The “Crypto Report: Will the Crypto Market Go Up?” video by Bloomberg Technology features an interview with Kavita Gupta, the founder of Delta Blockchain Fund. In the video, Gupta shares her thoughts on whether the crypto market will go up, discussing topics such as the macro environment, institutional investments, and the potential for future gains. She also touches on the areas of blockchain that are likely to see the most growth in the coming year, as well as her concerns and advice for crypto investors.

Gupta highlights the influx of institutional money into the crypto space, the impact of hedge funds, and the involvement of traditional banks like JP Morgan and Goldman Sachs. She shares her cautious opinion that the bottom of the market has not yet been reached and indicates her personal buying strategy. Regarding the overall market trend, Gupta believes that 2024 will be a positive year for crypto, potentially leading to all-time highs. She also emphasizes the importance of staying informed and focusing on the real use cases of crypto for investors, particularly tech investors.

This image is property of i.ytimg.com.

Crypto Market Performance

Cryptocurrency markets, despite their volatility, have continued to garner attention and interest from investors worldwide. As one of the most well-known and widely adopted cryptocurrencies, Bitcoin often serves as a macro indicator for the entire crypto market. Its performance has a significant impact on other cryptocurrencies, making it an essential asset to monitor for investors seeking to understand the overall market sentiment.

Bitcoin as a Macro Indicator

Bitcoin’s historical price movements have shown a strong correlation with the broader crypto market. When Bitcoin experiences significant gains or losses, it tends to influence the prices of other cryptocurrencies, leading to a domino effect. This phenomenon can be attributed to Bitcoin’s market dominance and its role as a benchmark for the digital asset class as a whole.

Venture Capital Influx

The crypto industry has experienced an impressive influx of venture capital over the past few years. This heightened interest from venture capitalists can be attributed to several factors, including the potential for high returns, the disruptive nature of blockchain technology, and the increasing adoption of cryptocurrencies in various sectors. This influx of funds has provided much-needed capital for startups and has facilitated their growth and development.

Institutional Investments

In addition to venture capital, institutional investors have taken notice of the potential of cryptocurrencies and blockchain technology. Traditional financial institutions such as banks and hedge funds are beginning to allocate a portion of their portfolios to digital assets. This shift in investment strategy has been driven by a recognition of the long-term potential of cryptocurrencies, as well as a desire to diversify investment portfolios and access new asset classes.

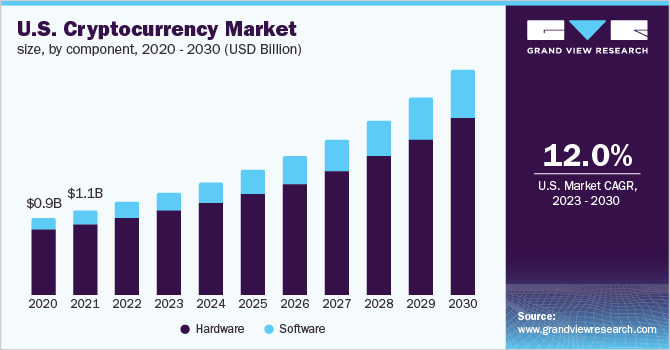

This image is property of www.grandviewresearch.com.

Effect of Institutional Investments on the Market

The entry of institutional investors into the crypto market has had a profound impact on its dynamics. Their large investment sizes and long-term investment horizons have helped stabilize prices and reduce volatility. Moreover, their involvement has attracted additional retail investors, further boosting market liquidity. The presence of institutional investors also brings credibility to the crypto industry, potentially encouraging regulatory bodies to develop a more favorable stance towards cryptocurrencies.

Time to Invest and Potential Gains

Given the growing interest from institutional investors, many wonder if it is the right time to invest in cryptocurrencies. While it is impossible to predict short-term price movements accurately, the entry of institutional investors signals a growing acceptance and mainstream adoption of digital assets. This increased demand, coupled with limited supply, could potentially drive up prices in the long run. Nevertheless, it is crucial to approach cryptocurrency investments with caution, as the market remains subject to significant fluctuations and regulatory uncertainties.

