In the “Crypto Report: Silvergate’s FTX Bet” video by Bloomberg Technology, the discussion revolves around how Silvergate, a bank, entered the realm of servicing clients involved in crypto. The value proposition for banks like Silvergate lies in the fact that they can hold deposits for crypto customers without having to pay out interest, making it an affordable way for them to fund themselves. However, concerns have been raised due to the bank’s relationships with FTX and Alameda, with short sellers piling on the stock and lawmakers asking questions. The exposure of Silvergate to these entities and the co-mingling of funds have become difficult questions for regulators, lawmakers, and investors. This article explores the impact of these relationships and examines the investor anxiety surrounding Silvergate’s exposure to crypto contagion, as evidenced by the drastic decline in their stock price over the past year amidst various events in the crypto industry.

The turbulent nature of the crypto market, exemplified by events like the blow up of the Terra Luna ecosystem and the collapse of three arrows capital and Celsius, has affected not only FTX but also other companies with exposure to crypto, including Silvergate. The anxiety among investors stems from their exposure to the contagion and the subsequent decline in stock prices. It is crucial to zoom out and consider the overall landscape of digital assets, as the market has experienced significant fluctuations. While the situation raises questions about how these relationships were not noticed earlier, it indicates the challenges faced by Silvergate as regulators, lawmakers, and investors delve deeper into the intricacies of their financial services in the crypto space.

Crypto Report: Silvergate’s FTX Bet

Introduction

In the fast-paced world of cryptocurrency, Silvergate has made waves with its recent collaboration with FTX and Alameda. This report aims to provide an overview of Silvergate’s involvement in the crypto industry, its value proposition for banks, its banking relationships, and the concerns and questions raised about its exposure. We will also delve into Silvergate’s relationship with FTX and Alameda, explore the difficult questions raised by lawmakers, regulators, and investors, analyze the short interest on Silvergate’s stock, discuss investor anxiety and exposure to contagion, and finally zoom out to consider the broader events impacting Silvergate and other companies. By the end of this report, you will have a comprehensive understanding of Silvergate’s FTX bet and its potential implications.

Background of Silvergate’s Crypto Services

Silvergate, a leading provider of innovative financial infrastructure solutions, has been actively involved in the cryptocurrency industry for several years. The company recognized early on the immense potential of blockchain technology and cryptocurrencies, and has since developed a suite of services tailored to meet the needs of crypto-focused businesses. These services include fiat currency funding solutions, real-time payments, and robust digital asset custody options. With its deep knowledge and expertise in the crypto space, Silvergate has become a trusted partner for numerous cryptocurrency businesses, serving as a bridge between the traditional banking system and the emerging digital economy.

This image is property of i.ytimg.com.

Value Proposition for Banks in Crypto

The value proposition for banks to enter the crypto market is significant. By offering crypto-related services, traditional banks can tap into a rapidly growing customer base, attract new revenue streams, and enhance their technological capabilities. Additionally, banks can establish themselves as key players in the evolving landscape of digital assets, positioning themselves for long-term success. However, venturing into the crypto space is not without risks and challenges. Banks must navigate regulatory complexities, develop robust compliance frameworks, and ensure the security of digital assets. Thankfully, Silvergate’s expertise and experience in providing crypto services can assist banks in overcoming these hurdles, facilitating their entry into this promising market.

Silvergate’s Banking Relationships

Silvergate has established strong banking relationships with a wide range of institutions, including some of the biggest names in the financial industry. These relationships are crucial for Silvergate’s operations, as they enable the seamless transfer of funds between traditional banks and crypto businesses. By partnering with Silvergate, these banks gain access to a trusted, secure, and efficient infrastructure for conducting crypto-related transactions. Such partnerships have significantly contributed to the growth and success of Silvergate, as the company’s reputation for reliability and compliance has attracted an extensive network of banking partners.

This image is property of assets.bwbx.io.

Concerns and Questions Raised

As with any rapidly evolving industry, concerns and questions surrounding the crypto market abound. Some skeptics worry about the unregulated nature of cryptocurrencies, the potential for market manipulation, and the risks associated with storing digital assets. These concerns are not without merit, as the crypto industry has seen its fair share of scams, hacks, and illicit activities. However, it is important to note that Silvergate operates with strict adherence to regulatory guidelines and industry best practices, prioritizing compliance and security. The company’s commitment to transparency and responsible practices should alleviate many of the concerns raised and provide reassurance to investors and stakeholders alike.

Exposure of Silvergate

Given the inherent volatility of the crypto market, one cannot ignore the exposure that Silvergate may have to price fluctuations and market downturns. As a provider of financial infrastructure services to the crypto industry, Silvergate’s fortunes are closely tied to the performance of its clients. A significant drop in the value of cryptocurrencies or a downturn in the industry as a whole could have an adverse impact on the demand for Silvergate’s services. However, it is worth mentioning that Silvergate’s track record and expertise in the crypto space position the company favorably to weather potential storms, ensuring its resilience and ability to adapt to changing market conditions.

This image is property of assets.bwbx.io.

Deposits on Silvergate’s Balance Sheet

One aspect of Silvergate’s operations that warrants attention is the deposits held on its balance sheet. The crypto industry operates on a unique model where digital assets are custodied by service providers like Silvergate. These custodied assets represent deposits to Silvergate, which are then used to facilitate transactions and provide liquidity to clients. It is essential for stakeholders to understand the dynamics of these deposits, as they play a vital role in assessing Silvergate’s financial health and exposure. Despite the inherent complexity of managing custodied assets, Silvergate has demonstrated remarkable proficiency in this area, earning the trust and confidence of its clients.

