola and Yat have extensive experience in the blockchain and cryptocurrency space and provided valuable insights into various aspects of the industry.

The interview took place in the context of discussing the current state and future prospects of blockchain technology and its impact on different sectors, such as finance, gaming, and virtual reality.

Topics discussed

During the interview, Ola and Yat discussed various topics related to blockchain technology and its potential. They highlighted the importance of blockchain in revolutionizing finance and how it enables financial inclusion for individuals who are unbanked or underbanked.

They also discussed the intersection of blockchain and gaming, emphasizing the role of non-fungible tokens (NFTs) in enabling true ownership of in-game assets. Ola and Yat recognized the transformative potential of blockchain in the gaming industry, paving the way for new business models and creating unique opportunities for players.

The conversation also touched upon the concept of the metaverse and how blockchain technology, particularly through web3, is essential in building a decentralized and interconnected virtual world. Ola and Yat expressed their enthusiasm for the metaverse and its potential to reshape not only entertainment but also education, commerce, and social interactions.

This image is property of i.ytimg.com.

Blockchain and Cryptocurrency

Relationship between blockchain and cryptocurrency

Blockchain and cryptocurrency are closely intertwined, as blockchain technology is the underlying infrastructure that enables the existence and functioning of cryptocurrencies. Cryptocurrencies are digital or virtual currencies that rely on blockchain technology to establish trust and facilitate secure transactions.

Blockchain provides the necessary framework for cryptocurrencies by enabling the recording and verification of transactions on a distributed ledger. It ensures that the transactions are secure, transparent, and tamper-resistant, eliminating the risk of fraud and double-spending.

How blockchain enables cryptocurrency transactions

Blockchain enables cryptocurrency transactions by providing a decentralized and transparent platform for validating and recording transactions. When a cryptocurrency transaction occurs, it is broadcasted to the network of nodes or computers participating in the blockchain. These nodes verify the transaction’s authenticity and reach a consensus on its validity.

Once the transaction is verified, it is added to a block, which is then added to the existing chain of blocks, forming the blockchain. This ensures that every transaction is recorded in a permanent and immutable manner, creating a transparent transaction history that is accessible to anyone. The decentralized nature of blockchain technology ensures that no single entity has control over the transactions, enhancing security and trust.

Transactions on the blockchain are typically facilitated by miners, individuals or entities who use computational power to solve complex mathematical problems. In return for their computational work, miners are rewarded with newly created cryptocurrency tokens or transaction fees. This incentivizes participation in the blockchain network and ensures its security and integrity.

The Concept of the Metaverse and Web3

Definition and explanation of the metaverse

The metaverse refers to a virtual universe comprising multiple interconnected digital spaces and environments. It is a concept inspired by science fiction literature and movies, where individuals can interact with each other and their digital surroundings in real-time.

In the metaverse, users can have avatars, which are digital representations of themselves, and engage in various activities, including socializing, working, shopping, and gaming. The metaverse aims to create a seamless and immersive digital experience that mirrors the real world but with expanded possibilities and creative freedom.

How web3 is related to the metaverse

Web3 refers to the third generation of the internet, which is centered around decentralization and blockchain technology. It aims to create a user-centric and peer-to-peer internet, where individuals have full control of their data and online identities.

Web3 is closely related to the metaverse as it provides the technological infrastructure and protocols needed to build and connect different metaverse experiences. Blockchain technology plays a crucial role in web3 by ensuring secure and transparent transactions, establishing true ownership of digital assets, and enabling interoperability between various metaverse platforms.

Web3 is also focused on empowering individuals by providing them with the tools and platforms to create and monetize their own digital content. This aligns with the metaverse’s vision of a user-centric environment where individuals have the freedom to express themselves and benefit from their creations.

This image is property of plsadaptive.s3.amazonaws.com.

Economic Activity and Employment Opportunities

Impact of the metaverse and web3 on economic activity

The metaverse and web3 have the potential to significantly impact economic activity. By creating a virtual environment where individuals can engage in various activities, from commerce to entertainment, the metaverse opens up new opportunities for economic growth.

In the metaverse, individuals can buy and sell virtual goods and services, participate in virtual economies, and generate income through various means, such as creating and selling digital art, providing virtual services, or running virtual businesses. This creates a new digital economy that is not bound by traditional physical limitations.

Web3, with its focus on decentralization and peer-to-peer interactions, further supports economic activity within the metaverse by reducing transaction costs, eliminating intermediaries, and enabling direct value exchange between individuals. This allows for more efficient and frictionless economic transactions, fostering innovation and entrepreneurship in the digital realm.

