In a surprising move, Binance has sent shockwaves through the crypto world with its announcement to acquire FTX. This news has raised numerous questions regarding the implications for companies associated with FTX, such as FTX Ventures and its exposure to firms like Skybridge. As FTX is a lean company on a global scale with a vast network of connections across the industry, concerns about the deal falling through and potential liquidity issues have sparked a flurry of calls and speculations. The volatility of the ftt token in the midst of this acquisition has also contributed to price fluctuations in the industry, exacerbating worries about liquidity. Furthermore, the interrelationships between FTX, the ftt token, and other entities like Alameda have raised important questions about the potential for a liquidity crunch. Another pressing question is which regulatory body will oversee the deal, especially given the regulatory entities present in various countries. The situation has even prompted discussions about the impact on industry players and the need for regulators to be more proactive in protecting investors. With political implications on the horizon as some of the largest political donors are involved, it’s clear that this acquisition has far-reaching tentacles that cannot be ignored.

This image is property of i.ytimg.com.

Introduction

In the fast-paced world of cryptocurrency, there are two major players that have been making waves – Binance and FTX. These platforms have gained immense popularity and have become go-to choices for traders and investors alike. However, the recent news of Binance’s shocking move to buy FTX has sent shockwaves throughout the crypto community. In this article, we will delve into the background of both Binance and FTX, discuss the implications of this acquisition, and explore the potential impact on various companies and the industry as a whole.

Background of Binance and FTX

What is Binance?

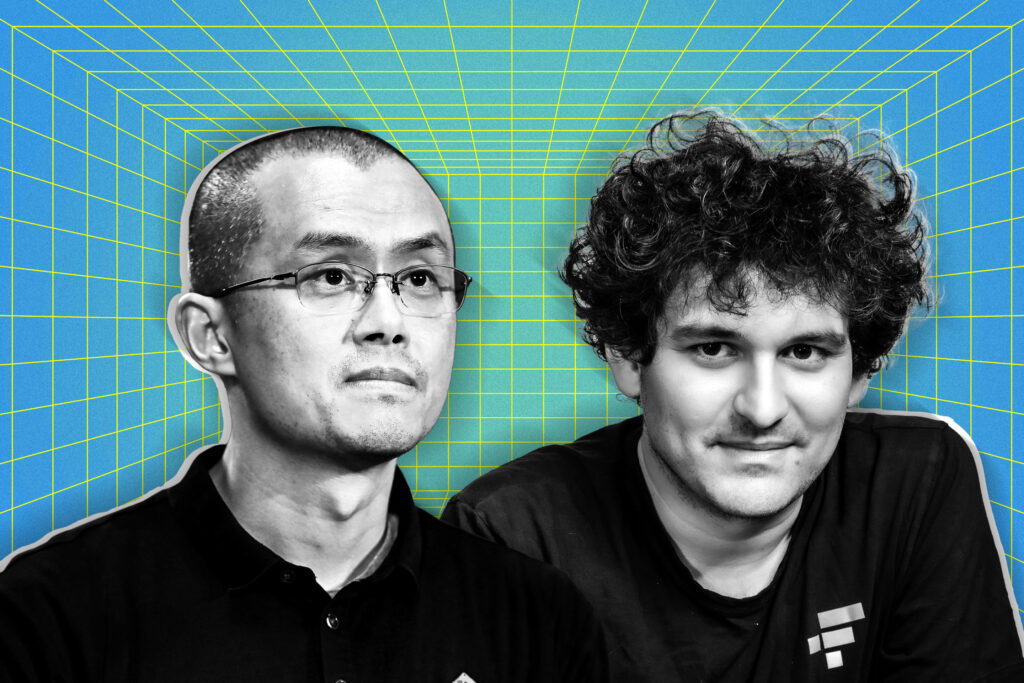

Binance is one of the largest and most well-known cryptocurrency exchanges in the world. Founded in 2017 by Changpeng Zhao, also known as CZ, Binance quickly rose to prominence due to its user-friendly interface, wide range of supported cryptocurrencies, and low trading fees. The platform offers various features such as spot trading, futures trading, and even its own native token called BNB. Over the years, Binance has expanded its services and garnered a large user base, establishing itself as a powerhouse in the crypto industry.

What is FTX?

On the other hand, FTX is a relatively newer player in the cryptocurrency space, but it has managed to make a name for itself in a short period of time. Launched in 2019 by Sam Bankman-Fried, FTX gained popularity due to its innovative trading products and advanced trading features. FTX offers a wide range of trading options, including leveraged tokens, perpetual futures contracts, and options trading. The platform has become highly regarded for its robust trading infrastructure and its emphasis on providing a seamless user experience.