Silvergate’s Relationship with FTX and Alameda

Silvergate’s recent collaboration with FTX and Alameda has caught the attention of the crypto community and beyond. FTX, a prominent cryptocurrency exchange, and Alameda, a leading quantitative trading firm, united with Silvergate to establish a private network called “SILVER.” This network aims to provide a more efficient and cost-effective channel for institutional investors to fund their trading activities. By leveraging the strengths and expertise of each partner, the SILVER network demonstrates the commitment of all parties to drive innovation and enhance the accessibility of institutional-grade infrastructure in the crypto space.

This image is property of content.pymnts.com.

Difficult Questions Raised by Lawmakers, Regulators, and Investors

Silvergate’s involvement in the crypto industry has not gone unnoticed by lawmakers, regulators, and investors. Questions have been raised about the potential risks associated with providing services to the crypto sector, the need for robust regulatory oversight, and the impact on traditional banking practices. While these questions are valid and necessitate thoughtful consideration, it is crucial to approach them with an open mind, recognizing the transformative potential of cryptocurrencies and the importance of striking the right balance between innovation and regulation. Silvergate’s proactive engagement with regulators and its commitment to compliance highlight its dedication to addressing these difficult questions in a responsible and constructive manner.

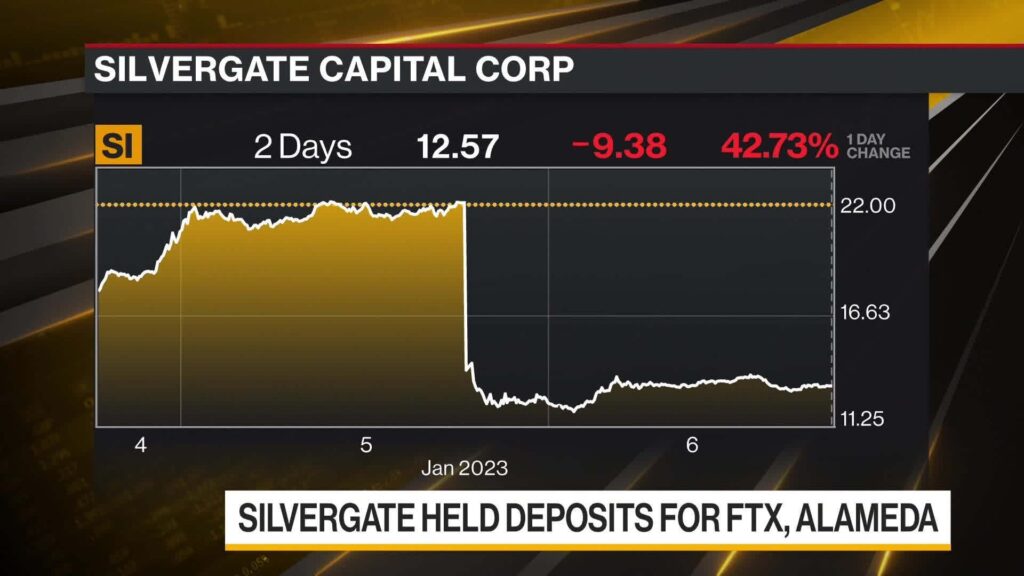

Short Interest on Silvergate’s Stock

The stock market has its eyes on Silvergate, with short interest in the company’s stock attracting attention from investors. Short interest refers to the number of shares that investors have sold short, betting on the price of the stock to decline. The presence of short interest implies that some market participants have reservations about the future prospects of Silvergate. However, it is essential to evaluate short interest within the broader context of market sentiment and the overall performance of the crypto industry. While short interest may raise concerns, it is worth noting that it represents only one perspective among many, and that investors should consider multiple factors before drawing conclusions about Silvergate’s future trajectory.

This image is property of s.yimg.com.

Investor Anxiety and Exposure to Contagion

In a highly interconnected financial system, investor anxiety and exposure to contagion are inevitable. The crypto industry, which operates within this broader system, is not immune to such concerns. Market volatility, regulatory developments, and global economic conditions can all contribute to periods of heightened anxiety and increased exposure to contagion. Investors in Silvergate, as well as other crypto-related companies, should be mindful of these factors and take a holistic approach to assessing their portfolios. Diversification, prudent risk management, and a long-term investment perspective can help mitigate anxiety and safeguard against potential contagion effects.

Zooming Out: Events Impacting Silvergate and Other Companies

To gain a comprehensive understanding of Silvergate’s FTX bet, it is crucial to consider the broader events impacting the company and the crypto industry as a whole. Factors such as regulatory developments, technological advancements, geopolitical tensions, and macroeconomic trends can all influence the trajectory of Silvergate and its peers. As an investor or stakeholder, it is essential to zoom out from the micro-level analysis and approach the investment landscape with a bird’s-eye view, taking into account both the opportunities and challenges presented by the dynamic nature of the crypto market.

Conclusion

In conclusion, Silvergate’s FTX bet represents a strategic move in the crypto industry, driven by the company’s extensive expertise and commitment to innovation. As a leader in providing financial infrastructure to the crypto sector, Silvergate’s collaboration with FTX and Alameda demonstrates its ability to adapt to evolving market dynamics and cater to the needs of institutional investors. While concerns surrounding the exposure and regulatory landscape persist, Silvergate’s robust banking relationships, commitment to compliance, and track record of delivering reliable services position the company favorably in the crypto ecosystem. By staying attentive to industry developments, engaging with regulators, and maintaining a disciplined investment approach, Silvergate has the potential to navigate the challenges and reap the rewards of its FTX bet.