Emerging job opportunities in the metaverse

As the metaverse continues to grow and evolve, it will create new job opportunities that were previously unimaginable. Some of the emerging job roles in the metaverse include virtual architects and designers, virtual event organizers, virtual reality content creators, blockchain developers, virtual economy analysts, and virtual goods traders.

These job opportunities span various industries, including gaming, entertainment, fashion, art, and education. The metaverse presents a unique landscape where traditional skills and expertise can be applied in innovative ways, enabling individuals to carve out their own niche and establish themselves as pioneers in this expanding digital frontier.

Tokenization and Value Unlocking

Definition and explanation of tokenization

Tokenization refers to the process of representing real-world assets or rights on the blockchain using digital tokens. These tokens can represent ownership of physical assets, such as real estate or artwork, or intangible assets, such as intellectual property or loyalty points.

Tokenization unlocks value by transforming illiquid assets into liquid and divisible units that can be easily bought, sold, and traded on the blockchain. It allows for fractional ownership, enabling individuals to invest in high-value assets that were previously inaccessible to smaller investors.

Additionally, tokenization introduces programmability to assets, enabling them to have predefined rules and functionalities. For example, a token representing ownership of a rental property can automatically distribute rental income to token holders on a periodic basis.

Potential benefits of tokenization in different industries

Tokenization has the potential to revolutionize various industries by introducing greater efficiency, accessibility, and liquidity. In the real estate industry, for example, tokenizing properties allows for fractional ownership, making it easier for individuals to invest in real estate and diversify their portfolios. It also reduces transaction costs and increases liquidity in the market.

In the art industry, tokenization enables artists to sell fractional ownership of their artwork, expanding their investor base and providing new revenue streams. It also introduces transparency and provenance, allowing buyers to verify the authenticity of artworks and track their ownership history.

Tokenization can also transform the finance industry by streamlining the issuance and trading of securities. By representing securities as tokens on the blockchain, regulatory compliance can be automated, eliminating inefficiencies and reducing costs associated with traditional securities transactions.

Furthermore, tokenization can be applied to intellectual property, loyalty programs, supply chains, and various other sectors, unlocking value and creating new opportunities for innovation and collaboration.

This image is property of miro.medium.com.

Liquidity and Transparency through Tokenization

How tokenization enables increased liquidity

Tokenization enhances liquidity by transforming traditionally illiquid assets into easily tradable digital tokens. With tokenization, assets that were once limited to a small number of investors or held for long periods can now be divided into fractional units, making them accessible to a broader investor base.

The divisibility of tokens allows for increased liquidity by enabling smaller investors to participate in ownership or investment opportunities that were previously only available to wealthy individuals or institutions. It also facilitates secondary market trading, as tokens can be bought, sold, and traded on digital asset exchanges, providing a continuous market for asset transfers.

Tokenization also reduces barriers to entry by eliminating geographical restrictions and reducing transaction costs. With blockchain-based tokenization, investors from anywhere in the world can participate in asset ownership and trading, fostering global liquidity and democratizing investment opportunities.

Improvement of transparency through tokenization

Tokenization brings transparency to asset ownership and transactions by recording them on a blockchain, a publicly accessible and immutable ledger. Every transaction is transparently recorded and can be easily traced and verified by anyone.

The transparency provided by tokenization ensures that asset ownership is verifiable, eliminating fraud and providing greater trust in the market. It enables individuals to track the movement and history of assets, ensuring their authenticity and provenance.

Tokenization also enhances transparency in financial transactions by creating an auditable trail of ownership and transactions. This can have significant implications for regulatory compliance, as it allows regulators and authorities to easily monitor and enforce compliance with financial regulations.

By increasing transparency, tokenization promotes trust, reduces the risk of fraud, and improves the overall efficiency and integrity of asset ownership and transactions.

The Importance of Regulation in the Crypto Industry

Role of regulation in ensuring industry stability

Regulation plays a crucial role in ensuring stability and trust in the crypto industry. While blockchain and cryptocurrencies offer numerous benefits, they also present unique challenges, such as security risks, money laundering, and market manipulation.

Effective regulation can help address these challenges and provide a framework that protects investors, promotes fair competition, and ensures the integrity of the financial system. Regulation can establish standards for security practices, customer protection, and anti-money laundering measures, mitigating risks and increasing confidence in the industry.

