Can Proof of Stake Solve Crypto’s Energy Issues? According to Alex de Vries, founder of DigiEconomist, adopting proof of stake as the industry standard could potentially solve a significant portion of the energy consumption issues plaguing the crypto industry. The transition from proof of work to proof of stake, which is much less energy intensive, particularly in the context of Ethereum, is often considered the green solution for the industry. While there are other alternatives, proof of stake is the most popular choice and can result in remarkable energy savings, with some cryptos already benefiting from this technology for years. By making this change, the industry could address almost the entirety of its energy consumption concerns.

It’s undeniable that when discussing energy in the realm of cryptocurrencies, the conversation must include the Ethereum merge. The shift from a blockchain based on proof of work to one that utilizes proof of stake significantly reduces energy usage. In fact, using proof of stake can potentially allow for energy consumption that is thousands of times less compared to proof of work. This switch in software can lead to incredible energy savings, especially considering that numerous cryptocurrencies already operate on proof of stake and have been doing so successfully for years. Therefore, if proof of stake becomes the standard in the industry, it has the potential to solve a major part, if not the entirety, of the energy consumption issue at hand.

This image is property of i.ytimg.com.

Introduction

Cryptocurrency has gained significant attention in recent years, with people around the world diving into this new digital frontier. As the popularity of cryptocurrencies grows, so does the scrutiny of their environmental impact. One particular aspect that has come under scrutiny is the energy consumption associated with crypto mining. This article aims to explore the concept of Proof of Stake (PoS) as an alternative to the traditional Proof of Work (PoW) consensus mechanism, examining its potential to address the energy issue in the crypto industry and its impact on sustainability.

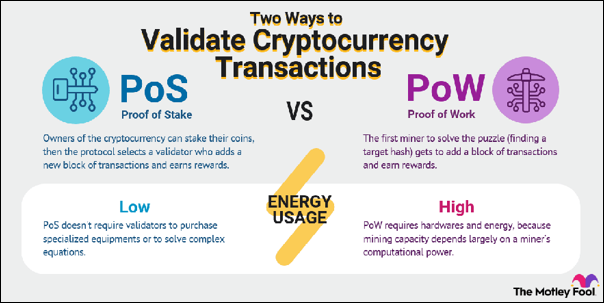

Proof of Stake vs. Proof of Work

Definition of Proof of Stake

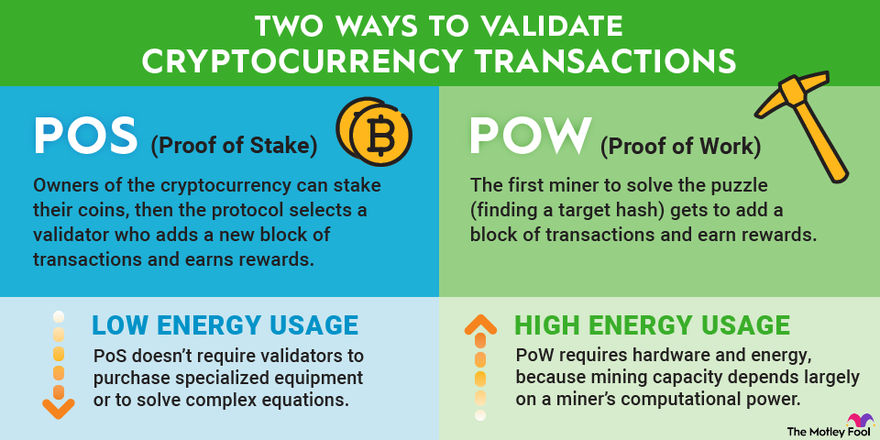

Proof of Stake is a consensus algorithm used by certain cryptocurrencies to achieve distributed consensus. In PoS, instead of miners competing to solve complex mathematical puzzles, validators are chosen to mint new blocks based on the amount of cryptocurrency they hold and are willing to “stake” or lock up as collateral. The selection process is often randomized, taking into account various factors such as the age and size of the stake.

Definition of Proof of Work

Proof of Work, on the other hand, is the consensus algorithm employed by popular cryptocurrencies like Bitcoin. Miners in a PoW system compete to solve complex mathematical puzzles, with the first miner to solve the puzzle earning the right to add the next block to the blockchain. This process requires immense computational power and energy consumption.

