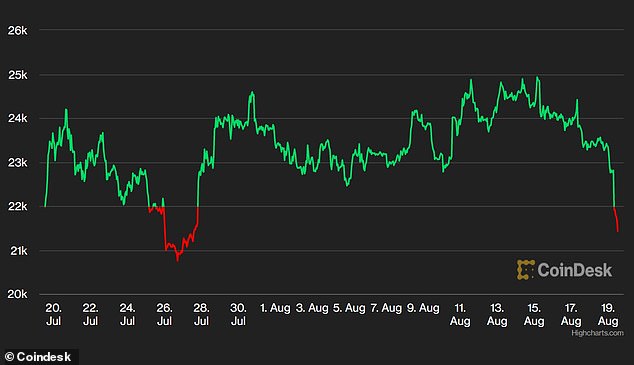

Bitcoin has been making significant strides this year, reaching above $21,000 and flirting with its longest winning streak in almost a decade. This upward momentum has sparked excitement among crypto investors, with Bitcoin adding over 25% in value in just 13 straight days. While the catalyst for this surge is not entirely clear, some believe it may be due to the correlation with the Federal Reserve’s actions and the overall economic conditions. With Bitcoin currently being seen as a macro asset, investors are optimistic about its future performance. However, there are still uncertainties surrounding the sustainability of these gains and the overall sentiment in the crypto industry, as companies in this space have not seen much positive news. Nonetheless, Bitcoin’s recent performance has sparked a renewed interest among traders and a sense of hope for continued growth in the industry.

This image is property of i.ytimg.com.

Bitcoin’s Recent Performance

Bitcoin’s rise above $21,000

Bitcoin has recently achieved a significant milestone by surpassing the $21,000 mark. This surge in price has brought renewed attention to the cryptocurrency, as it continues to reach new heights. The rally has been fueled by a combination of factors, including increased institutional interest and the perception of Bitcoin as a store of value. As the price of Bitcoin continues to rise, it is capturing the attention of investors and enthusiasts alike.

Approaching longest winning streak since November 2013

Bitcoin’s recent performance is also notable for the length of its winning streak. As of now, Bitcoin has experienced 13 consecutive days of gains, which is the longest winning streak since November 2013. This sustained period of growth indicates strong momentum and bullish sentiment in the market. It is worth noting that Bitcoin’s previous record was 10 consecutive days of gains, highlighting the significance of the current streak.

25% gain in 13 straight days

During its winning streak, Bitcoin has seen an impressive 25% gain in just 13 straight days. Such rapid growth is remarkable and has attracted the attention of both long-term and short-term traders. These gains have also added to the overall positive sentiment surrounding Bitcoin, as investors and traders eagerly monitor its performance. While this surge in price may create concerns about potential market volatility, it also presents opportunities for those looking to capitalize on Bitcoin’s upward movement.

Potential catalysts for the rise

There are several potential catalysts for Bitcoin’s recent rise. One notable factor is its increasing correlation with the policies of the Federal Reserve, particularly in light of the economic conditions influenced by the ongoing COVID-19 pandemic. As governments around the world continue to implement stimulus measures, Bitcoin has emerged as a potential hedge against inflation. Additionally, the perceived safety of Bitcoin compared to speculative assets has attracted a growing number of investors, further driving its price upward. Furthermore, the recent pivot of the Federal Reserve towards more accommodative policies has positioned Bitcoin as a leveraged bet on the central bank’s actions. All of these factors combined have contributed to the recent performance and positive outlook for Bitcoin.

Bitcoin’s Technical Indicators

14-day RSI oversold

One technical indicator that has caught the attention of analysts is the 14-day Relative Strength Index (RSI). The RSI is a momentum oscillator that measures the speed and change of price movements. In the case of Bitcoin, the 14-day RSI has reached oversold territory, indicating that the recent price increase may be unsustainable in the short term. This oversold condition suggests that a correction or consolidation phase may be on the horizon. Traders and investors should monitor the RSI closely, as it can provide valuable insights into potential market trends.

Technical analysis as a basis for trading

Technical analysis plays a vital role in predicting price movements in the cryptocurrency market. Traders and investors often rely on various technical indicators, chart patterns, and statistical models to make informed decisions. These tools help identify potential buy and sell signals, as well as support and resistance levels. While technical analysis can provide valuable insights, it is important to note that it is not foolproof. Market conditions, news events, and other external factors can influence asset prices, often defying technical analysis predictions. Traders must exercise caution and employ risk management strategies when using technical analysis for trading.

