In a whirlwind of activity, the value of Bitcoin briefly slipped below the $26K threshold before quickly rebounding, while the broader crypto market experienced an 8% tumble against the U.S. dollar, teetering on the edge of dropping below the $1 trillion threshold. This volatile shift in the market resulted in a staggering $1 billion in liquidations within the crypto market. As traders eagerly approach the weekend, the crypto sector faces a pronounced slide, with Bitcoin leading the decline, diminishing by 8.6% daily and 10.3% weekly. Ethereum and XRP also suffered significant losses, with the latter plummeting 14.7% in a single day. The turbulence within the market has led to over $1 billion in liquidations in the last 24 hours, leaving traders to grapple with the impact of this crash.

Bitcoin Dips Below $26K in Crypto Market Whirlwind; $1 Billion Liquidated Amid Top Coins’ Tumble

Bitcoin’s value briefly slipped below the $26K threshold at 5:50 p.m. Eastern Time on Thursday before swiftly rebounding past the $26,000 benchmark. Concurrently, the expansive crypto landscape experienced an 8% tumble against the U.S. dollar, teetering dangerously close to dropping below the $1 trillion threshold. Moreover, a staggering $1 billion in derivatives positions were met with liquidations within the crypto market.

Bitcoin Wavers and $1B in Crypto Derivatives Trades Liquidated

As we approach the weekend, the crypto sector grapples with a pronounced slide, depreciating 8% against the dollar in the last 24 hours. As of 7:22 p.m. Eastern Time on Thursday, the global trade volume over the preceding day sits at roughly $69.60 billion.

Notably, $37.62 billion of this sum represents stablecoin trading, signaling a considerable shift of traders either pivoting to stablecoin pairs or gravitating towards the dollar-anchored token ecosystem. Bitcoin (BTC), the crypto vanguard, has diminished 8.6% daily and 10.3% weekly.

About $23.22 billion of the day’s global trade volume is attributed to BTC transactions. Ethereum (ETH) lost 9.3% against the dollar today and stands 11.3% lower this week. XRP, notably, felt a sharp decline on Thursday, plummeting 14.7% daily and 20.7% weekly.

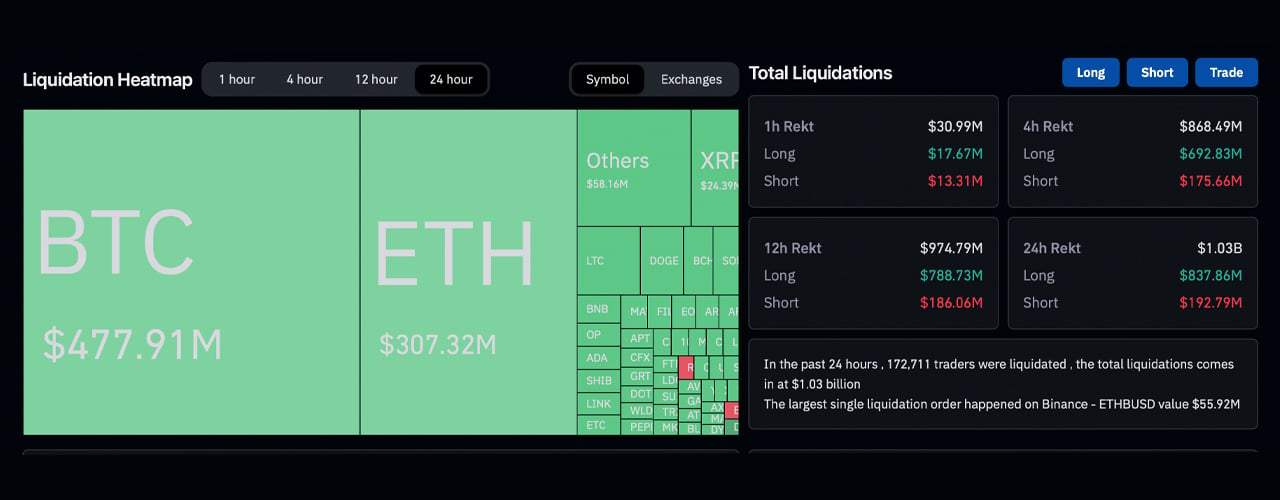

Excluding stablecoins, every top-ten cryptocurrency suffered notable declines amidst this turbulence. Although BTC exchanged hands at $26,400 per coin at 7:22 p.m., it had briefly dipped to $25,600 a coin just an hour earlier. Data from coinglass.com reveals that crypto enthusiasts faced over $1 billion in liquidations in the last 24 hours.