Comparison of energy consumption

One of the main advantages of PoS over PoW is its significantly lower energy consumption. In a PoS system, validators do not need to solve resource-intensive puzzles, reducing the energy requirements drastically. This stands in stark contrast to PoW, which relies on powerful hardware and consumes massive amounts of electricity, leading to concerns regarding the environmental impact of crypto mining.

Advantages and disadvantages of Proof of Stake

In addition to lower energy consumption, PoS offers other advantages over PoW. For instance, it mitigates the need for expensive mining hardware, making cryptocurrency participation more accessible to a broader audience. PoS also enhances network security by punishing malicious validators who try to attack the system. However, PoS does have its own set of challenges, such as potential issues with stake concentration and governance, which we will explore in more detail later in this article.

Addressing Crypto’s Energy Consumption

The energy issue in cryptocurrency

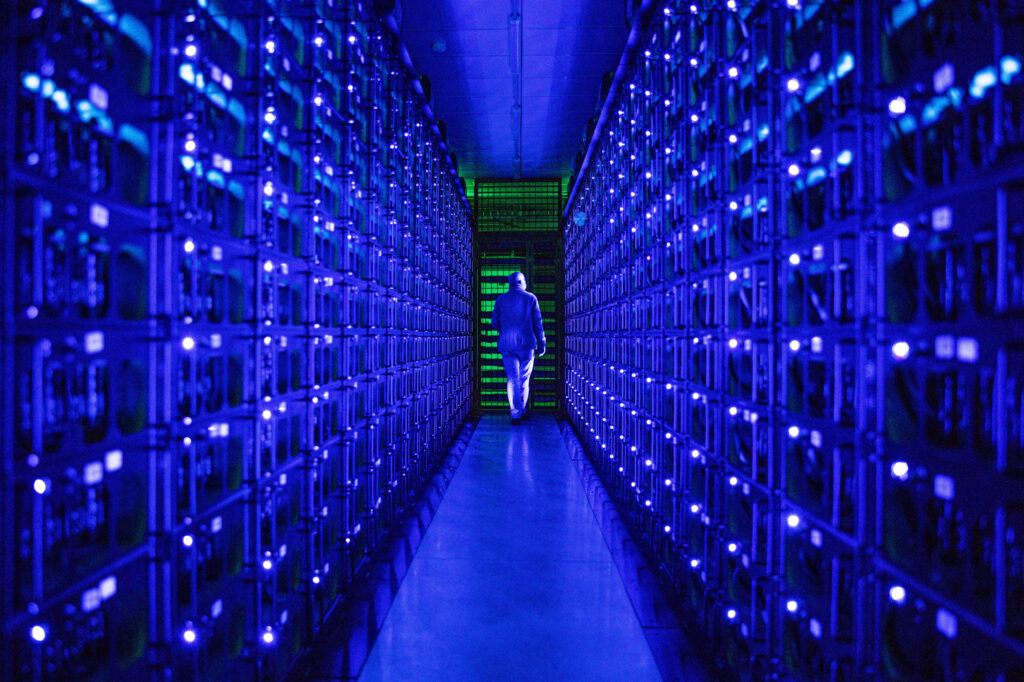

The exponential growth of the crypto market has led to a corresponding increase in energy consumption. The energy required for mining activities has raised concerns about the sustainability and environmental impact of cryptocurrencies. It is estimated that Bitcoin mining alone consumes more energy than some countries. As the demand for cryptocurrencies continues to rise, finding sustainable solutions for energy consumption becomes imperative.

Impact of energy consumption on the environment

The energy-intensive nature of PoW mining has raised alarm bells in terms of its carbon footprint and contribution to global warming. Mining operations often rely on fossil fuels, leading to significant greenhouse gas emissions. With the growing global focus on combating climate change, the environmental impact of cryptocurrencies cannot be overlooked.

Efforts to reduce energy consumption in crypto

Fortunately, the crypto community has recognized the need to address the energy issue, and various initiatives are underway to reduce energy consumption. One such approach is transitioning from PoW to PoS, which inherently consumes less energy. Other efforts include exploring renewable energy sources for mining operations and optimizing mining hardware for improved energy efficiency. While progress is being made, there is still much work to be done to make the crypto industry more sustainable.

Exploring alternative consensus mechanisms

Beyond PoS, there are several other consensus mechanisms being explored to reduce energy consumption in the crypto industry. Some of these mechanisms include Proof of Authority, Delegated Proof of Stake, and Directed Acyclic Graphs (DAG). Each of these approaches offers unique features and advantages, giving rise to a diverse landscape of consensus mechanisms that may play a significant role in the future of cryptocurrencies.

