This article explores the current state of Bitcoin futures open interest and trading volume, highlighting contrasting trends in the market. While Bitcoin futures open interest has reached a high for 2023, trading volume has hit a yearly low. The article delves into various factors that may be contributing to this situation, including regulatory concerns, recent news events, and market analysis. Additionally, the article covers a wide range of related topics such as the impact of taxation on cryptocurrencies, predictions for Bitcoin’s future movement, developments in AI, and the influence of inflation on Bitcoin’s price. Overall, this comprehensive article provides a thorough analysis of the factors influencing Bitcoin’s market dynamics.

This image is property of s3.cointelegraph.com.

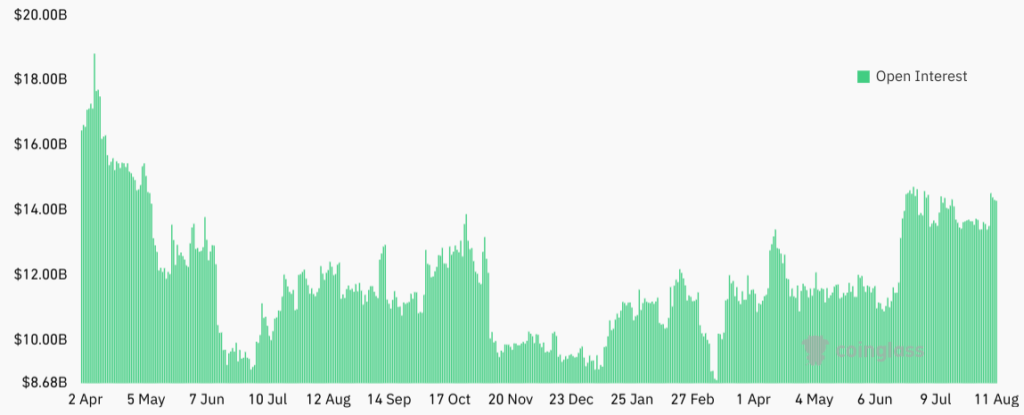

Bitcoin futures open interest at 2023 high

Explanation of Bitcoin futures open interest

Bitcoin futures open interest refers to the total number of outstanding futures contracts on Bitcoin. It represents the total number of contracts that have been entered into by market participants but have not yet been closed or settled. Open interest is an important metric in futures markets as it provides insights into market liquidity, investor sentiment, and potential price movements.

Current statistics showing Bitcoin futures open interest at a 2023 high

According to recent data, Bitcoin futures open interest has reached a new high for the year 2023. This indicates a significant increase in market participation and interest in Bitcoin futures contracts. The surge in open interest suggests that more investors are taking positions in Bitcoin futures, either to speculate on the price movement or to hedge their exposure to Bitcoin.

Possible reasons for the increase in Bitcoin futures open interest

Several factors may have contributed to the increase in Bitcoin futures open interest. Firstly, the growing mainstream adoption of cryptocurrencies and the increased acceptance of Bitcoin by institutional investors have likely attracted more participants to the futures market. Additionally, the recent price volatility in the cryptocurrency market may have enticed traders to take positions in Bitcoin futures to capitalize on potential price swings.

Furthermore, the introduction of new derivative products and platforms, as well as regulatory developments that provide a more favorable environment for Bitcoin futures trading, could have also contributed to the surge in open interest.

Impact of Bitcoin futures open interest on the cryptocurrency market

The rising open interest in Bitcoin futures can have several implications for the cryptocurrency market. Firstly, it signifies increased market liquidity, as more participants are actively trading Bitcoin futures. This increased liquidity can contribute to more efficient price discovery and smoother market operations.

Moreover, the growing open interest in Bitcoin futures suggests a higher level of investor confidence and interest in Bitcoin as an investment asset. This could potentially attract more institutional investors and traditional market participants, leading to further market development and maturation.

It is essential to monitor Bitcoin futures open interest as it can provide valuable insights into market dynamics, sentiment, and potential price movements. By analyzing open interest data, market participants can better understand the prevailing trends and make informed trading decisions.