Significance of Binance and FTX in the crypto world

Both Binance and FTX have exerted significant influence in the crypto world. Binance, being one of the earliest and most successful exchanges, has played a pivotal role in driving cryptocurrency adoption and facilitating the trading of various digital assets. Its user-friendly platform and extensive range of supported tokens have attracted millions of users, making it a dominant force in the industry.

FTX, on the other hand, has made a name for itself through its innovative trading products and advanced trading features. The platform has introduced unique offerings such as leveraged tokens, allowing traders to amplify their exposure to certain cryptocurrencies. FTX has also garnered attention for its partnerships with major sports leagues, solidifying its brand presence in the crypto space.

Binance’s Shocking Move to Buy FTX

Announcement of the acquisition deal

The announcement of Binance’s intention to acquire FTX came as a surprise to many in the crypto industry. On [insert date], CZ took to social media to announce the acquisition deal, stating that the decision was driven by a desire to further enhance the user experience and expand the range of services offered by Binance. The details of the acquisition, including the financial terms, have been kept confidential, leaving industry insiders and investors speculating about the potential implications.

Reactions from the crypto world

News of the acquisition sparked a flurry of reactions from the crypto community. Some hailed the move as a strategic decision that could potentially lead to greater innovation and growth within the industry. Others, however, expressed concerns about the consolidation of power and the impact it could have on competition and user autonomy.

Questions about the implications of the acquisition

The acquisition of FTX by Binance raises several important questions. One of the primary concerns is how this will affect the operation and autonomy of FTX. As a relatively independent platform, FTX has built a reputation for its unique offerings and independent approach to the market. With Binance’s acquisition, there are concerns that FTX may lose its independent identity and innovative spirit. Additionally, there are questions about the impact on FTX users and whether they will experience any changes in the trading experience or platform features.

Impact on FTX US and Various Companies

Exposure of FTX US to other companies

FTX US, the United States-based subsidiary of FTX, may face specific challenges and implications due to the acquisition by Binance. As FTX US operates within the regulatory framework of the United States, any changes brought about by the acquisition will need to be compliant with the applicable regulations and guidelines. This may result in additional scrutiny and requirements for FTX US, potentially affecting its operations and ability to offer certain services.

Potential effects on companies like Skybridge and IEX

The acquisition of FTX by Binance has the potential to impact other companies in the cryptocurrency industry. Companies that have established relationships or partnerships with FTX, such as investment firm Skybridge Capital and stock exchange IEX, may need to reassess their collaborations and the potential implications of the acquisition. Changes in management or strategic direction could influence the dynamics of these partnerships and may require companies to adapt their strategies accordingly.

Concerns about the industry as a whole

The acquisition of FTX by Binance raises wider concerns about the cryptocurrency industry as a whole. Some industry observers worry that the increasing consolidation of power and influence in the hands of a few dominant players could stifle competition and innovation. This acquisition, along with other recent mergers and acquisitions in the crypto space, has led to a call for increased regulation and oversight to ensure a level playing field for all market participants.

This image is property of i.ytimg.com.

Liquidity Issues and Market Reaction

CZ’s statement on liquidity crunch

Following the announcement of the acquisition, CZ made a statement addressing concerns about potential liquidity issues at Binance and FTX. He emphasized that the acquisition deal was aimed at improving liquidity and market depth, rather than causing any liquidity crunch. CZ assured users and investors that the acquisition would bring additional resources and expertise to address any potential liquidity issues.

Volatility of FTT token

The announcement of the acquisition had a notable impact on FTT, the native token of FTX. FTT experienced increased volatility in the days following the announcement, as investors speculated on the potential implications of the acquisition. This heightened volatility reflected the uncertainty and mixed sentiments surrounding the acquisition, with some investors seeing it as an opportunity for growth while others expressed concerns.

Speculation on the causes of liquidity crunch

Despite CZ’s reassurances, questions still lingered about the potential causes of a liquidity crunch and its implications. Some industry observers speculated that the increasing popularity of leveraged trading products offered by FTX, coupled with the potential influx of users from Binance, could strain the liquidity pools of both platforms. Others pointed to regulatory concerns and potential limitations on liquidity resulting from increased oversight as potential factors contributing to a liquidity crunch.

Interconnectedness and Potential Liquidity Crunch at FTX

Interrelationship between FTT token and Alameda

One aspect that adds complexity to the potential liquidity crunch is the interrelationship between FTT, the native token of FTX, and Alameda Research, a quantitative cryptocurrency trading firm closely associated with FTX. Alameda Research is a major holder of FTT tokens, and any liquidity issues at FTX could have implications for Alameda’s holdings and trading strategies. This interrelationship highlights the interconnected nature of the crypto ecosystem and the potential ripple effects of any liquidity crunch.