Understanding Proof of Stake

How does Proof of Stake work?

In a PoS system, validators are chosen to create new blocks and validate transactions based on the number of coins they “stake” or hold. The selection process is typically randomized, taking into account factors such as the age and size of the stake. Validators are incentivized to act honestly, as they risk losing their stake if they attempt to manipulate the system. This design encourages participation and ensures network security.

Benefits of Proof of Stake

The adoption of PoS brings several benefits to the crypto ecosystem. One such advantage is reduced energy consumption compared to PoW. PoS eliminates the need for resource-intensive mining rigs and allows for more energy-efficient block creation and transaction validation. Additionally, PoS systems are often more scalable, enabling faster transaction processing and higher throughput compared to PoW.

Reduced energy consumption

One of the most significant advantages of PoS is its reduced energy consumption compared to PoW. By eliminating the need for power-hungry mining rigs, the energy requirements of the network are significantly reduced. This change not only addresses concerns about sustainability and environmental impact but also makes participating in the crypto ecosystem more accessible and cost-effective for individuals and businesses.

Scalability and transaction speed

Another advantage of PoS is its scalability potential. With PoW, the network’s speed is largely dependent on the computational power of the miners, which can lead to bottlenecks as the network grows. In PoS, the validation process is typically faster and more efficient, allowing for higher transaction throughput. This scalability is crucial to support widespread adoption of cryptocurrencies and their integration into everyday transactions.

This image is property of m.foolcdn.com.

Proof of Stake in Practice

Cryptocurrencies utilizing Proof of Stake

Several cryptocurrencies have already adopted or are considering the transition to PoS. Ethereum, the second-largest cryptocurrency by market capitalization, plans to switch from PoW to PoS with the upcoming Ethereum 2.0 upgrade. Other notable PoS-based cryptocurrencies include Cardano, Polkadot, and Tezos, each offering unique features and varying approaches to consensus.

Successful examples of Proof of Stake

One successful example of PoS implementation is the cryptocurrency Cardano. Known for its rigorous academic approach to development, Cardano has become one of the leading PoS-based cryptocurrencies. Its Ouroboros consensus protocol ensures both security and scalability, making it a promising model for future PoS systems. Cardano’s approach highlights the potential of PoS to revolutionize the crypto landscape.

Comparison with other consensus mechanisms

While PoS has gained significant attention, it is important to recognize that there are other consensus mechanisms being explored as well. Delegated Proof of Stake (DPoS) is one such mechanism that utilizes a small number of elected validators to create blocks, enhancing scalability while sacrificing some decentralization. Directed Acyclic Graphs (DAGs) like IOTA’s Tangle offer an alternative approach to consensus, enabling high transaction throughput and scalability. Each mechanism has its own strengths and weaknesses, and further research is needed to determine their long-term viability.

Challenges and limitations

While PoS offers numerous advantages, it also presents challenges and limitations. One of the primary concerns is the potential for stake concentration, where a small group of validators controls a significant portion of the cryptocurrency. This concentration can undermine the decentralized nature of cryptocurrencies and lead to a power imbalance. Additionally, effective governance mechanisms must be in place to ensure fair decision-making and prevent undue influence.

The Potential of Proof of Stake

Addressing energy issues in crypto

The potential of PoS lies in its ability to address the energy issue in the crypto industry. By transitioning from PoW to PoS, cryptocurrencies can significantly reduce their carbon footprint and reliance on energy-intensive mining operations. This shift towards more energy-efficient consensus mechanisms aligns with the global push for sustainability and positions cryptocurrencies as a more environmentally friendly alternative to traditional financial systems.

Reducing carbon footprint

With the growing concern over climate change, it is crucial to find ways to reduce carbon emissions across all sectors. PoS offers a sustainable solution for the crypto industry, decreasing energy consumption and the associated greenhouse gas emissions. By embracing PoS, cryptocurrencies can contribute to the global effort to combat climate change and promote a greener future.

Sustainability and scalability

Beyond reducing energy consumption, PoS offers scalability advantages that are essential for widespread adoption. As the demand for cryptocurrencies continues to grow, scalability becomes a critical factor in their success. PoS mechanisms allow for faster transaction processing and improved throughput, enabling cryptocurrencies to handle a higher volume of transactions and support the needs of a global user base.