BTC trading volume at yearly low

Explanation of BTC trading volume

BTC trading volume refers to the total number of Bitcoin units that have been bought and sold on various cryptocurrency exchanges over a specific period. It represents the level of market activity and liquidity in Bitcoin trading.

Current statistics showing BTC trading volume at a yearly low

Recent data indicates that BTC trading volume has reached a yearly low. This suggests a decrease in market activity and investor participation in Bitcoin trading. The low trading volume can be an indication of reduced interest in Bitcoin or a lack of significant buying and selling pressure.

Possible reasons for the decrease in BTC trading volume

Several factors may have contributed to the decline in BTC trading volume. Firstly, the recent stabilization of Bitcoin’s price and the relative absence of significant price movements may have led to a decrease in speculative trading activity. When prices are stagnant, traders often refrain from making frequent trades, resulting in lower trading volume.

Additionally, seasonal factors, such as a decrease in trading activity during summer months or holidays, could also contribute to the reduced trading volume. Furthermore, regulatory developments and restrictions imposed on cryptocurrency exchanges in certain jurisdictions may have limited the trading activities of market participants, leading to lower trading volume.

Impact of low BTC trading volume on the cryptocurrency market

Low BTC trading volume can have several implications for the cryptocurrency market. Firstly, it can indicate a lack of market interest or confidence in Bitcoin, which could potentially lead to a decline in its value. Reduced trading volume may also result in increased market volatility, as there may be fewer market participants to absorb large buy or sell orders, leading to sharper price movements.

Furthermore, low trading volume can make it challenging for investors and traders to enter or exit positions in Bitcoin, resulting in reduced market liquidity. Lower liquidity can hinder price discovery and make it more difficult to execute trades at desired prices.

It is crucial for market participants to closely monitor BTC trading volume, as it can provide insights into market sentiment, liquidity, and potential price trends. By analyzing trading volume data, investors can make more informed trading decisions and adjust their strategies accordingly.

Grayscale CEO emphasizes the need for a balanced regulatory approach

Overview of Grayscale and its CEO

Grayscale is a leading digital asset management company that offers cryptocurrency investment products, including the Grayscale Bitcoin Trust. As of its CEO, Michael Sonnenshein, he is a respected figure in the cryptocurrency industry and has been actively involved in promoting institutional adoption of cryptocurrencies.

Importance of balanced regulatory approach in cryptocurrency

Grayscale’s CEO, Michael Sonnenshein, has emphasized the need for a balanced regulatory approach in the cryptocurrency industry. He believes that regulations play a crucial role in fostering investor protection, market integrity, and innovation. However, he also recognizes the importance of avoiding overly burdensome regulations that hinder the growth and development of the industry.

A balanced regulatory approach is necessary to provide a clear legal framework that protects investors, prevents illicit activities, and fosters innovation. It ensures that legitimate market participants can operate within a regulated environment, while also allowing for experimentation and technological advancements.

Concerns regarding regulatory hindrances to innovation

Sonnenshein has expressed concerns about regulatory hindrances that could stifle innovation in the cryptocurrency industry. Overly strict regulations or a lack of regulatory clarity can create uncertainty and deter investors and entrepreneurs from entering the market. This can limit the potential benefits and advancements that cryptocurrencies and blockchain technology can offer.

Furthermore, Sonnenshein believes that regulatory frameworks should be adaptable and flexible to keep pace with the rapidly evolving nature of the cryptocurrency industry. The dynamic nature of the market requires regulators to strike a balance between oversight and fostering innovation, allowing for new business models to emerge while ensuring proper investor protection.

Suggestions for achieving balanced regulation in the cryptocurrency industry

To achieve a balanced regulatory approach in the cryptocurrency industry, Sonnenshein suggests that regulators work closely with industry participants and stakeholders to develop clear and comprehensive guidelines. Collaboration between regulators and industry leaders can help address concerns and promote a regulatory environment that supports innovation while safeguarding investor interests.

Additionally, Sonnenshein emphasizes the importance of international coordination in developing regulatory frameworks. Given the global nature of cryptocurrencies, consistent regulations across different jurisdictions can provide greater clarity and create a more level playing field for market participants.