Concerns about overbought conditions

While Bitcoin’s recent rise has been met with excitement and optimism, there are also concerns about overbought conditions. Overbought conditions occur when the price of an asset has risen too quickly and is considered to be trading above its intrinsic value. This situation can lead to a potential price correction or reversal. Traders and investors should be mindful of these concerns and exercise caution when making investment decisions. It is essential to conduct thorough research and seek expert advice to mitigate potential risks associated with overbought conditions.

Difficulties in predicting future trends

Predicting future trends in the cryptocurrency market is a challenging task, even for experienced traders and analysts. The market is highly volatile and influenced by numerous factors, including market sentiment, regulatory developments, and macroeconomic conditions. While technical analysis and other tools can provide insights into potential price movements, they are not always accurate predictors of the future. Traders should be prepared for unexpected market fluctuations and adjust their strategies accordingly. Diversification and a long-term perspective can help mitigate the risks associated with predictions and enhance overall portfolio performance.

Macro Factors Influencing Bitcoin

Correlation with the Federal Reserve’s policies

Bitcoin’s recent performance has shown a close correlation with the policies of the Federal Reserve. As the central bank continues to implement measures to stimulate the economy and mitigate the impact of the ongoing pandemic, Bitcoin has emerged as a potential beneficiary. The perceived inflation hedge qualities of Bitcoin have attracted the attention of investors seeking to protect their wealth from the potential devaluation of traditional fiat currencies. This correlation with the actions of the Federal Reserve highlights the increasing influence of macroeconomic factors on Bitcoin’s price movement.

Impact of economic conditions on Bitcoin

The state of the global economy has a direct impact on the performance of Bitcoin. In times of economic uncertainty or recession, investors often turn to alternative assets, such as Bitcoin, to diversify their portfolios and hedge against market volatility. The ongoing COVID-19 pandemic and its economic aftermath have created an environment of uncertainty, making Bitcoin an attractive option for investors. The perceived safety of Bitcoin compared to traditional financial institutions and its potential for long-term growth have driven increased demand and contributed to its recent price surge.

The perceived safety of Bitcoin compared to speculative assets

Bitcoin is often considered a safe haven asset in times of economic uncertainty. Unlike stocks, which are subject to company-specific risks, Bitcoin represents a decentralized and borderless form of money that is not directly influenced by political or economic events in any single country. This perceived safety has attracted a growing number of investors looking for a store of value that transcends traditional financial systems. As a result, Bitcoin has positioned itself as a potential alternative to speculative assets, providing stability and potential long-term growth opportunities.

Bitcoin as a leveraged bet on the Fed’s pivot

Bitcoin’s recent rise can also be seen as a leveraged bet on the Federal Reserve’s pivot towards more accommodative monetary policies. As central banks worldwide adopt measures to combat the economic impact of the pandemic, the increasing money supply and low-interest-rate environment have raised concerns about potential inflation. Bitcoin’s limited supply and decentralized nature make it an attractive investment for those seeking protection against inflationary pressures. This bet on the Federal Reserve’s actions has further fueled Bitcoin’s recent performance.

Investor Sentiment

Increased comfort among macro investors

Macro investors, traditionally focused on traditional financial markets, are increasingly embracing cryptocurrency, particularly Bitcoin. This shift in sentiment can be attributed to several factors, including the increasing recognition of Bitcoin’s growing market capitalization and its potential as a store of value. As macro investors become more comfortable with the idea of cryptocurrencies, they allocate a portion of their portfolios to Bitcoin, contributing to its sustained growth. The increased comfort among macro investors indicates a growing acceptance and maturation of the cryptocurrency industry.

Positive sentiment in the crypto industry

Within the crypto industry itself, there is a prevailing positive sentiment regarding Bitcoin’s sustained growth. Industry players, including cryptocurrency exchanges, wallet providers, and blockchain developers, see Bitcoin’s recent performance as a validation of their efforts in building a robust and decentralized financial ecosystem. This positive sentiment is further fueled by the increasing integration of cryptocurrencies into mainstream financial services and the broader adoption of blockchain technology. The collective optimism within the crypto industry adds to Bitcoin’s overall bullish outlook.