Bitcoin derivatives traders holding long positions bore a hefty loss of $477 million throughout the day. ETH derivatives traders with long stakes saw $307 million vanish, while XRP’s long positions encountered approximately $24.39 million in liquidations.

Breaking down the $1.03 billion liquidated in the past day: $189.67 million were shorts, and a massive $826.60 million were longs. While XRP bore the brunt of the day’s losses, SHIB experienced a 13.8% dip following complications with the Shibarium launch.

Crypto Sector Depreciates 8% Against Dollar

The cryptocurrency sector has experienced a significant depreciation of 8% against the U.S. dollar in the last 24 hours. This decline has prompted concerns as the market teeters on the edge of dropping below the $1 trillion threshold. Traders and investors are closely monitoring the situation as they navigate the volatile crypto market.

The depreciation not only affects the overall market value of cryptocurrencies but also impacts individual coins and tokens. Bitcoin, as the leading cryptocurrency, has experienced an 8.6% daily and 10.3% weekly drop in value. This decline underscores the market’s current instability and the challenges faced by traders and investors.

Other top cryptocurrencies such as Ethereum and XRP have also suffered losses against the dollar. Ethereum has lost 9.3% in value over the course of the day and stands 11.3% lower for the week. XRP, on the other hand, has seen a significant decline of 14.7% daily and 20.7% weekly. These declines highlight the widespread impact of the market turbulence and the need for caution when trading or investing in cryptocurrencies.

Global Trade Volume Hits $69.60 Billion

Despite the market downturn, the global trade volume in the cryptocurrency market remains substantial. In the last 24 hours, the trade volume reached approximately $69.60 billion. This figure encompasses trading activity across various cryptocurrencies and indicates ongoing market participation despite the challenging conditions.

Within this trade volume, stablecoin trading comprises a significant portion, amounting to $37.62 billion. Stablecoins, which are cryptocurrencies tied to a stable asset like the U.S. dollar, have gained popularity among traders seeking a more stable store of value amidst market volatility. The substantial trading volume in stablecoins reflects the market’s appetite for stability during uncertain times.

Bitcoin continues to dominate the trading volume, with approximately $23.22 billion traded in the last 24 hours. This highlights the continued influence and prominence of Bitcoin within the cryptocurrency market. Traders and investors closely monitor Bitcoin’s performance as it often sets the tone for the broader market.

Stablecoin Trading Reaches $37.62 Billion

Stablecoins have witnessed a surge in trading volume amidst the recent market turbulence. In the past 24 hours, stablecoin trading reached an impressive $37.62 billion, reflecting a considerable shift in trader behavior.

Stablecoins are a type of cryptocurrency designed to maintain a stable value by pegging their price to a specific external reference, typically a fiat currency like the U.S. dollar. This stability makes them an attractive option for traders seeking to mitigate the risks associated with volatile cryptocurrencies.

The significant increase in stablecoin trading suggests that traders are either shifting their focus to stablecoin pairs or seeking refuge in the relative stability of the dollar-anchored token ecosystem. This trend reflects the market’s desire for stability and its response to the current market conditions.

Bitcoin (BTC) Drops 8.6% Daily and 10.3% Weekly

Bitcoin, the world’s largest cryptocurrency, has experienced a significant decline in value in the past 24 hours. The price of Bitcoin dropped by 8.6% daily and 10.3% weekly, highlighting the challenges faced by the market.

This decline in Bitcoin’s value has repercussions across the cryptocurrency market as many other digital assets tend to follow Bitcoin’s price movements. Traders and investors closely monitor Bitcoin’s performance as it often sets the tone for the broader market.

