In the video, Kraken Co-Founder Jesse Powell joins Emily Chang to discuss the fallout from Binance backing out of the FTX acquisition. He explains that the deal between the two exchanges fell apart, most likely due to the regulatory scrutiny surrounding FTX. As a result, FTX may now be heading towards bankruptcy, sparking concerns for its clients and consumers in the industry. Powell also discusses the potential interest of Kraken in buying certain assets or licenses from FTX, but emphasizes that the value of these assets is unlikely to match the extent of the hole left by FTX’s collapse. He warns investors to carefully consider the history, proof of reserves, and longevity of exchanges before trading, as the risk of insolvency and liquidity crises in the crypto world still persists.

This image is property of i.ytimg.com.

Background

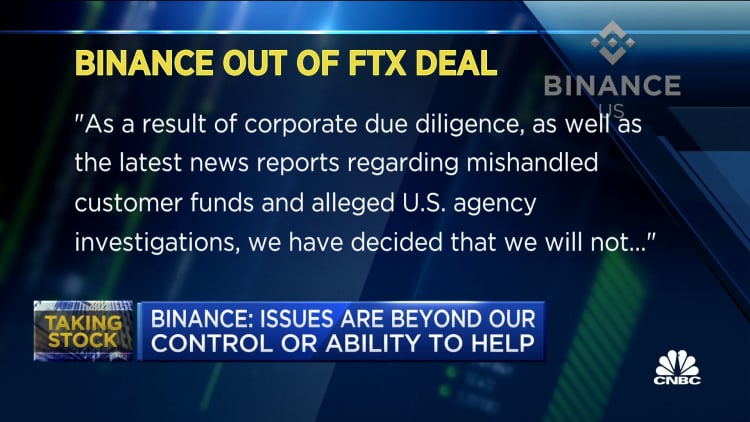

Binance and FTX deal falls apart

The cryptocurrency community was left in a state of shock recently when news broke that the deal between Binance and FTX had fallen apart. This had been considered a significant move for both parties involved, and many investors were eagerly anticipating the outcome. The sudden collapse of the deal sent shockwaves through the crypto world, causing uncertainty and unrest among investors.

FTX heading into bankruptcy process

Following the failed deal with Binance, FTX now finds itself heading into the bankruptcy process. This is a significant development that has caught many off guard. FTX was once seen as a rising star in the cryptocurrency industry, and its downfall has sent shockwaves through the entire market. Many investors are now left wondering what the future holds for FTX and how this will impact the wider crypto world.

Repercussions in the Crypto World

Impact on investors

The collapse of the Binance-FTX deal and FTX’s subsequent bankruptcy process has had a profound impact on investors. Many who had invested in FTX were hoping to see significant returns on their investments, but now find themselves facing significant losses. The sudden turn of events has caused panic and uncertainty among investors, leading to a sell-off in the market and a downturn in overall crypto prices.

Similarities with Mt. Gox incident

The situation surrounding FTX has drawn comparisons to the infamous Mt. Gox incident. Mt. Gox was once the largest Bitcoin exchange in the world but ultimately collapsed due to mismanagement and security breaches. The parallels between the two incidents are striking, with both involving the sudden bankruptcy of a major cryptocurrency exchange. This serves as a stark reminder of the inherent risks and vulnerabilities present in the crypto industry.

Kraken’s Potential Interest in FTX

Potential assets of interest

With FTX heading into bankruptcy, there has been speculation about whether Kraken may be interested in acquiring some of FTX’s assets. Kraken is a well-established and reputable exchange, making it a potential candidate for such a move. However, it remains to be seen which assets Kraken would be interested in and whether an acquisition would be beneficial for both parties involved.

Unlikely to match value of the hole

While Kraken may have an interest in acquiring some of FTX’s assets, it is unlikely that the value of these assets would be enough to cover the hole left by FTX’s bankruptcy. FTX’s collapse has left a significant void in the market, and it will take more than just the acquisition of assets to fill it. Kraken’s potential involvement may provide some stability to the market, but the impact is likely to be limited in terms of reversing the overall negative sentiment.

Bankruptcy Process

Likelihood of entering bankruptcy

FTX’s entry into the bankruptcy process is looking increasingly likely. With the collapse of the Binance deal and the mounting financial difficulties faced by FTX, it appears that bankruptcy is the only viable option. This is a significant blow for FTX and its investors, as bankruptcy often leads to the loss of assets and a lengthy legal process. The precise details of FTX’s bankruptcy proceedings are yet to be determined.

Possibility of organized asset auction

In the event of FTX’s bankruptcy, there is a possibility of organized asset auctions to help repay creditors and satisfy outstanding debts. This could involve selling off FTX’s assets, such as cryptocurrencies and other holdings, to the highest bidders. The proceeds from these auctions would then be used to address the financial shortcomings caused by the bankruptcy. Such auctions are a common occurrence in bankruptcy cases and provide a structured approach to asset liquidation.

This image is property of techcrunch.com.

