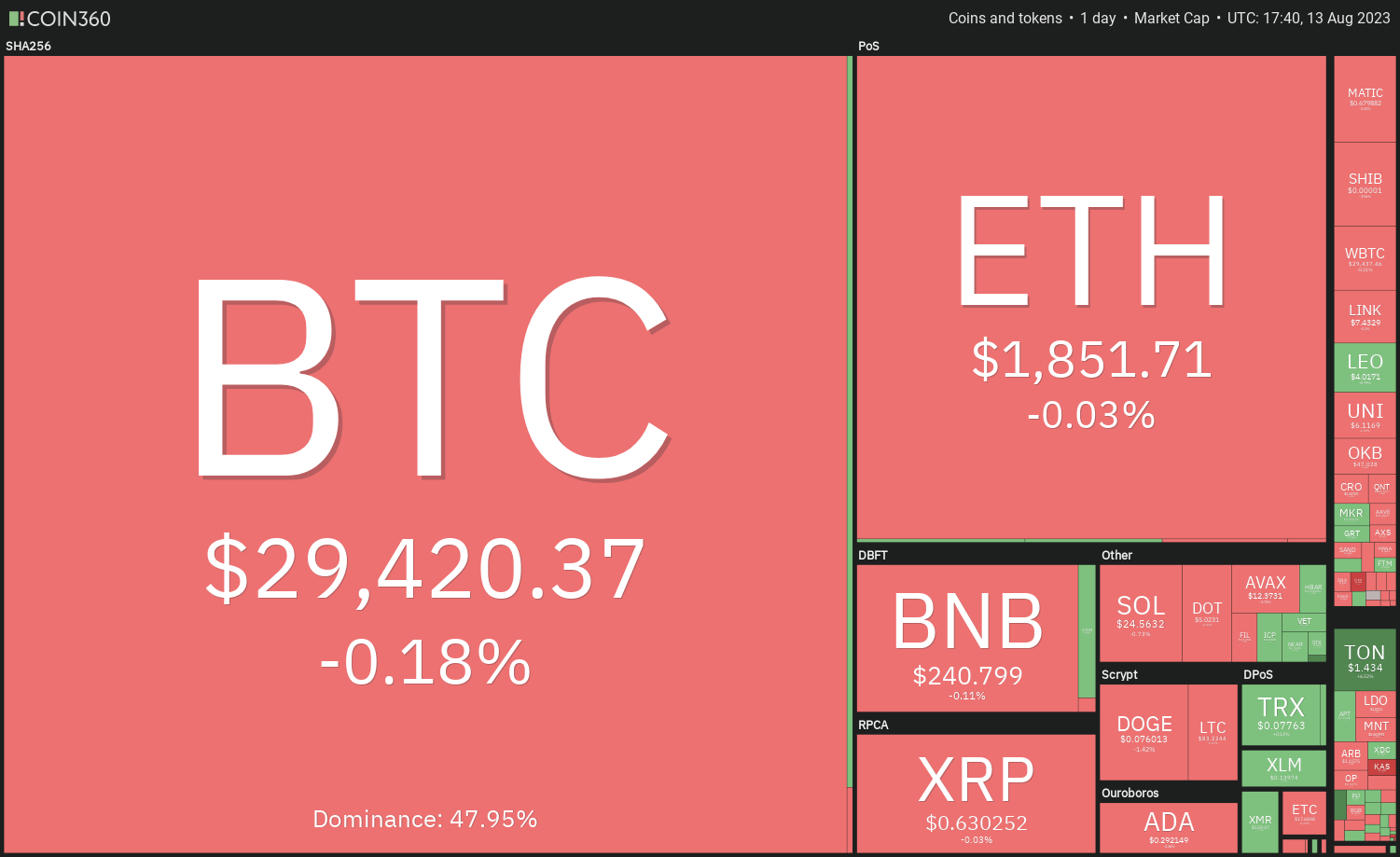

In the world of cryptocurrency trading, Bitcoin’s recent sideways price movement has caused traders to shift their focus towards alternative coins like SHIB, UNI, MKR, and XDC. While Bitcoin remains range-bound, these coins have shown signs of strength, capturing the attention of traders looking for potential gains. Bitcoin’s stability above its 20-week exponential moving average suggests that the bulls are still in control, which has historical precedence of leading to upward expansions. However, the lack of volatility in Bitcoin has caused trading volumes to drop to their lowest levels since December 2022, indicating a potential shift of interest among traders. In this article, we will analyze the charts of SHIB, UNI, MKR, and XDC to determine their short-term prospects and identify potential trading opportunities.

Bitcoin’s Sideways Price Action

Bitcoin has been experiencing a period of sideways trading, with the price remaining relatively stable above the 20-day exponential moving average (EMA). This compression above the moving average is significant, as it has only occurred four times since the creation of Bitcoin. Interestingly, on all three previous occasions, the price eventually broke out to the upside, indicating a historical favor towards the bulls.

However, despite this positive sign, Bitcoin futures trading volumes have reached their lowest levels since December 2022. This lack of volatility suggests that traders may have shifted their focus to other markets or chosen to avoid making any significant moves at the current price levels.