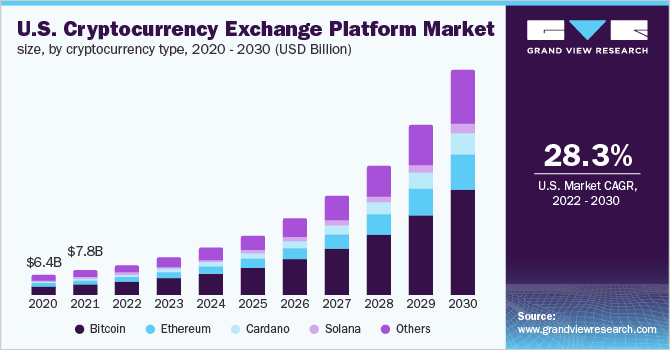

This image is property of www.grandviewresearch.com.

Downturn and Its Duration

While the crypto market has experienced tremendous growth over the years, it is not immune to downturns. Periods of market corrections and bearish trends are commonplace in the volatile world of cryptocurrencies. The duration of a downturn can vary, ranging from a few weeks to several months. It is essential for investors to be prepared for such downturns, both emotionally and financially, by incorporating risk management strategies into their investment plans.

Crypto Market in 2024

Looking ahead to 2024, the crypto market is poised for further evolution and growth. The ongoing institutional adoption, improved regulatory clarity, and technological advancements are expected to shape the market positively. As cryptocurrencies become more integrated into mainstream finance and daily transactions, their value proposition is likely to strengthen. This should attract a broader range of investors, including retail, institutional, and even governmental entities.

This image is property of www.forbes.com.

Areas of Blockchain to Focus on Next Year

In the coming year, several areas within the blockchain industry deserve attention and exploration. One promising field is decentralized finance (DeFi), which aims to revolutionize traditional financial systems by enabling peer-to-peer transactions without intermediaries. The potential of DeFi lies in its ability to provide financial services to the unbanked population and simplify cross-border transactions. Other areas that show promise include non-fungible tokens (NFTs), supply chain management, and decentralized identity solutions.

Infrastructure and Institutional Adoption

To achieve widespread adoption, blockchain technology must overcome various challenges, particularly in terms of infrastructure. Scalability, interoperability, and energy efficiency are some of the pressing issues that need to be addressed for blockchain to reach its fullest potential. Moreover, increased collaboration between blockchain projects and traditional institutions can expedite institutional adoption by leveraging existing financial infrastructure and regulatory frameworks.

This image is property of www.marketsandmarkets.com.

Real Infrastructure Problems and Blockchain

Blockchain has the potential to address real-world infrastructure problems by improving efficiency, transparency, and security. For example, in supply chain management, blockchain solutions can enable the tracking and verification of products at every stage of the supply chain, reducing the risk of fraud and counterfeiting. In the healthcare sector, blockchain technology can enhance data integrity and privacy, revolutionizing patient records management and clinical trials. By focusing on solving real infrastructure problems, blockchain can demonstrate tangible value and attract further investments.

Investor Concerns

Despite the exciting prospects of the crypto market, there are several concerns that investors should be aware of. One primary concern is regulatory uncertainty. As the crypto industry continues to evolve, governments worldwide are grappling with developing regulations that balance innovation and consumer protection. Sudden regulatory changes or bans can have a significant impact on the value and accessibility of cryptocurrencies.

Tech Investors and Real Use Cases

Another concern revolves around the presence of tech investors who may be solely driven by speculative motives. While it is undeniable that the potential for significant gains exists in the crypto market, it is crucial for investors to differentiate between projects with real use cases and those driven solely by hype. Investing in cryptocurrencies with solid technology, real-world applications, and a strong development team can mitigate the risk associated with speculative projects.

Builders and Their Products in the Market

Lastly, paying attention to the builders within the crypto market is vital. Evaluating the quality and viability of the products being developed by various blockchain projects is crucial for making informed investment decisions. Assessing factors such as the team’s experience, partnerships, community support, and roadmap can help determine the long-term potential of a project, minimizing the risk of investing in projects that appear promising on the surface but lack substance.

In conclusion, the crypto market continues to evolve at a rapid pace, driven by factors such as Bitcoin’s performance, venture capital influx, and institutional investments. It is crucial for investors to carefully monitor market dynamics, adhere to risk management strategies, and focus on projects with real-world use cases. While the market holds potential for substantial gains, it is essential to approach cryptocurrencies with a long-term perspective and cautious optimism. By staying informed and adopting a prudent investment approach, investors can navigate the crypto market and potentially benefit from its growth and maturation.