Kraken’s Involvement and Exposure

Kraken’s communication with FTX

Kraken has been in communication with FTX regarding the recent developments, but it is important to note that this does not imply exposure to FTX or its financial troubles. Kraken has maintained its strong standing in the crypto industry by adhering to conservative business practices and ensuring its financial stability. While it may be involved in discussions surrounding FTX’s bankruptcy process, Kraken has taken measures to minimize its exposure to any potential risks.

No exposure to FTX or Alameda

It is crucial to understand that Kraken has no exposure to FTX or its parent company, Alameda. Kraken has built a reputation for transparency and has implemented rigorous risk management practices to safeguard its operations. This commitment to security and prudence ensures that Kraken remains protected from potential vulnerabilities in the industry, such as those currently being experienced by FTX.

Kraken’s Conservative Business Practices

Proof of reserves

Kraken stands out in the industry for its commitment to providing proof of reserves. This means that Kraken regularly undergoes audits to verify that it holds the required reserves to cover customer balances. This dedication to transparency provides reassurance to Kraken’s users that their funds are secure and that Kraken operates with integrity. These conservative business practices have helped Kraken establish itself as a trusted exchange within the crypto community.

Longevity in the space

Kraken’s longevity in the cryptocurrency industry is a testament to its conservative approach and solid business practices. While other exchanges and projects may experience rapid rises and falls, Kraken has consistently maintained its position as a leading exchange for over a decade. This longevity underscores the stability and trustworthiness that Kraken offers its customers, making it a preferred choice for many investors looking for a reliable trading platform.

This image is property of www.tbstat.com.

Exposing Vulnerabilities in the Industry

Crypto funds and hedge funds at risk

The collapse of FTX and the potential bankruptcy process serve as a stark reminder of the risks faced by crypto funds and hedge funds. Investments in cryptocurrencies can be highly volatile, and the failure of a major exchange like FTX can have far-reaching consequences. This serves as a cautionary tale for investors, highlighting the importance of conducting thorough due diligence and diversifying their portfolios to mitigate potential risks.

Liquidity crises and insolvency

The FTX incident also exposes vulnerabilities in the crypto industry related to liquidity crises and insolvency. Cryptocurrency exchanges often operate with thin profit margins, and any significant downturn in the market can quickly lead to insolvency. The ability of exchanges to handle high volumes of trading and maintain adequate liquidity is crucial in ensuring the stability of the market. The FTX case demonstrates the importance of robust risk management and financial resilience in the crypto industry.

Market Evaluation and Risk Assessment

Marking illiquid assets

The collapse of FTX raises questions about how illiquid assets are valued and marked in the crypto market. Illiquid assets can be challenging to accurately evaluate, leading to potentially misleading valuations. The importance of transparency and accuracy in asset valuation becomes evident in cases like FTX, where a sudden collapse highlights the potential risks associated with illiquid holdings. A more consistent and transparent approach to valuing illiquid assets is necessary to protect investors and maintain market stability.

Extreme risk in heavily centralized assets

The FTX incident also emphasizes the extreme risk associated with heavily centralized assets. Centralized exchanges like FTX often hold a significant amount of users’ funds, making them vulnerable to security breaches and financial difficulties. Investors should carefully consider the level of centralization in their chosen exchanges and diversify their holdings across different platforms to reduce the risk of losses due to a single exchange’s failure.

This image is property of image.cnbcfm.com.

Margin Calls and Financial Shortcomings

Margin calls due to declining asset value

Margin calls can become a significant issue during times of declining asset value, as witnessed in the FTX case. When the value of assets used as collateral in margin trading contracts declines, users may face margin calls where they are required to provide additional funds to cover the losses or risk having their positions forcibly liquidated. The FTX incident highlights the importance of understanding the risks associated with margin trading and implementing proper risk management strategies.

Inability to fulfill loan obligations

The FTX bankruptcy process may also result in an inability to fulfill loan obligations. Lenders who have provided funds to FTX or its affiliated entities may face difficulties in recovering their investments. Such situations serve as a reminder for lenders and investors to conduct thorough due diligence and assess the financial stability of borrowers before providing loans. Understanding and managing the risks associated with lending in the crypto industry is crucial to protecting capital and mitigating potential losses.

In conclusion, the collapse of the Binance-FTX deal and FTX’s subsequent bankruptcy process have had far-reaching consequences in the crypto world. Investors have been impacted, and similarities with past incidents like Mt. Gox highlight the risks inherent in the industry. While Kraken’s potential interest in FTX’s assets may offer some stability, it is unlikely to match the value of the hole left by FTX’s bankruptcy. Kraken’s involvement and exposure are limited, thanks to its conservative business practices and strong communication. The FTX incident exposes vulnerabilities in the industry, including the risks faced by crypto funds and hedge funds, liquidity crises, and insolvency. It also underscores the importance of accurate asset valuation and the dangers of heavily centralized assets. The collapse of FTX has also shed light on margin calls and financial shortcomings, emphasizing the need for risk management strategies and thorough due diligence. As the crypto market continues to evolve, it is crucial for investors and industry participants to remain vigilant and make well-informed decisions to navigate the risks and uncertainties of this rapidly changing landscape.