Overall, a balanced regulatory approach is crucial for the long-term sustainability and growth of the cryptocurrency industry. It can instill confidence in investors, promote market integrity, and foster innovation, ultimately leading to greater mainstream adoption of cryptocurrencies.

SBF ordered to jail

Background information on SBF and its involvement in the cryptocurrency market

SBF, short for Sam Bankman-Fried, is a prominent figure in the cryptocurrency industry. He is the founder and CEO of FTX, a leading cryptocurrency exchange and derivatives platform. SBF has been vocal about his commitment to innovation and has made significant contributions to the development of the cryptocurrency ecosystem.

Details of the court’s order to jail SBF

In a recent development, SBF has been ordered to jail. The specific details and reasons behind the court’s decision are unclear at this time. It is important to note that this is a significant event in the cryptocurrency industry, as SBF’s involvement and influence have had a substantial impact on the market.

Possible reasons for the court’s decision

The reasons behind the court’s decision to jail SBF are currently unknown, and speculation would be inappropriate at this point. It is important to wait for further updates and official statements regarding the matter. However, any legal action involving prominent figures in the cryptocurrency industry can have implications for the overall market and investor sentiment.

Impact of SBF’s imprisonment on the cryptocurrency industry

The imprisonment of a prominent figure like SBF can have far-reaching implications for the cryptocurrency industry. It may create uncertainties and concerns among market participants, as his absence could potentially disrupt ongoing projects or initiatives associated with FTX.

Moreover, SBF’s reputation and influence in the industry may have an indirect impact on investor sentiment and market dynamics. News of prominent individuals facing legal issues can lead to increased scrutiny and regulatory pressure on the broader cryptocurrency ecosystem.

It is crucial for market participants to closely monitor developments surrounding SBF’s imprisonment and any potential ramifications for the cryptocurrency market. The implications could extend beyond the immediate circumstances and have broader effects on investor confidence, regulatory actions, and market sentiment.

This image is property of images.cointelegraph.com.

Bitcoin ETF delayed

Explanation of Bitcoin ETF and its significance

A Bitcoin exchange-traded fund (ETF) is a financial product that tracks the price of Bitcoin and allows investors to gain exposure to the cryptocurrency without directly owning or transacting it. It is traded on traditional stock exchanges and provides a regulated and accessible way for investors to invest in Bitcoin.

The approval of a Bitcoin ETF is highly anticipated in the cryptocurrency industry because it is seen as a significant step towards mainstream adoption. It would provide institutional investors and retail investors with a more familiar investment vehicle and could attract significant capital into the cryptocurrency market.

Details of the delay in Bitcoin ETF approval

There has been a delay in the approval of a Bitcoin ETF by regulatory authorities. The specific reasons and timelines for the delay vary depending on the jurisdiction and the regulatory agency involved. Authorities have raised concerns regarding market manipulation, investor protection, and the overall stability of the cryptocurrency market.

While there is growing interest from investors and market participants in a Bitcoin ETF, regulatory agencies are cautious and conducting thorough reviews to ensure that the necessary safeguards are in place before approving such a product.

Reasons for the delay

The delay in approving a Bitcoin ETF can be attributed to several factors. Firstly, regulatory agencies are concerned about the potential for market manipulation in the cryptocurrency market. They want to ensure that sufficient surveillance and oversight mechanisms are in place to prevent fraudulent activities and protect investor interests.

Additionally, the volatility and lack of regulatory clarity surrounding the cryptocurrency market are also factors contributing to the delay. Regulators want to have a comprehensive understanding of the risks and challenges associated with cryptocurrencies before approving investment products that offer exposure to them.

Furthermore, concerns about investor protection and the potential for retail investors to be exposed to highly speculative and risky assets are also considerations that regulators take into account when evaluating Bitcoin ETF proposals.

Impact of the delay on the cryptocurrency market

The delay in approving a Bitcoin ETF can have both short-term and long-term implications for the cryptocurrency market. In the short term, the delay may lead to increased uncertainty and market volatility, as investors were eagerly anticipating the launch of a Bitcoin ETF as a potential catalyst for a price rally.