Hope for Bitcoin’s sustained growth

Bitcoin’s recent rally has instilled hope for the sustained growth of the cryptocurrency. Investors and enthusiasts alike are optimistic about its future potential, as the mainstream adoption of Bitcoin continues to gain traction. This hope for Bitcoin’s sustained growth is based on the belief that it will continue to attract institutional investors, government recognition, and widespread use as a medium of exchange. While there are undoubtedly risks associated with Bitcoin’s volatility and regulatory challenges, many proponents believe that the benefits outweigh the concerns, leading to a positive overall outlook.

Importance of good news in driving sentiment

In the volatile cryptocurrency market, good news and positive developments play a crucial role in driving investor sentiment. Any favorable announcements, such as institutional investment, regulatory clarity, or technological advancements, can significantly impact Bitcoin’s price and overall market sentiment. Conversely, negative news and unforeseen setbacks can dampen enthusiasm and lead to market corrections. Therefore, it is essential for market participants to stay informed about the latest news and developments to navigate this dynamic landscape effectively.

This image is property of i.ytimg.com.

Volatility and Industry Developments

Potential impact of bankruptcy filings on crypto prices

Bankruptcy filings by prominent companies in the cryptocurrency space can have a significant impact on crypto prices. When a company faces financial distress or fails to meet its obligations, it may need to liquidate its assets, including cryptocurrencies. The sudden influx of these digital assets into the market can create downward pressure on prices. Traders and investors should monitor bankruptcy filings closely and assess their potential impact on the overall crypto market. Proper risk management strategies, such as diversification and setting stop-loss orders, can help mitigate the risks associated with bankruptcy-related volatility.

Uncertainty surrounding industry developments

The cryptocurrency industry is known for its rapid pace of innovation and constant evolution. However, this dynamic nature also brings a level of uncertainty. New projects, technologies, and market entrants can disrupt the status quo and create volatility in the market. It is crucial for market participants to stay abreast of the latest developments, conduct thorough due diligence, and assess potential risks and opportunities. While uncertainty can breed volatility, it also presents opportunities for those who can effectively navigate the ever-changing landscape.

Outcome of ongoing court cases

Ongoing court cases involving cryptocurrencies, such as those related to regulatory scrutiny, intellectual property disputes, or fraud allegations, can have far-reaching implications for the industry. The outcomes of these cases can influence market sentiment, regulatory decision-making, and investor confidence. Traders and investors should closely monitor these legal proceedings and evaluate their potential impact on the crypto market. Legal clarity and resolution of such cases can contribute to a more stable and predictable environment for cryptocurrencies.

Influence of regulation on the industry

Regulatory developments play a significant role in shaping the cryptocurrency industry. Governments and regulatory bodies worldwide are grappling with how to classify, regulate, and supervise cryptocurrencies and related activities. The introduction of new regulations or changes in existing ones can have a profound impact on market sentiment and pricing dynamics. Moreover, regulatory clarity can attract institutional investors and mainstream adoption, while uncertainty and overly restrictive regulations can hinder the industry’s growth. The influence of regulation on the industry cannot be overlooked and requires careful attention from market participants.

Shift in Risk Sentiment

Risk sentiment shifting in the crypto space

The crypto space has experienced a noticeable shift in risk sentiment in recent times. Previously, cryptocurrencies were perceived as highly risky and speculative assets, primarily attracting retail investors and tech-savvy enthusiasts. However, this perception has gradually evolved, with an increasing number of institutional investors and traditional financial players entering the cryptocurrency market. The involvement of more risk-averse investors represents a shift towards a more balanced risk sentiment within the industry.

Return of larger players to the industry

The return of larger players to the cryptocurrency industry is indicative of changing risk sentiment. High-profile individuals, hedge funds, and investment banks have reentered the space, attracted by the potential for high returns and the maturation of the market. This trend reflects a growing acceptance and recognition of cryptocurrencies as a legitimate asset class. The presence of larger players also has the potential to bring stability and liquidity to the market, further reducing perceived risks associated with investing in cryptocurrencies.

Examples of key individuals rejoining the industry

Several key individuals, who were once skeptical or critical of cryptocurrencies, have since changed their tune and joined the industry. Their involvement and public endorsements of cryptocurrencies have helped legitimize the sector and generate positive sentiment among both retail and institutional investors. Examples include renowned investors, influential industry figures, and respected financial institutions that have embraced Bitcoin and other cryptocurrencies as part of their investment strategies. The increasing participation of these individuals contributes to the overall shift in risk sentiment within the crypto space.