The sharp drop in Bitcoin’s value underscores the current volatility and uncertainty in the cryptocurrency market. Traders and investors need to exercise caution and closely analyze market conditions before making any trading or investment decisions involving Bitcoin or other cryptocurrencies.

Bitcoin (BTC) and Ethereum (ETH) Dominate Trading Volume

Bitcoin and Ethereum continue to dominate the trading volume in the cryptocurrency market, despite the recent market downturn. These two cryptocurrencies remain at the forefront of investor and trader interest, reflecting their established positions in the market.

Bitcoin, as the pioneer of cryptocurrencies, holds a significant market share and accounts for a substantial portion of the total trading volume. Traders and investors closely monitor Bitcoin’s performance as it often serves as an indicator of the overall market sentiment.

Ethereum, on the other hand, has emerged as a leading smart contract platform and plays a vital role in the decentralized finance (DeFi) ecosystem. Its widespread adoption and innovative features have propelled its trading volume, solidifying its position as one of the most valuable cryptocurrencies.

The dominance of Bitcoin and Ethereum in trading volume reflects their importance and influence within the cryptocurrency market. Traders and investors should pay close attention to the performance of these two cryptocurrencies to gain insights into market trends and dynamics.

Ethereum (ETH) Declines 9.3% Against Dollar

Ethereum, the second-largest cryptocurrency by market capitalization, has experienced a significant decline in value against the U.S. dollar. In the past 24 hours, Ethereum’s value dropped by 9.3%, adding to its weekly decline of 11.3%.

The decline in Ethereum’s value reflects the challenges faced by the broader cryptocurrency market. Ethereum’s performance is closely watched by traders and investors due to its integral role in the decentralized finance (DeFi) ecosystem and its innovative smart contract capabilities.

As the market downturn persists, it is important for traders and investors to closely monitor Ethereum’s performance and consider the potential impact on their portfolios. Understanding the market dynamics and conducting thorough analysis can help inform sound investment decisions in the face of market volatility.

XRP Plummets 14.7% Daily and 20.7% Weekly

XRP, the cryptocurrency associated with Ripple, has experienced a steep decline in value in the past 24 hours. XRP’s value plummeted by 14.7% daily and 20.7% weekly, highlighting the challenges faced by the cryptocurrency in the current market conditions.

The decline in XRP’s value is a significant setback for the cryptocurrency, as it struggles to regain its footing amidst regulatory challenges and market volatility. XRP’s performance serves as a reminder of the risks inherent in the cryptocurrency market and the need for careful consideration when investing in such assets.

Traders and investors should closely monitor the developments surrounding XRP and the regulatory landscape that may impact its future. Understanding the unique dynamics of individual cryptocurrencies is crucial for making informed investment decisions in the cryptocurrency market.

Top-Ten Cryptocurrencies Suffer Declines

The top-ten cryptocurrencies in terms of market capitalization have all experienced notable declines amidst the recent market turbulence. This widespread decline underscores the challenges faced by the cryptocurrency market as a whole.

While Bitcoin, Ethereum, and XRP have already been mentioned, other cryptocurrencies in the top ten, such as Cardano (ADA), Binance Coin (BNB), and Dogecoin (DOGE), have also suffered losses in value. This highlights the interconnectedness of the cryptocurrency market and the impact of market sentiment on various digital assets.

Traders and investors should be cautious when navigating the market and consider diversification strategies to mitigate risk. Analyzing individual cryptocurrencies and their underlying fundamentals is essential for making informed investment decisions in this volatile market.

Bitcoin Dips Below $26K

Bitcoin briefly dipped below the $26,000 threshold during Thursday’s market turmoil. At 5:50 p.m. Eastern Time, the price of Bitcoin slipped below this key level but quickly rebounded, surpassing the $26,000 benchmark.

The dip below $26,000 caused concern among traders and investors, highlighting the market’s volatility and uncertainty. Bitcoin’s price movements often set the tone for the broader cryptocurrency market, and abrupt changes like these can have ripple effects on other digital assets.

