In an analysis by Timothy Peterson, founder and investment manager at Cane Island Alternative Advisors, it is suggested that Bitcoin may experience a 15% dip to $25,000 by October. Peterson predicts that this potential dip would be the “last big dip” before the next bull run in BTC price. While Bitcoin bulls attempt to break above $30,000, Peterson points to the historical August and September performance of Bitcoin, indicating a possible return to the $25,000 mark. Despite this short-term dip, Peterson maintains a bullish outlook and predicts that Bitcoin will reach $100,000 by mid-2026 according to the “Lowest Price Forward” metric.

Bitcoin risks 15% dip by October

Bitcoin, the world’s largest and most popular cryptocurrency, is facing the possibility of a significant dip in price in the coming months. According to Timothy Peterson, founder and investment manager at Cane Island Alternative Advisors, there is a 50% chance that Bitcoin will drop below $25,000 before the end of September. This would mark a 15% decrease in value from its current price. Peterson believes that this potential dip is part of the normal price volatility that Bitcoin experiences, and it would serve as the “last big dip” before the next bull run.

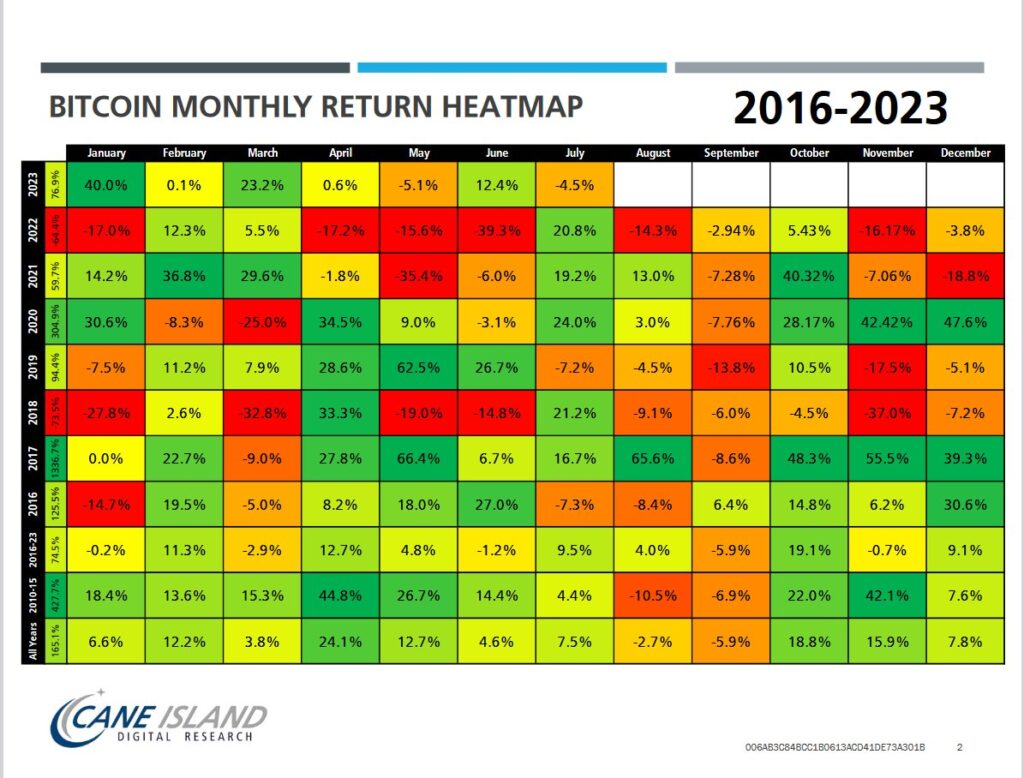

Various traders and analysts have been keeping a close eye on Bitcoin’s price performance in August and September, as these months have historically been challenging for the cryptocurrency. Peterson’s analysis is based on monthly performance statistics for BTC/USD, indicating that a dip to $25,000 is likely. While this may cause concern for some investors, Peterson sees it as an opportunity for the next bull run to commence.

$100K is due in 2026

Despite the risk of a short-term dip in Bitcoin’s price, Timothy Peterson remains optimistic about its long-term trajectory. He predicts that Bitcoin will reach a staggering $100,000 by mid-2026. Peterson’s prediction is based on the Lowest Price Forward metric, which has a track record of accurately forecasting Bitcoin’s price movements. This metric previously predicted Bitcoin’s last visit to $10,000 in September 2020.

Peterson emphasizes that while Bitcoin may experience dips after a bear market, these moments should be seen as opportunities for patience rather than doubt. He believes that Bitcoin is less than 1000 days away from reaching the $100,000 milestone. This bold prediction speaks to the potential value and growth that Bitcoin holds in the coming years.

Understanding Bitcoin’s Price Volatility

Bitcoin’s price volatility is a well-known characteristic of the cryptocurrency market. It is important for investors and traders to understand and anticipate these fluctuations in order to make informed decisions. Bitcoin’s price is influenced by various factors, including market demand, investor sentiment, regulatory developments, and macroeconomic conditions.

While Bitcoin has experienced significant price increases over the past decade, it has also faced periods of sharp declines. These price fluctuations are often attributed to market cycles, where periods of rapid growth (bull markets) are followed by periods of consolidation or decline (bear markets). Understanding these cycles can help investors navigate the volatile nature of the cryptocurrency market.

The Importance of Technical Analysis

Traders and analysts like Timothy Peterson rely on technical analysis to predict Bitcoin’s price movements. Technical analysis involves studying historical price and volume data to identify patterns and trends. By analyzing these patterns, traders can make educated guesses about future price movements.

In the case of Bitcoin’s potential dip to $25,000 and its eventual rise to $100,000, Peterson’s analysis is based on historical performance data and the Lowest Price Forward metric. While technical analysis is not foolproof and cannot predict future prices with certainty, it provides valuable insights into potential price trends.

Managing Risk and Investment Strategies

Investing in Bitcoin and other cryptocurrencies carries inherent risks. The cryptocurrency market is highly volatile and subject to sudden price swings. It is crucial for investors to develop a risk management strategy to protect their investments. This strategy may include diversifying one’s portfolio, setting stop-loss orders to limit potential losses, and staying informed about market developments.

Additionally, investors should consider their investment horizon and risk tolerance when deciding on their Bitcoin strategy. Short-term price movements may be unpredictable, but a long-term perspective can help investors weather the volatility and capitalize on potential growth opportunities.

Conclusion

Bitcoin’s price is at a critical juncture, with the possibility of a 15% dip by October. However, Timothy Peterson believes that this dip would serve as the “last big dip” before the next bull run, offering an opportunity for Bitcoin to reach $100,000 by mid-2026. While the cryptocurrency market carries inherent risks, understanding Bitcoin’s price volatility, relying on technical analysis, and implementing effective risk management strategies can help investors navigate this volatile landscape. By staying informed and taking a long-term perspective, investors can potentially capitalize on the growth opportunities that Bitcoin presents.