Crypto as an industry for second chances

The cryptocurrency industry has become a haven for second chances, attracting individuals who have faced setbacks or challenges in traditional finance. It provides an opportunity for redemption and the chance to pioneer innovative solutions and business models. This characteristic of the industry is particularly appealing to risk-tolerant individuals, willing to take chances and explore uncharted territories. The industry’s ethos of reinvention and disruption allows individuals to leverage their skills and experiences in new ways, contributing to the overall growth and evolution of the crypto space.

This image is property of i.dailymail.co.uk.

Reactions to Industry Figures

Mixed reactions to the founders of collapsed hedge fund Three Hours Capital

The collapse of hedge fund Three Hours Capital and the subsequent actions of its founders have evoked mixed reactions within the cryptocurrency industry. Some view the situation as a cautionary tale, underscoring the need for stricter regulations and investor protections. Others criticize the founders for their alleged mismanagement and misconduct, attributing the collapse to internal factors rather than external market conditions. Regardless of the differing perspectives, the incident serves as a reminder of the importance of accountability, transparency, and ethical conduct within the industry.

Pain and lack of closure among industry creditors

The fallout from collapsed crypto projects often leaves industry creditors in a state of pain and uncertainty. In cases where investors, employees, or service providers are left unpaid or faced with significant financial losses, the impact can be severe. The lack of closure or recourse can further exacerbate the pain experienced by industry creditors. This highlights the need for increased regulatory oversight and measures to protect those involved in the cryptocurrency ecosystem. Improved transparency and accountability can help mitigate the negative consequences associated with failed projects.

Importance of regulatory clarity for the industry

Regulatory clarity is essential for the long-term growth and stability of the cryptocurrency industry. The lack of clear guidelines and consistent regulations often hampers the industry’s development and inhibits institutional participation. When regulators provide clear frameworks that balance innovation and investor protection, it fosters confidence and promotes responsible practices within the industry. The industry’s stakeholders, including entrepreneurs, developers, and investors, rely on regulatory clarity to navigate the complex landscape and ensure compliance with applicable laws.

Anticipation of regulation and its impact on the industry

The anticipation of increased regulation within the cryptocurrency industry has led to diverse opinions among market participants. While some welcome regulation as a means of ensuring market integrity and protecting investors, others express concerns about overregulation stifling innovation and impeding the industry’s growth. The impact of regulation on the industry will depend on the approach taken by regulators and their ability to strike a balance between oversight and fostering innovation. The anticipation of regulatory decisions and their subsequent implementation remains a significant point of interest for industry players.

Bullish Outlook

Bullish sentiment among industry insiders

There is a prevailing bullish sentiment among many industry insiders regarding the future of Bitcoin and cryptocurrencies. The latest surge in Bitcoin’s price, coupled with growing institutional adoption and mainstream recognition, has fueled optimism about the long-term prospects of cryptocurrencies. Many industry insiders see the potential for further price appreciation, technological advancements, and wider adoption of cryptocurrencies in various sectors of the economy. This bullish sentiment reflects the industry’s confidence in the underlying technology and its potential to revolutionize traditional financial systems.

Excitement about decentralized finance

Decentralized finance, often referred to as DeFi, has garnered significant attention and excitement within the cryptocurrency industry. DeFi projects leverage blockchain technology to create automated financial services, removing intermediaries and central authorities from traditional financial transactions. The potential of DeFi to revolutionize lending, borrowing, and other financial services has captured the interest of investors and industry players. The growth and expansion of DeFi platforms and protocols have contributed to the overall bullish outlook for the cryptocurrency industry.

Desire for clarity and guidance from regulators

While the cryptocurrency industry embraces decentralization and the absence of central authorities, there is also a desire for clarity and guidance from regulators. Market participants recognize the importance of regulatory oversight in building trust and attracting mainstream investors. Clear guidelines and regulations can help establish a level playing field and mitigate risks associated with fraud, money laundering, and other illicit activities. Therefore, there is a growing expectation that regulators will provide comprehensive frameworks that foster innovation while safeguarding the interests of investors and the overall stability of the market.