Traders and investors must closely monitor Bitcoin’s performance and analyze market conditions to make informed decisions. Understanding the factors driving Bitcoin’s price fluctuations can provide valuable insights in navigating the cryptocurrency market.

Over $1 Billion in Liquidations in Last 24 Hours

The recent market turbulence has resulted in over $1 billion in liquidations within the cryptocurrency market. Traders and investors faced substantial losses as the value of their positions decreased, leading to forced liquidations.

The liquidations reflect the challenges and risks associated with trading and investing in cryptocurrencies. Market volatility can lead to significant swings in prices, causing losses for those who fail to react in a timely manner.

It is crucial for traders and investors to employ risk management strategies and closely monitor market conditions to protect their investments. Understanding the potential risks and taking necessary precautions can help mitigate the impact of market downturns and minimize losses.

Losses for Bitcoin Derivatives Traders

Bitcoin derivatives traders have incurred significant losses amidst the recent market downturn. Traders who held long positions in Bitcoin futures or options faced substantial declines in the value of their positions, resulting in financial losses.

The losses incurred by Bitcoin derivatives traders highlight the potential risks associated with leveraged trading and derivative products. These complex financial instruments amplify both potential gains and losses, making them inherently risky.

Traders engaging in derivatives trading must have a solid understanding of the market dynamics and employ appropriate risk management strategies. Failing to do so can result in substantial financial losses, as witnessed during the recent market turmoil.

Long Positions in ETH and XRP Liquidated

Not only Bitcoin derivatives traders but also those holding long positions in Ethereum and XRP have suffered significant losses. Traders who maintained long positions in these cryptocurrencies saw the value of their holdings decline, resulting in liquidations.

The liquidations of long positions in Ethereum and XRP highlight the challenges faced by traders and investors in the current market conditions. The decline in these cryptocurrencies’ values underscores the market’s volatility and the need for caution when engaging in trading activities.

Traders should carefully analyze market conditions and implement appropriate risk management strategies to protect their investments. Understanding the unique dynamics of individual cryptocurrencies is crucial for making informed trading decisions and safeguarding capital.

Breakdown of Liquidations

The recent market turbulence has led to a breakdown of liquidations within the cryptocurrency market. In the past 24 hours, over $1.03 billion has been liquidated, with $189.67 million coming from short positions and a massive $826.60 million resulting from long positions.

The liquidations of both long and short positions indicate the widespread impact of the market downturn on traders and investors. Regardless of their trading strategy, market participants have faced significant financial losses.

These liquidations serve as a reminder of the risks associated with trading and investing in cryptocurrencies. Traders must exercise caution, adapt to changing market conditions, and employ robust risk management strategies to mitigate potential losses.

SHIB Experiences 13.8% Dip

SHIB, a cryptocurrency that gained significant attention in recent months, has experienced a substantial dip in value amidst the market turmoil. SHIB’s value decreased by 13.8%, highlighting the challenges faced by this specific digital asset.

The dip in SHIB’s value comes as a result of complications with the Shibarium launch, further exacerbating the market downturn. This demonstrates the influence of external factors and events on the performance of individual cryptocurrencies.

Traders and investors must closely monitor developments surrounding specific cryptocurrencies and assess the potential impacts on their portfolios. Understanding the fundamentals and unique dynamics of each cryptocurrency is vital for making informed investment decisions.

In conclusion, the recent market downturn has had a profound impact on the cryptocurrency market. Bitcoin and other top cryptocurrencies have experienced significant declines in value, and traders and investors have faced substantial losses.

Market participants must exercise caution, closely monitor market conditions, and implement effective risk management strategies to navigate the volatile cryptocurrency market. Understanding the dynamics of individual cryptocurrencies and analyzing market trends can provide valuable insights for making informed investment decisions.

As the market continues to evolve, it is crucial to stay informed and adapt to the changing landscape. By doing so, traders and investors can position themselves to capitalize on opportunities and mitigate potential risks in the cryptocurrency market.