The article titled “Bitcoin Payments Company Strike Nabs $80M Series B” features an interview between Strike CEO Jack Mallers and Ed Ludlow where they discuss the latest raise of $80 million in Series B funding for Strike, along with their outlook on lightning integration and the current state of the cryptocurrency market. Mallers explains that the funds will be used to further improve payments within the lightning network, which he considers to be one of the most innovative developments in the history of payments. He emphasizes the importance of bitcoin’s ability to move instantaneously and settle transactions instantly, highlighting its value as a digital asset.

Additionally, the interview touches on the topic of bitcoin’s volatility and its significance in the payments industry. Mallers points out that while bitcoin’s price fluctuations may concern some investors, it doesn’t affect Strike’s customers who use bitcoin as a means to transfer value. He believes that the fundamental properties of bitcoin as an attractive and secure asset have remained unchanged, and its importance in the world will continue to grow over time. The conversation also addresses the issue of trust in centralized banking systems, with Mallers highlighting the decentralized nature of bitcoin and the freedom for individuals to choose where they want to place their trust.

Strike Nabs $80M Series B

Overview

Bitcoin payments company Strike recently announced a significant milestone in its journey – the completion of an $80 million Series B funding round. This substantial infusion of capital is expected to have a profound impact on the cryptocurrency industry as a whole. In this article, we will delve into the insights shared by Strike CEO Jack Mallers, explore the basics of the Lightning Network, discuss the importance of this technology, analyze Bitcoin’s volatility, highlight its attractiveness as an asset, consider regulatory considerations, discuss the trustworthiness of central banks, and explore the challenges and opportunities of raising funds in a volatile market. By the end, we will have a comprehensive understanding of the significance of Strike’s achievements and the future potential it holds.