Bitcoin Price Analysis

Currently, Bitcoin is trading near the 20-day EMA, which indicates a period of indecision between the bulls and bears. The flattish moving averages and the relative strength index (RSI) near the midpoint further reinforce this lack of clear advantage for either side.

As a result, Bitcoin may remain range-bound between the support level of $28,585 and the resistance level of $30,150. The next trending move will likely occur once the price breaks out of this range. A decline below the support level of $28,585 could lead to further selling pressure and a potential drop to $26,000. Conversely, a break and close above the resistance level of $30,150 may attract buyers and push the price towards the resistance zone of $31,804 to $32,400.

Shiba Inu Price Analysis

Shiba Inu (SHIB) has been experiencing a strong recovery, with buyers facing resistance near the overhead resistance level of $0.000012. The upsloping 20-day EMA and the RSI near the overbought zone suggest that the bulls are currently in control.

If buyers can maintain their ground and prevent a significant pullback from the overhead resistance, the prospects for a rally above $0.000012 become more likely. In this scenario, the SHIB price could surge towards $0.000014 and potentially even reach $0.000016.

However, if the price falls below $0.000010, the recovery may be over, and the price could extend its pullback to the 20-day EMA, which serves as a crucial support level to monitor.

Uniswap Price Analysis

Uniswap (UNI) recently rebounded off the 50-day simple moving average (SMA) and rose above the 20-day EMA. This indicates active buying at lower levels and suggests that the bulls are still in the game.

However, the UNI price is facing a tough battle near the 20-day EMA, signaling that the bears have not yet given up. If the price fails to sustain above the 20-day EMA, selling pressure could intensify, and the price may drop to the 50-day SMA.

On the other hand, if the bulls manage to flip the 20-day EMA into support, the price could rise above the immediate resistance at $6.35 and potentially reach $6.70.

Maker Price Analysis

Maker (MKR) has been trading above the breakout level of $1,200, indicating that the bulls are attempting to turn this level into support. The gradual upward slope of the 20-day EMA and the positive RSI further support the bullish case.

If buyers can push the price above the immediate resistance of $1,284, they could challenge the local high at $1,370 and potentially start a new uptrend. However, if the bears can quickly bring the price back below the breakout level of $1,200, a decline to the 50-day SMA at $1,041 could be on the horizon.

XDC Network Price Analysis

XDC Network (XDC) has recently pulled back to the 20-day EMA, a crucial support level to watch. The flattening out of the 20-day EMA and the RSI just above the midpoint suggest that the bullish momentum may be waning.

To regain control, buyers will need to push the price above the overhead resistance level of $0.073, potentially leading to an upswing towards $0.082. On the contrary, a break and close below the 20-day EMA could result in a decline to the 61.8% Fibonacci retracement level at $0.056.

On the shorter time frame, the four-hour chart shows a descending triangle formation. A break and close below $0.061 could trigger a downward move towards $0.054 and the pattern target of $0.040. However, if the price continues to rise from the current level and breaks above the downtrend line, it would invalidate the bearish setup and open the door for a potential rally to $0.082.

Bitcoin’s Influence on Altcoins

While Bitcoin’s sideways price action has left many traders uncertain, several altcoins are looking to Bitcoin for direction. However, it’s important to note that some altcoins have been outperforming in the near term, showing signs of strength even as Bitcoin remains range-bound.

In particular, altcoins such as Shiba Inu (SHIB), Uniswap (UNI), Maker (MKR), and XDC Network (XDC) have shown promising price action and potential trading opportunities.

Potential Trading Opportunities

Based on the analysis of the top-five cryptocurrencies, namely SHIB, UNI, MKR, and XDC, there are signs of strength and positive price action. These cryptocurrencies have the potential to perform well in the coming days, presenting potential trading opportunities for investors.

Additionally, the charts of these cryptocurrencies are looking positive, indicating that bullish momentum may be present.

Short-Term Volatility and Trading Decisions

Bitcoin futures trading volumes have reached their lowest levels since December 2022. This low volatility suggests that traders may have shifted their focus to other markets or chosen to refrain from making significant trading moves at the current price levels.

Traders should consider this low volatility and potentially explore other markets or cryptocurrencies that are exhibiting more favorable trading conditions.

Technical Analysis on Bitcoin

Bitcoin is on track to form two successive Doji candlestick patterns on the weekly charts, but the positive sign is that the price is sustaining above the 20-week EMA. This indicates that the bulls have not lost their grip.

These Doji candlestick patterns suggest indecision in the market, with neither the bulls nor the bears having a clear advantage. However, the price sustaining above the 20-week EMA is a positive sign for the bulls.

In conclusion, Bitcoin’s sideways price action has led traders to focus on altcoins such as SHIB, UNI, MKR, and XDC. These altcoins have shown signs of strength and potential trading opportunities, with their charts looking positive. However, traders should also consider the low volatility in Bitcoin futures trading and explore other markets or cryptocurrencies that might offer more favorable trading conditions.