Impact of regulatory landscape on investment strategies

The regulatory landscape significantly influences investment strategies within the cryptocurrency industry. The evolving regulatory environment, including licensing requirements, compliance obligations, and reporting standards, shapes the way investors approach the market. Clear and favorable regulations can create an environment conducive to capital inflows, as institutional investors gain confidence and enter the market. Conversely, regulatory uncertainty or overly restrictive measures can hinder investment and limit the industry’s growth potential. The impact of the regulatory landscape on investment strategies cannot be understated, as it influences portfolio allocation, risk assessment, and long-term planning.

This image is property of www.newsbtc.com.

Expectations for Regulation

Anticipation of increased regulation

Market participants anticipate an uptick in regulation within the cryptocurrency industry. The rapid growth and global reach of cryptocurrencies have prompted regulatory bodies worldwide to examine and address the associated risks and opportunities. As more governments recognize the significance of cryptocurrencies and their potential impact on the financial system, the likelihood of increased regulation becomes more apparent. Traders, investors, and industry players should closely monitor regulatory developments to adapt their strategies and comply with any new requirements that may arise.

Clarity on centralized exchanges and SEC involvement

There is a particular need for regulatory clarity regarding centralized cryptocurrency exchanges and the involvement of the U.S. Securities and Exchange Commission (SEC). Centralized exchanges, which facilitate the trading of cryptocurrencies, often operate in a regulatory gray area. Clarifying the regulatory framework for these exchanges can help establish clear guidelines for market participants, enhance investor protection, and foster broader adoption. Additionally, the SEC’s involvement in the cryptocurrency space, particularly in relation to Initial Coin Offerings (ICOs) and securities regulations, is eagerly awaited by industry participants to ensure compliance and regulatory alignment.

Questions and uncertainty among industry players

The anticipation of increased regulation has raised numerous questions and uncertainties among industry players. Market participants are eager to understand how regulators will classify various cryptocurrencies, determine the compliance requirements for businesses operating in the industry, and address the challenges posed by cross-border transactions. As regulatory frameworks continue to evolve, industry players will seek guidance to ensure legal compliance and minimize any potential regulatory risks. Collaborative efforts between regulators and industry stakeholders can help bridge the gap and establish a supportive regulatory environment.

Interest in how regulators will manage and impact the crypto industry

The manner in which regulators manage and impact the cryptocurrency industry remains a topic of great interest and speculation. Market participants are keen to observe how regulators strike a balance between fostering innovation and protecting investors. The compatibility of existing regulations with the unique characteristics of cryptocurrencies poses both challenges and opportunities. The industry will closely study and scrutinize regulatory decisions and policies to assess their potential impact on the broader crypto ecosystem. The ability of regulators to adapt and keep pace with the dynamic nature of the industry will be crucial in shaping its future trajectory.

Conclusion

Bitcoin’s recent performance has been remarkable, surpassing the $21,000 mark and approaching its longest winning streak since November 2013. This surge in price has attracted increased attention to the cryptocurrency as both investors and traders monitor its performance. While technical indicators suggest that a correction or consolidation phase may be on the horizon, the overall bullish sentiment surrounding Bitcoin is fueled by its correlation with the Federal Reserve’s policies, the impact of economic conditions, and its perceived safety compared to speculative assets.

Investor sentiment is mixed, with increased comfort among macro investors and positive sentiment within the crypto industry. The industry’s hopes for sustained growth are supported by the importance of good news in driving sentiment. Volatility and industry developments, including bankruptcy filings and ongoing court cases, serve as points of uncertainty and highlight the influence of regulation on the industry.

There has been a notable shift in risk sentiment within the crypto industry, with the return of larger players and crypto as an industry for second chances. Reactions to industry figures have been mixed, emphasizing the need for regulatory clarity and the anticipation of upcoming regulation in the industry. Despite these challenges, there is a bullish outlook among industry insiders, fueled by excitement about decentralized finance and the desire for clarity and guidance from regulators.

Expectations for regulation include the anticipation of increased regulation, clarity on centralized exchanges and SEC involvement, and questions about the impact on the crypto industry. Regardless of the regulatory landscape, Bitcoin’s recent rise and potential for further growth reflect the importance of macro factors, technical analysis, investor sentiment, and the anticipation of regulation in shaping the industry’s future. The cryptocurrency industry continues to evolve, and market participants must navigate these dynamics in order to capitalize on opportunities and manage associated risks.