Questions about the significance for FTX

The acquisition of FTX by Binance raises questions about the significance of FTX within Binance’s overall strategy. FTX has carved out a niche for itself by offering unique trading products and positioning itself as an innovative player in the market. With the acquisition, there are concerns that FTX’s identity and focus may be diluted or overshadowed within the larger Binance ecosystem. Maintaining FTX’s distinctiveness while leveraging the resources and market presence of Binance will be a delicate balance to strike.

Potential impact on liquidity at ftx.com

One of the key concerns surrounding the acquisition is the potential impact on liquidity at ftx.com, the primary trading platform of FTX. Liquidity is critical for providing a seamless trading experience and facilitating efficient price discovery. Any disruption or reduction in liquidity at ftx.com could have significant consequences for traders and investors who rely on the platform. It remains to be seen how the acquisition will affect liquidity and whether any changes will be made to address potential issues.

This image is property of i.ytimg.com.

Regulatory Oversight of the Acquisition

Regulated entities of Binance and FTX

Both Binance and FTX operate within the regulatory frameworks of the jurisdictions they serve. Binance has established regulated entities in various countries, such as Binance US and Binance Singapore, to comply with local regulations. FTX US, as a subsidiary of FTX, also operates within the framework of United States regulations. The acquisition of FTX by Binance is likely to attract regulatory scrutiny, and both companies will need to ensure compliance with the applicable regulations.

Potential involvement of different regulators

Given the global nature of the cryptocurrency industry, the acquisition of FTX by Binance could involve multiple regulatory bodies. Regulators in the countries where Binance and FTX operate may review the acquisition to assess potential competition concerns, consumer protection issues, and the impact on market dynamics. The involvement of various regulators adds another layer of complexity to the acquisition and may lead to delays or additional requirements as part of the regulatory process.

Implications for regulation in the industry

The acquisition of FTX by Binance could have broader implications for regulation in the cryptocurrency industry. As regulators continue to grapple with the evolving landscape of digital assets, high-profile acquisitions and consolidations may prompt them to reevaluate their oversight and regulatory frameworks. The acquisition could serve as a catalyst for increased scrutiny and more comprehensive regulation, aimed at ensuring fair competition, investor protection, and the stability of the industry as a whole.

Reactions from Industry Players

Sam Bankman-Fried’s stance on legislation

Sam Bankman-Fried, the founder of FTX, has been vocal about the need for clear and sensible legislation in the cryptocurrency industry. He has emphasized the importance of regulatory clarity and the role of regulators in addressing potential issues and risks. While the acquisition of FTX by Binance may bring about changes in the regulatory landscape, it remains to be seen how Bankman-Fried’s stance on legislation will evolve and whether he will continue to advocate for a balanced approach to regulation.

Mark Palmer’s tweet to CZ

The news of the acquisition also drew attention on social media platforms, with Mark Palmer, the CEO of investment firm BTIG, tweeting directly to CZ. Palmer questioned the implications of the acquisition and its potential impact on competition within the industry. His tweet reflected the concerns of many industry observers who worry about the concentration of power and potential anti-competitive practices resulting from such acquisitions.

Forcing regulators to take action

The acquisition of FTX by Binance, along with other high-profile acquisitions and controversies in the crypto industry, may force regulators to take more decisive action. The increasing consolidation of power among a few major players, coupled with concerns about market manipulation and consumer protection, has put regulators under pressure to establish clear guidelines and enforce stricter oversight. The acquisition could be a tipping point that leads to a more proactive approach from regulators.

This image is property of content.fortune.com.

Timing and Impact on Investors

Potential delay in regulatory response

Given the complex nature of the acquisition and the involvement of multiple regulators, there is a possibility of delays in the regulatory response. The regulatory process can be time-consuming and may require thorough assessments of potential competition concerns, market dynamics, and consumer protection issues. This regulatory uncertainty and potential delay could create a sense of unease among investors, leading to increased volatility and hesitant market participation.

Concerns for investors’ interests and assets

The acquisition of FTX by Binance raises concerns for investors in both platforms. There may be uncertainties surrounding the protection of investors’ interests and assets, especially in the event of a liquidity crunch or regulatory intervention. Investors will closely watch how the acquisition unfolds and whether adequate measures are taken to safeguard their investments. The potential impact on the value of FTT tokens and the trading experience on both platforms will determine the level of investor confidence and satisfaction.

Conclusion

The acquisition of FTX by Binance has sent shockwaves through the crypto world, prompting discussions and speculation about its implications. Both Binance and FTX have played significant roles in advancing cryptocurrency adoption and innovation, and their coming together has raised questions about the future of both platforms. The potential impact on FTX US and other companies, liquidity issues, regulatory oversight, and investor concerns are just a few of the factors that will shape the outcome of this acquisition. As the crypto industry continues to evolve, the acquisition of FTX by Binance serves as a reminder of the complexities and challenges faced by market participants and regulators alike. Only time will reveal the full extent of the impact of this acquisition and the subsequent developments in the crypto ecosystem.