Economic implications

The potential economic implications of PoS cannot be overlooked. By reducing the barriers to entry, PoS opens up cryptocurrency participation to a broader audience. This increased accessibility has the potential to spur innovation and economic growth, as individuals and businesses can leverage the benefits of cryptocurrencies without the need for costly and energy-intensive mining equipment. Additionally, PoS encourages long-term investment in cryptocurrencies, fostering stability and reliability in the market.

This image is property of shardeum.org.

Criticism and Concerns

Security and decentralization

One of the key criticisms of PoS is its potential impact on security and decentralization. Critics argue that PoS systems may be more vulnerable to attacks, as malicious actors could accumulate a significant stake and attempt to manipulate the network. Additionally, the concentration of stakes among a few validators could compromise the decentralized nature of cryptocurrencies. Robust security measures, thorough testing, and ongoing research are necessary to address these concerns effectively.

Potential for stake concentration

The potential for stake concentration in PoS systems is a valid concern. If a small group of validators holds a significant amount of cryptocurrency, they may gain outsized control over the network’s decision-making processes. To mitigate this risk, mechanisms such as delegation and rotation of validators can be implemented to ensure a more distributed and democratic system. Balancing stake concentration with fair governance is crucial to maintaining the integrity of PoS-based cryptocurrencies.

Incentives and governance

Designing effective incentives and governance mechanisms within PoS systems is a complex task. Validators must be incentivized to act honestly and in the best interest of the network. Ensuring fair and transparent governance is also essential to prevent undue influence and maintain a decentralized ecosystem. Striking the right balance between incentives, governance, and security is an ongoing challenge, requiring continuous research and development.

Mitigating risks and addressing criticisms

To address the concerns and criticisms surrounding PoS, ongoing research and experimentation are necessary. Collaborative efforts between academia, industry leaders, and the crypto community can help identify vulnerabilities, propose solutions, and refine the design of PoS systems. Open dialogue and transparency are vital to building trust and confidence in the viability and security of PoS-based cryptocurrencies.

Industry Adoption and Future Outlook

Current adoption of Proof of Stake

The adoption of PoS is gaining momentum in the crypto industry. Several cryptocurrencies have already embraced PoS or are planning to make the transition. Ethereum, the most notable example, is currently in the process of launching Ethereum 2.0, which will introduce PoS as the underlying consensus mechanism. This transition is expected to significantly reduce energy consumption and improve scalability for the Ethereum network.

Ethereum’s transition to Proof of Stake

The transition of Ethereum to PoS is highly anticipated within the crypto community. Ethereum 2.0 aims to address the scalability limitations of the current PoW-based Ethereum network by implementing PoS. This upgrade will enhance transaction processing speed, reduce energy consumption, and lay the foundation for decentralized applications (dApps) to thrive on the Ethereum blockchain. The successful implementation of PoS on Ethereum could pave the way for wider industry adoption.

Impact on the wider crypto industry

The successful adoption of PoS by cryptocurrencies like Ethereum could have a ripple effect throughout the wider crypto industry. As more cryptocurrencies transition to PoS or explore alternative consensus mechanisms, the energy consumption and environmental impact of the entire industry could decrease significantly. This shift towards more sustainable and scalable solutions has the potential to attract new users, increase adoption, and unlock new applications for blockchain technology.

Potential challenges and opportunities

While PoS offers numerous advantages, there are potential challenges and opportunities on the horizon. For example, regulatory scrutiny may increase as cryptocurrencies gain wider adoption, requiring careful navigation to ensure compliance without stifling innovation. Furthermore, the evolution of PoS and other consensus mechanisms will require ongoing research, development, and collaboration to address emerging challenges and unlock the full potential of these technologies.

This image is property of media-cldnry.s-nbcnews.com.

Conclusion

The concept of Proof of Stake has emerged as a promising alternative to traditional consensus mechanisms like Proof of Work. Through its reduced energy consumption, improved scalability, and increased accessibility, PoS has the potential to address the energy issue in the crypto industry and promote a more sustainable future. While challenges and concerns exist, ongoing research, experimentation, and collaboration will be crucial in refining PoS and ensuring its long-term viability. As cryptocurrencies continue to evolve, PoS offers a pathway towards a more efficient, scalable, and environmentally friendly crypto ecosystem.