Regulation also provides clarity and legal certainty, which is essential for fostering innovation and attracting institutional investors. Clear regulations can promote responsible innovation, while also safeguarding against potential abuses or fraudulent activities.

Examples of regions with positive regulatory environments

Several regions have emerged as leaders in creating positive regulatory environments for the crypto industry. One such example is Switzerland, which has developed a comprehensive regulatory framework known as the Swiss Financial Market Supervisory Authority (FINMA).

FINMA has established clear guidelines for initial coin offerings (ICOs) and the operation of cryptocurrency exchanges. It focuses on investor protection, anti-money laundering measures, and ensuring the integrity of the financial system. Switzerland’s favorable regulatory environment has attracted numerous blockchain and cryptocurrency startups, making it a hub for innovation in the industry.

Another example is Singapore, which has taken a proactive approach to blockchain and cryptocurrencies. The Monetary Authority of Singapore (MAS) has introduced a regulatory framework that balances investor protection with the promotion of innovation. Singapore’s regulatory environment has encouraged the growth of the crypto industry, attracting both local and international companies to establish a presence in the region.

These examples highlight the importance of regulatory clarity and a supportive environment in fostering innovation and responsible growth in the crypto industry.

This image is property of i.ytimg.com.

Competition and Innovation in the Crypto Market

Positive effects of competition on innovation

Competition is a driving force for innovation in the crypto market. As more companies and projects enter the industry, they are motivated to develop unique and groundbreaking solutions to gain a competitive edge.

Competition encourages companies to invest in research and development, pushing the boundaries of what is possible in blockchain technology. This leads to the development of new protocols, consensus mechanisms, and scalability solutions, making blockchain more efficient, secure, and adaptable to different use cases.

Furthermore, competition fosters innovation in business models and user experiences. Companies strive to create products and services that are more user-friendly, cost-effective, and tailored to specific market needs. This results in the continuous improvement of the overall user experience and the expansion of blockchain’s applicability beyond its initial use cases.

Competition also drives collaboration and partnerships within the industry. Companies often work together to tackle common challenges and advance the adoption of blockchain technology. This collaborative spirit promotes knowledge sharing, standardization efforts, and the development of interoperable solutions, benefiting the entire ecosystem.

How competition drives industry improvement

Competition leads to industry improvement by pushing companies to continually innovate and improve their offerings. It creates a dynamic environment where companies must adapt to changing market conditions and evolving user demands.

Competition drives companies to focus on user experience, striving to provide seamless and intuitive interfaces for individuals to interact with blockchain-based applications and services. This results in improved usability, accessibility, and adoption of blockchain technology.

Competition also influences pricing and cost structures. Companies need to offer competitive pricing to attract and retain customers, leading to more affordable solutions and lower transaction costs for users.

Moreover, competition encourages companies to prioritize security and privacy measures. With the constant threat of cyberattacks and data breaches, companies must invest in robust security infrastructure and practices to gain the trust of users. This focus on security improves the overall resilience and integrity of the blockchain ecosystem.

Overall, competition drives industry improvement by fostering innovation, enhancing user experience, reducing costs, and prioritizing security. It ensures that the crypto market remains dynamic and responsive to the evolving needs and expectations of its users.

Conclusion

Blockchain technology continues to reshape various industries and pave the way for new possibilities in value exchange, economic activity, and innovation. With its decentralized and transparent nature, blockchain has the potential to transform finance, gaming, and virtual reality, among other sectors, creating new job opportunities and revolutionary business models.

The concept of the metaverse, coupled with web3, introduces a decentralized and interconnected virtual universe where individuals can interact, work, play, and transact. This opens up a new frontier for economic growth and creativity, with tokenization enabling increased liquidity, transparency, and value unlocking across different industries.

However, the growth and stability of the crypto industry depend on effective regulation. A positive regulatory environment can provide the necessary framework to protect investors, ensure market integrity, and foster responsible innovation. Countries like Switzerland and Singapore serve as examples of regions with favorable regulatory environments.

Competition within the crypto market drives innovation, leading to continuous improvement in technology, user experience, and security. It creates a dynamic ecosystem that adapts to evolving market conditions and user demands, ultimately benefiting users and driving industry improvement.

As blockchain technology continues to evolve, it is essential to stay informed and explore the potential it offers. Whether it be through financial transactions, virtual reality experiences, or the creation of new economic models, blockchain is poised to shape the way we exchange value online and unlock limitless opportunities for individuals and businesses alike.