However, in the long term, the delay may result in more robust and comprehensive regulations for the cryptocurrency market. Regulatory agencies are taking the time to thoroughly evaluate the risks and benefits of a Bitcoin ETF, which could lead to a more stable and secure investment environment.

Moreover, the delay in approving a Bitcoin ETF provides an opportunity for market infrastructure and regulatory frameworks to further develop and mature. It allows time for the establishment of stronger custody solutions, enhanced market surveillance mechanisms, and greater investor protections.

Market participants should closely monitor updates and announcements regarding the approval of a Bitcoin ETF, as it has the potential to significantly impact the cryptocurrency market and drive further mainstream adoption.

SEC to appeal Ripple case

Overview of the Ripple case and the involvement of the SEC

The Ripple case involves the U.S. Securities and Exchange Commission (SEC) and Ripple Labs, a blockchain-based payments company. The SEC filed a lawsuit against Ripple Labs, alleging that its sales of XRP, the native cryptocurrency of the Ripple network, were unregistered securities offerings.

The case attracted significant attention in the cryptocurrency industry, as it has implications for the classification and regulation of cryptocurrencies as securities. The outcome of the case could set a precedent for future enforcement actions by the SEC and impact the broader cryptocurrency market.

Details of the SEC’s decision to appeal the case

The SEC recently announced its decision to appeal the Ripple case ruling. The specific details of the appeal and the grounds on which it is based are currently unknown. This development indicates that the SEC is not satisfied with the ruling and seeks further legal action to potentially reinforce its position.

Possible outcomes of the appeal

The appeal in the Ripple case could lead to various outcomes. If the appeal is successful, it could strengthen the SEC’s position regarding the classification of cryptocurrencies as securities and provide further clarity on regulatory requirements for companies issuing and selling digital assets.

Alternatively, if the appeal is unsuccessful, it may impact the SEC’s ability to enforce regulations on cryptocurrencies and raise questions regarding the regulatory authority’s jurisdiction and interpretation of securities laws.

The outcome of the appeal will likely shape the regulatory landscape for cryptocurrencies in the United States and influence how other regulatory agencies around the world approach similar cases.

Implications of the appeal on the cryptocurrency industry

The appeal in the Ripple case has significant implications for the cryptocurrency industry. The case has already sparked debates and discussions regarding the treatment of cryptocurrencies as securities and the regulatory oversight of the market.

The appeal could potentially impact the legal status and regulatory requirements for various cryptocurrencies, particularly those that have similarities with the digital asset at the center of the Ripple case. Market participants, including companies and investors, will closely watch the proceedings and outcome of the appeal as it could impact their operations and investment strategies.

Moreover, the appeal could also shape how regulators approach cryptocurrencies in the future and provide greater regulatory clarity for market participants. A clear and consistent regulatory framework is essential for the sustainable growth and development of the cryptocurrency industry, as it provides certainty and confidence to investors and companies operating in the market.

Overall, the appeal in the Ripple case is a significant event that could have far-reaching implications for the cryptocurrency industry. Market participants should closely monitor developments and outcomes to stay informed and adjust their strategies accordingly.

This image is property of s3.cointelegraph.com.

Discover the secret crypto strategies that experts don’t want you to know.

Brazil’s Congress moves to levy higher taxes on cryptocurrencies

Explanation of the proposed tax changes for cryptocurrencies in Brazil

Brazil’s Congress is considering legislation that would impose higher taxes on cryptocurrencies. The proposed tax changes aim to subject cryptocurrencies to the same tax rules as traditional assets, such as stocks and bonds. Currently, cryptocurrencies are not subject to the same tax treatment in Brazil, leading to concerns about tax evasion and potential revenue loss for the government.

The proposed tax changes would require individuals and businesses to report their cryptocurrency holdings and transactions, similar to how they report other financial assets. Additionally, capital gains from cryptocurrency trading and investments would be subject to income tax.

Details of the higher tax rates and their application to cryptocurrencies

The specific details of the proposed tax rates for cryptocurrencies in Brazil are currently unknown, as the legislation is still being debated in Congress. However, the general objective is to align the tax treatment of cryptocurrencies with traditional assets. This could result in higher tax rates for cryptocurrency transactions and investments.