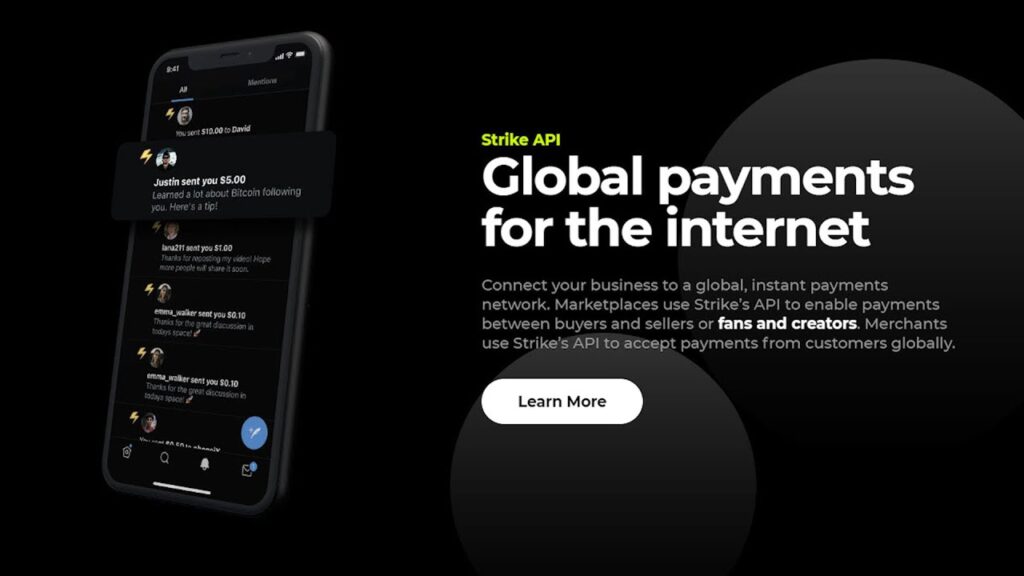

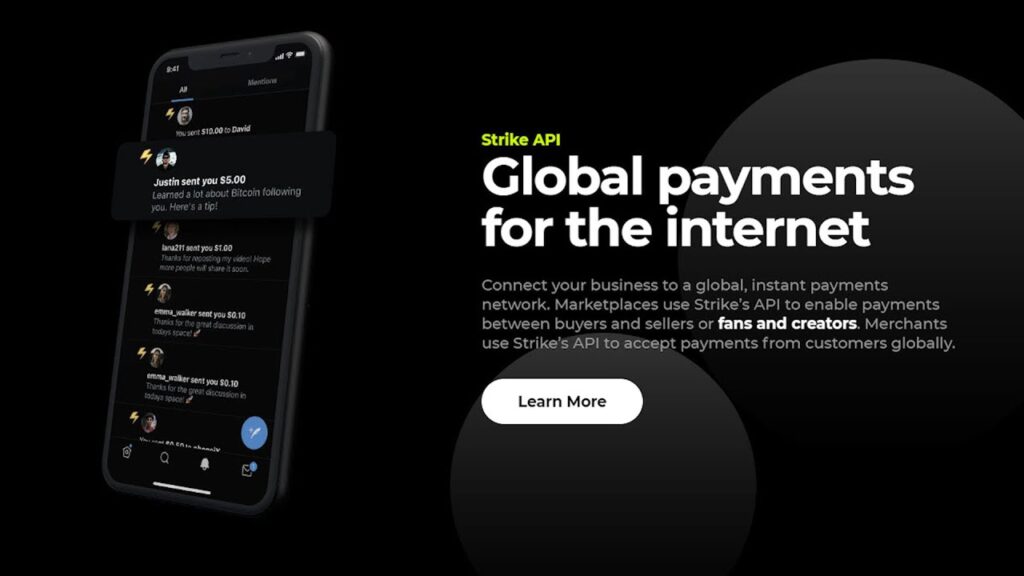

CEO Jack Mallers’ Insights

To gain a deeper understanding of Strike’s recent accomplishments, we had the privilege of interviewing the company’s CEO, Jack Mallers. In our conversation, Mallers shared his excitement about integrating the Lightning Network into Strike’s operations. This technology allows for instantaneous and low-cost Bitcoin transactions, revolutionizing the way payments are conducted. Mallers also discussed the strategic moves Strike would make with the raised funds, emphasizing their commitment to improving the payment experience through Lightning Network innovation. By exploring these insights, we gain valuable perspective on how Strike plans to reshape the cryptocurrency industry.

This image is property of i.ytimg.com.

Basics of Lightning Network

The Lightning Network is an integral part of Strike’s payment solutions. It is a protocol built on top of the Bitcoin blockchain that enables immediate and inexpensive transactions. But how does it work? The Lightning Network allows users to create payment channels between parties, facilitating off-chain transactions. By doing so, it alleviates the scalability issues that have plagued cryptocurrencies like Bitcoin, enabling a significantly higher transaction throughput. In simple terms, it empowers Strike to provide lightning-fast, low-cost payments to its users, all while utilizing the security and robustness of the Bitcoin network.

Importance of Lightning Network

The Lightning Network offers several key advantages that make it an essential element of Strike’s operations. Firstly, it enables real-time, near-instantaneous settlement of Bitcoin transactions. This ability to transact without delays or reliance on third parties positions Strike as a leading player in the digital payment arena. Furthermore, compared to traditional payment networks, Lightning Network transactions incur significantly lower fees, making it an attractive solution for both businesses and individuals. The disruptive potential of this technology cannot be understated, as it has the potential to revolutionize the payments industry worldwide, unlocking new opportunities for global commerce.

This image is property of i.ytimg.com.

Bitcoin Volatility

One of the prevailing criticisms surrounding cryptocurrencies, particularly Bitcoin, is their notorious price volatility. However, it is crucial to separate Bitcoin’s utility as a means of payment from its value fluctuations. Strike understands this distinction and has designed its services to provide seamless and secure payments regardless of Bitcoin’s price movements. By focusing on the utility of Bitcoin as a transactional currency, Strike has positioned itself to serve customers who value the advantages of real-time, low-cost transactions without being hampered by concerns over short-term price volatility.

Bitcoin as an Attractive Asset

While Bitcoin’s volatility raises concerns for some, others find it to be an attractive asset for various reasons. The benefits of real-time, low-cost transactions offered by Strike are instrumental in showcasing the advantages of Bitcoin as digital money. Compared to traditional assets, Bitcoin offers unparalleled speed, cost-efficiency, and borderless transactions. Additionally, Bitcoin’s properties as a store of wealth have become increasingly evident. As individuals seek alternatives to traditional stores of value, Bitcoin’s potential for long-term growth and its ability to preserve wealth in uncertain times become compelling reasons to consider it as a portfolio diversification asset.

This image is property of cdn.decrypt.co.

Regulatory Considerations

In recent years, the regulatory landscape surrounding cryptocurrencies has become an important topic of discussion. Strike, as a Bitcoin payments company, operates with a thorough understanding of these complexities. The perspective shared by Jack Mallers sheds light on the company’s commitment to adhering to regulatory frameworks while providing users with an improved payment experience. By ensuring compliance and transparency, Strike aims to foster trust in the broader cryptocurrency ecosystem, while emphasizing the importance of individual decision-making regarding asset selection and usage.

Trust in Central Banks

Central banks have played a crucial role in the global financial system for centuries. However, recent developments have raised questions regarding the trustworthiness of these institutions. Strike recognizes the value of individual autonomy in making financial decisions and highlights the importance of trust in personal choices and the assets individuals choose to hold. By embracing decentralized cryptocurrencies like Bitcoin, Strike offers an alternative to centralized financial systems, allowing individuals to exercise greater control over their financial future and placing trust in the power of distributed networks.

This image is property of i.ytimg.com.

Raising Funds in a Volatile Market

The ability to raise significant funds in a volatile market is a testament to the strength and value of Strike’s proposition. While the cryptocurrency market experiences fluctuations, Strike’s ability to secure $80 million in Series B funding is a remarkable achievement. It underscores the growing interest and support from investors who recognize the potential of the Lightning Network and the transformative effect it can have on global payments. Strike’s successful funding round not only validates their vision and strategy but also paves the way for further development and expansion of their innovative payment solutions.

Conclusion

In conclusion, Strike’s successful completion of an $80 million Series B funding round is a monumental achievement that will have a significant impact on the cryptocurrency industry. With insights from CEO Jack Mallers, a deep dive into the Lightning Network and its importance, an exploration of Bitcoin’s volatility, and an evaluation of its attractiveness as an asset, Strike’s role in reshaping the global payments landscape becomes clear. Through regulatory considerations, trust in central banks, and the ability to raise funds in volatile markets, Strike demonstrates its commitment to delivering innovative, secure, low-cost payment solutions. As we look ahead, the role of Strike and the Lightning Network in revolutionizing the way we transact appears increasingly promising.