The higher tax rates would impact individuals and businesses involved in cryptocurrency trading, mining, or holding cryptocurrencies as an investment. It would impose additional reporting obligations and potentially increase the tax burden on cryptocurrency-related activities.

Discussion on the reasons behind the proposed tax changes

The proposed tax changes for cryptocurrencies in Brazil are driven by several factors. Firstly, there is a growing global trend towards regulating cryptocurrencies and bringing them within the existing regulatory framework. Many countries have recognized the need to address tax evasion and money laundering risks associated with cryptocurrencies.

Additionally, the Brazilian government is seeking to increase tax revenue and ensure that all forms of income are subject to taxation. Cryptocurrencies have become increasingly popular in Brazil, and the government aims to capture tax revenue from this growing market.

Furthermore, the proposed tax changes aim to provide greater regulatory clarity and consumer protection. By subjecting cryptocurrencies to the same tax rules as traditional assets, the government aims to mitigate the risks associated with cryptocurrency transactions and enhance transparency in the market.

Impact of the tax changes on the cryptocurrency market in Brazil

The proposed tax changes could have both short-term and long-term impacts on the cryptocurrency market in Brazil. In the short term, the higher tax rates and additional reporting obligations may discourage some individuals and businesses from participating in cryptocurrency-related activities. This could result in a temporary reduction in market activity and trading volume.

However, in the long term, the tax changes could contribute to a more regulated and mature cryptocurrency market in Brazil. It would provide greater clarity for market participants and investors, which could enhance investor confidence and attract institutional investors to the market.

It is essential for individuals and businesses involved in the cryptocurrency market in Brazil to stay informed about the proposed tax changes and understand their potential implications. Adapting to the new tax regulations and ensuring compliance with reporting obligations will be crucial to navigate the evolving regulatory landscape in Brazil.

Analyst predicts Bitcoin has bottomed

Overview of the analyst’s prediction for Bitcoin’s price trajectory

An analyst has predicted that Bitcoin has reached its bottom and will experience a gradual increase in price moving forward. This prediction suggests that the bear market for Bitcoin, characterized by a prolonged period of price decline, has come to an end, and the cryptocurrency is poised for a bullish trend.

Analysis of recent price action and market trends

The analyst’s prediction is based on a detailed analysis of recent price action and market trends. They likely consider factors such as historical price patterns, indicators, and market sentiment to support their conclusion that Bitcoin has reached its bottom.

By assessing the characteristics of the recent price movements, the analyst may identify technical signals, such as trend reversals or strong support levels, indicating that Bitcoin’s price is likely to increase in the future.

Factors contributing to the analyst’s prediction

Several factors may contribute to the analyst’s prediction that Bitcoin has bottomed. Firstly, they may consider the historical price patterns of Bitcoin, observing similarities with previous market cycles where the cryptocurrency experienced significant price declines followed by periods of consolidation and price recovery.

Moreover, the analyst may analyze broader market trends, such as increasing institutional adoption of cryptocurrencies, growing mainstream acceptance, and regulatory developments. Positive factors, such as increased interest from institutional investors and adoption by established financial institutions, can contribute to the prediction that Bitcoin has reached its bottom and will continue to rise in value.

Potential implications of Bitcoin hitting its bottom

If Bitcoin has indeed reached its bottom, it could have significant implications for the cryptocurrency market. Firstly, it could boost investor confidence in Bitcoin and the broader cryptocurrency ecosystem, leading to increased investment and market activity.

Moreover, a bottoming out of Bitcoin’s price could signal the start of a new bullish trend, attracting new investors and potentially driving the price to new all-time highs. This could have a ripple effect on the entire cryptocurrency market, with other cryptocurrencies also experiencing increased interest and price appreciation.

However, it is important to note that predictions in the cryptocurrency market are speculative in nature and subject to inherent uncertainties. Market conditions and various external factors can impact the trajectory of Bitcoin’s price, making it essential for investors to exercise caution and conduct thorough research before making investment decisions.

Missed out on the Bitcoin boom? Our latest crypto guide reveals the next big thing.